In the tumultuous sea of cryptocurrencies, where fortunes are made and lost in the blink of an eye, there emerges a tale of a coin so hot, it could melt the coldest heart. Ethena, or ENA as it is affectionately known, has soared like a phoenix from the ashes, registering a staggering 14% gain in the past 24 hours and a monumental 145.61% in just one month. At $0.6445, ENA’s market cap has swelled to $4.09B, placing it among the elite of the DeFi world. But, my dear reader, should you join this mad dash for digital gold? 🤔

The driving force behind this meteoric rise is none other than the growth of Ethena’s native stablecoin, USDe, whose circulating supply has now ballooned to $7.54 billion. This surge has been accompanied by a 50% increase in Ethena’s Total Value Locked (TVL) in July alone. The impact of StablecoinX’s $260M buyback, initiated on July 21, continues to ripple through the market, with approximately 8% of the supply expected to be removed from circulation by the end of August. Ah, the sweet scent of scarcity! 🌸

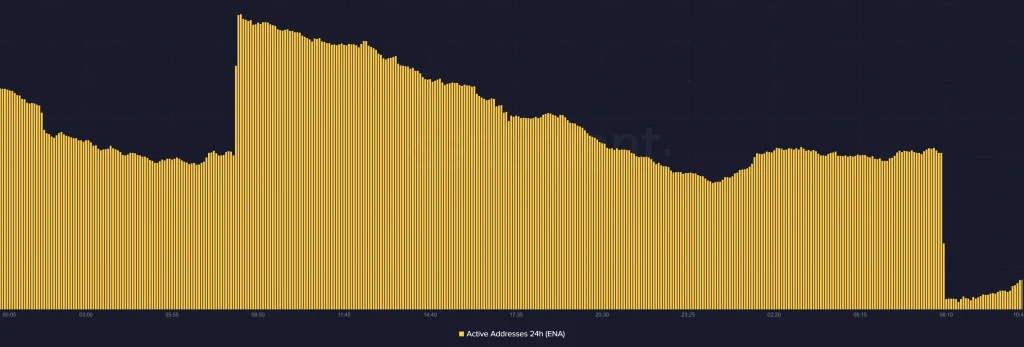

Active Addresses Give Mixed Signals?

The chart by Santiment paints a picture of a market in flux. After a mid-day spike, the number of active addresses on the ENA network took a nosedive. Could this be the result of traders cashing in their chips, or perhaps a momentary lull before the storm? Network activity peaked sharply around midday, only to wane into the evening and reach a nadir in the early hours of the next morning. Yet, a glimmer of hope appeared as activity rebounded in the latest timeframe, suggesting that the pullback might be fleeting. After all, speculation is the lifeblood of this market, and the marketers are always ready to pounce. 🦁

This ebb and flow of activity further hints at a market in transition, where the faint of heart are quickly weeded out, and only the bold survive. But what does the future hold for ENA? Let us delve deeper into the price analysis to find out.

ENA Price Analysis:

As I pen these words, ENA is trading at $0.6445, just shy of a resistance zone around $0.7046. It has found solid support at $0.6145, with additional fortifications at $0.5638 and $0.4764. The Relative Strength Index (RSI) stands at 60.96, flirting with overbought territory, which might indicate a period of consolidation on the horizon. However, the widening Bollinger Bands suggest that volatility is on the rise, and a breakout could be imminent.

If the bulls manage to breach the $0.7046 resistance, the next target could be as high as $0.8551. On the flip side, a dip below $0.6145 could lead to a retest of lower supports. Despite the potential for short-term consolidation, the overall bullish structure of ENA remains intact, supported by robust on-chain metrics and growing investor interest.

FAQs

Why is ENA’s price up today?

The surge is fueled by the explosive growth of USDe supply, a $260M token buyback, and whale accumulation. 🐳

What are the key resistance and support levels for ENA?

Key resistance levels are at $0.693 and $0.855, while support is found at $0.6145, $0.5638, and $0.4764. 📊

Is ENA overbought right now?

With an RSI of 60.96, ENA is nearing overbought levels, hinting at possible consolidation ahead. 🤔

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- The Worst Black A-List Hollywood Actors

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-07-31 09:38