In the grand theater of commerce, where fortunes rise and fall like the tides of the sea, there unfolds a spectacle both ancient and new. The market, that inscrutable arbiter of human ambition, now turns its gaze upon three colossi of silicon and code, whose fates shall be measured in quarterly increments. Let us peer beyond the ledgers and balance sheets into the very souls of these enterprises, for even in this age of circuits and algorithms, the human heart beats stubbornly on.

The Semiconductor Colossus and the Tempest of Expectation

Justin Pope (Nvidia — Aug. 27): Behold Nvidia, that modern-day titan whose ascent mirrors the tragic arc of Icarus himself. Born in the shadow of obscurity, it now soars at the pinnacle of market capitalization, its wings forged from the molten gold of artificial intelligence. Yet as the poet warns: “The higher the monkey climbs, the more he shows his tail.”

Consider the paradox of this enterprise: a company transformed from gaming peripheral to oracle of the algorithmic age. Its P/E ratio of 55 stands as both testament to faith and monument to fear, for the world demands not merely growth but divinity. Can mortal engineers sustain this celestial trajectory? The omens are mixed.

Observe the portents: TSMC’s bullish revisions, Alphabet’s cloud swollen with 32% growth, the tentative thawing of Sino-American frost permitting H20 chip sales anew. These fragments of prophecy suggest the AI tempest may yet howl for years. And yet — that $4.5 billion writedown lingers like a stain upon the ledger, a reminder that even silicon gods must kneel before the altar of geopolitics.

Roblox and the Enigma of Digital Eden

Jake Lerch (Roblox — July 31): In the garden of virtual delights, where children build castles from pixels and dreams, Roblox reigns as both gardener and prisoner. Its stock, bloated with 105% growth, mirrors the fevered devotion of a generation that finds more truth in Grow a Garden than in the crumbling edifices of reality.

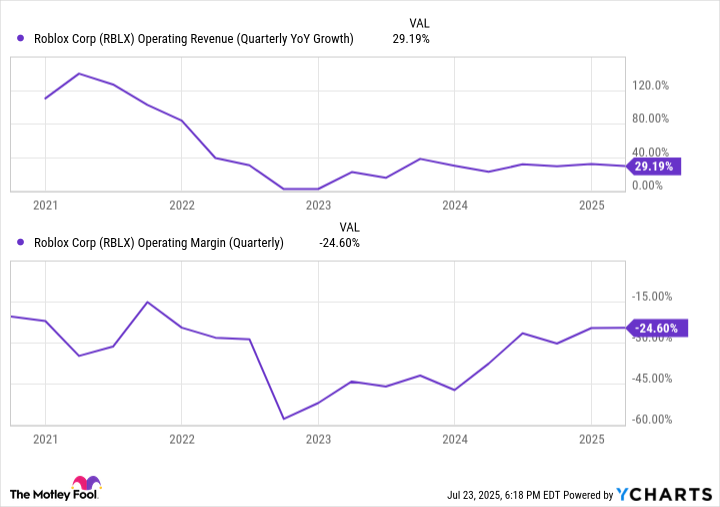

Twenty-one million souls concurrently tending digital flora — is this the new pastoral ideal? The company’s balance sheet, once a ledger of losses, now trembles on the precipice of profitability. But let us not mistake popularity for permanence; the fickle crowd that anoints today’s monarch may crown another tomorrow. The analysts’ 31% growth projection is both sword and shield in this court of illusions.

What moral shall we draw from this digital parable? That operating margins and concurrent users are but modern hieroglyphs inscribed upon the walls of our collective delusion? Perhaps. Yet in the child who plants her first virtual seed, there lies a truth more profound than any quarterly report can contain.

The Phoenix of Sunnyvale: AMD‘s Reckoning

Will Healy (Advanced Micro Devices — Aug. 5): Consider AMD, the eternal contender, whose stock dances now to the tune of Trumpian tariffs and whispers of MI400 accelerators. Its P/E ratio of 116 is less a valuation than a psalm of hope, though even the most ardent believer might question if fortyfold forward earnings justify such faith.

Here lies the tragicomedy: a company that designs the engines of artificial intelligence while its own growth stutters through gaming segment declines. The MI400, that mythical beast, may yet dethrone Nvidia’s Vera Rubin platform — but shall we measure progress by the speed of transistors or the weight of human longing?

As AMD approaches its record highs, one wonders: does this ascent reflect technological triumph or merely the market’s eternal hunger for a new narrative? The answer, elusive as Tolstoy’s elusive Pierre Bezukhov, resides somewhere between the data center’s hum and the analyst’s fevered scribble.

In the final reckoning, these three titans — Nvidia, Roblox, AMD — are but actors upon a stage older than time, their silicon wafers and virtual gardens mere ephemera in the grand procession of human endeavor. Let us watch, then, with neither hope nor despair, but with the quiet understanding that the market’s tragicomedy endures, ever faithful to its own immutable laws. 🎭

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-07-28 10:32