Roblox’s stock has climbed like a drunkard’s ladder since 2025 began. More than doubled, in fact. The company’s creators and players have become a cult of daily active users, glued to their screens for hours, and the bookings? They’re growing like mold in a damp sock. But here’s the rub: even after this rally, the stock still limps 12% below its 2021 peak. So it goes.

Roblox’s Niche Is Still Expanding

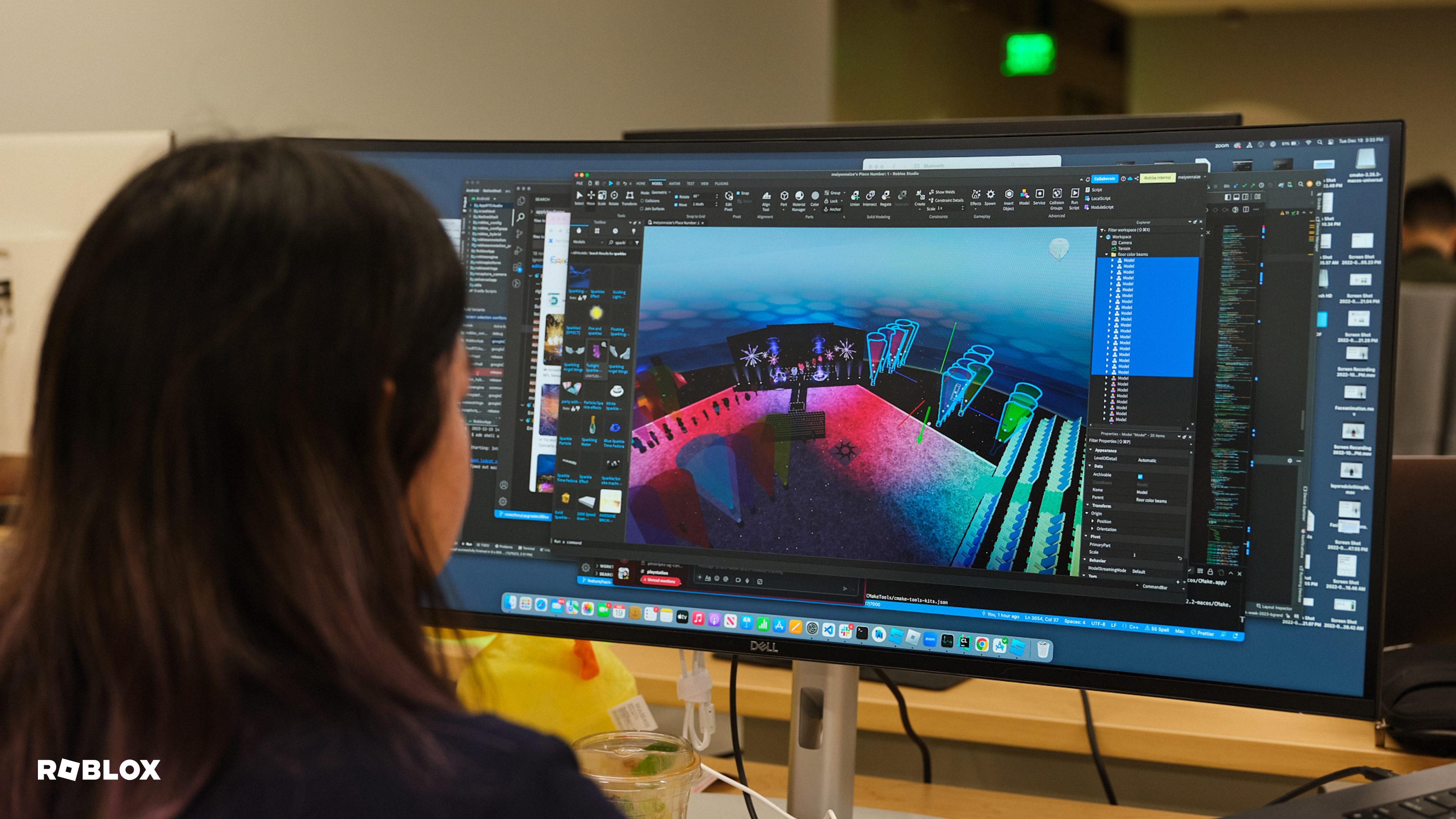

Imagine a world where kids build games with digital Legos and trade in virtual gold. That’s Roblox. Users don’t need to code—they just need imagination and a credit card. Robux, the platform’s currency, flows like water. Players buy it; creators sell it. It’s less Unity, more YouTube. But let’s not kid ourselves: this isn’t a utopia. It’s a business, and businesses are fickle things.

The pandemic turned Roblox into a household name, like a viral TikTok trend that outlived the trend. But growth slowed in 2022, like a car with a flat tire. Yet, it kept moving, picking up older users and overseas ones. By 2024, bookings, DAUs, and hours spent gaming all ticked upward. Let’s look at the numbers:

| Metric | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Bookings growth | 45% | 5% | 23% | 24% |

| DAU growth | 40% | 23% | 22% | 21% |

| ABPDAU growth | 4% | -14% | 0% | 2% |

| Hours engaged growth | 35% | 19% | 22% | 23% |

ABPDAU stabilized as older users and international markets started spending more. Ads in the metaverse? Novel. More engaging than a pop-up banner, perhaps. But novelty is a fickle friend. In Q1 2025, bookings surged 31%, DAUs hit 97.8 million, and hours spent gaming rose to 21.7 million. Analysts predict 27% bookings growth and 47% EBITDA growth for the year. That’s not bad for a company once called a “pandemic fad.”

Near-Term Catalysts and Challenges

Roblox’s future hinges on new games, metaverse ads, better tools for developers, and overseas expansion. From 2024 to 2027, bookings and EBITDA are expected to grow at 22% and 37% CAGR, respectively. At $79 billion, the stock trades at 12x next year’s bookings. Sounds reasonable, doesn’t it? But let’s not forget: Roblox is still a money-losing venture. Infrastructure costs, safety measures for kids, and stock-based pay (which gobbled 23% of bookings in 2024) keep profits at bay. And those developer fees? They’re like throwing money out a window to keep creators happy.

Is Roblox a No-Brainer Buy?

Roblox is growing, yes. But sustainability? That’s a question mark. Its debt-to-equity ratio of 24.1 is enough to make a grown investor weep. And insiders have sold nine times more shares than they bought. So it goes. This isn’t a no-brainer. It’s a bet. A gamble with potential, but one that requires patience. Buy in dribs and drabs, not a flood. The market’s a fickle lover, and Roblox’s rally could vanish like a fart in a hurricane. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- 9 Video Games That Reshaped Our Moral Lens

2025-07-31 12:12