In the sprawling landscape of equity markets, dividend stocks proliferate, yet few merit serious consideration. At their worst, they resemble mirages—promising much but often collapsing under the weight of economic turbulence. Some companies may refrain from altering their dividends for years, while others offer yields so paltry they barely warrant a glance. It is against this backdrop that Coca-Cola (KO) emerges, not as a glittering beacon of excitement, but rather as a steadfast presence in a sea of uncertainty.

The strength of Coca-Cola lies not in its flashiness—indeed, its business model is rather mundane—but in its remarkable resilience. In the face of market fluctuations and unpredictable political climates, notably the erratic tendencies of current trade policies, Coca-Cola appears well-positioned to weather the storm. The company, a titan of consumer staples, operates largely with a localized manufacturing strategy, ensuring that the bulk of its products for U.S. consumers are produced domestically. Thus, while it is not wholly insulated from the peril of tariffs, its foundation is sturdier than many of its multinational counterparts.

One cannot ignore the prevailing economic anxieties, especially those stemming from aggressive tariffs that threaten to raise manufacturing costs across industries. While Coca-Cola is not immune to such forces, its adaptability represents a crucial advantage. Brand loyalty—an intangible asset gained over decades—fuels consumer trust and ensures that products remain on supermarket shelves even in less favorable economic times. This is the enduring power of Coca-Cola’s name, a hallmark of reliability in an ever-changing market.

//media.ycharts.com/charts/69536e6e6f5b04684afc178b5df87e75.png”/>

The initial days of the pandemic posed significant challenges, yet Coca-Cola’s remarkable recovery serves as a beacon of hope for investors. This resilience should instill confidence; no matter the trial, Coca-Cola has historically discovered pathways to resurgence.

A Comforting Dividend Legacy

Prior to any particular analysis of Coca-Cola’s dividends, consider the robust foundation of its operations—qualities that suggest an unwavering capacity to maintain its dividend, regardless of market turbulence. The company boasts the distinguished title of a Dividend King, having raised its payout an astonishing 63 consecutive years, a feat that has become emblematic of its commitment to shareholder value.

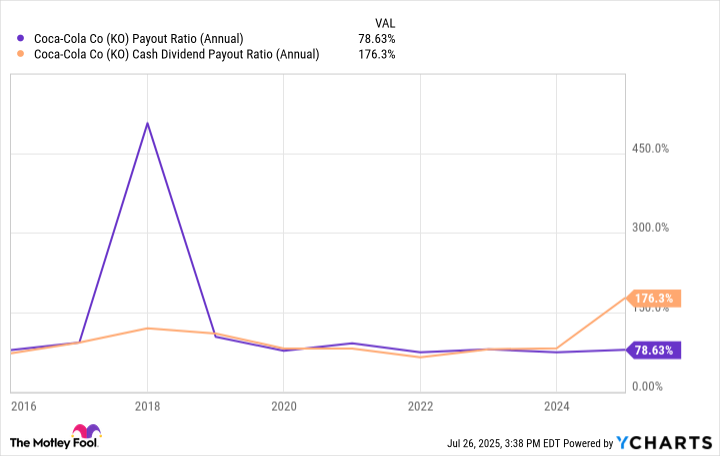

Skeptics may discern troubling signs, such as a cash payout ratio of 176% and a near-80% payout ratio—figures that at first glance seem untenable. Yet, history reveals that these numbers, though alarming, are not without precedent for Coca-Cola. The company has thus far managed to celebrate yearly dividend increases despite such metrics.

Currently, Coca-Cola offers a forward yield of 3%, eclipsing the measly 1.3% average of the S&P 500. The dedication to returning capital to shareholders remains resolute. When combined with a robust operational structure and a formidable brand presence, such attributes render Coca-Cola a compelling choice for those who seek income within their investments.

The prudent investor ought to remain vigilant, aware that complacency often leads to missed opportunities. In the unvarnished world of finance, where many chase fleeting trends, Coca-Cola stands as a paradox—a steadfast guardian of income, even as the world spins unpredictably. 🥤

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- The Worst Black A-List Hollywood Actors

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-07-30 18:26