The Parisian air crackled; a rumor spread—Sequans Communications S.A. had parted with another $88.5 million, securing 755 more bitcoins with a sigh as deep as a Russian winter night.

The Melancholic Accumulation of 755 Bitcoins

Sequans, a semiconductor firm nestled along the Seine, confessed to yet another purchase, acquiring the world’s favorite digital hobbyhorse at an average of $117,296 per bitcoin. Fees, expenses, existential dread—all included. With this, Sequans’ bitcoin trove now numbers 3,072 coins, as of July 25, 2025; a stash Tolstoy himself might have called “slightly immoderate.”

Every last satoshi, they would have you know, came from the proceeds of an equity offering whose elegance could only be matched by its transparency—completed July 7, 2025. As for the math: $358.5 million set adrift into the Bitcoin vortex, at a stately average price of $116,690 per bitcoin. Fees were invited to the soirée, naturally.

Thus, Sequans fancies itself a pioneer, or at least the Don Quixote of treasury management, tilting at the bitcoin windmill whilst claiming innovation for publicly-traded semiconductor houses. The company claims to build their stash with the net proceeds of equity and debt offerings, operational cash flow, and, on occasion, by rummaging through the attic for forgotten intellectual property (IP). “A strategic plan,” one might call it—if one were in a charitable mood.

Meanwhile, far from the roulette table, Sequans engineers chips and modules for the 4G/5G IoT world: smart homes, clever cars, and industrial systems—each hoping for connection, each living their own quiet Chekhovian drama. Basebands, RF transceivers, mysterious software; an inventory as complex as a Dostoevsky plot and nearly as lucrative.

Founded in 2003, Paris, Sequans (NYSE: SQNS) has scattered its offices like seeds—from U.S. plains to Asian cities, seeking the sun. It dreams, perhaps naively, that weaving its bitcoin obsession into its semiconductor tapestry will mean something—eventually.

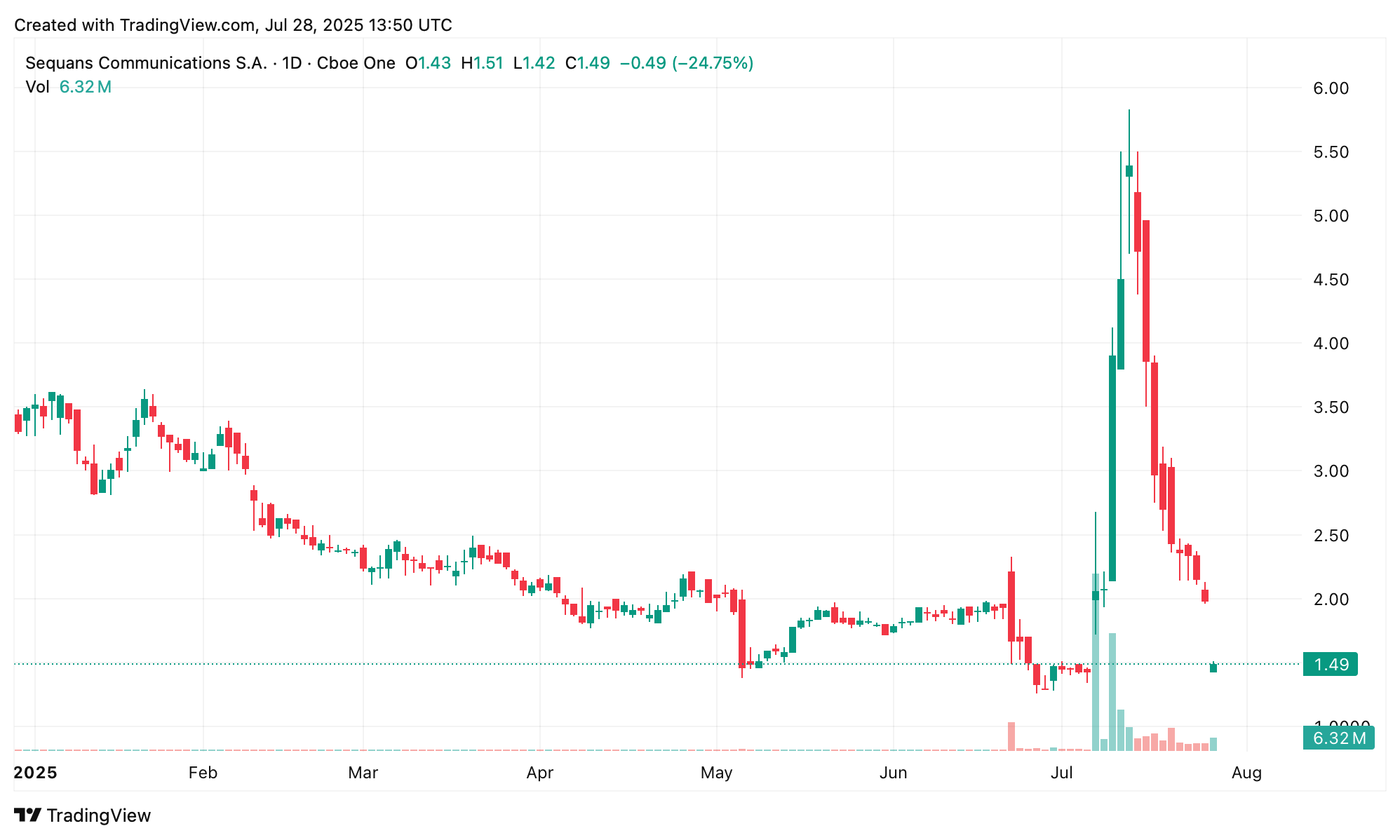

But a cloud lingers: SQNS shares, not wishing to be left out, tumbled 28% on Monday (quelle surprise!), having lost 41% over the last five trading sessions. The market now values the company at a tender $50.27 million—a sum which might’ve bought you a tolerable Moscow apartment, but fewer and fewer bitcoins by the day. Ah, Paris! Ah, fintech!

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-07-28 18:02