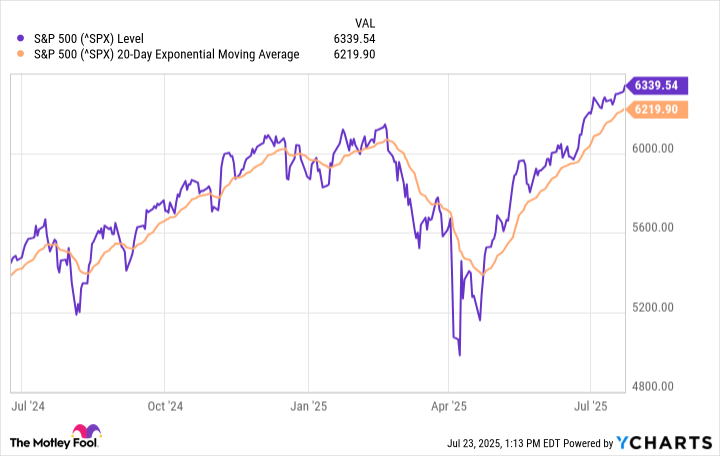

The market, a grand stage where fortunes are both made and lost, is abuzz with activity. After nearly succumbing to the somber shadows of bear territory in the merry month of April, the S&P 500 has staged a triumphant return—regaining its footing like a disgraced poet reclaiming their verse. As of July 23, it finds itself perched upon newfound heights, a remarkable ascent of approximately 8% over the course of the year.

Ah, the panorama of volatility—a fickle muse—calmed its tempestuous winds since the illustrious unveiling of high tariff rates by President Trump. Yet, the valiant market persists, undeterred by the relentless murmurings of tariffs, signs of economic dilapidation, and whispers echoing from the dusty chambers of governmental finance. Indeed, in a delightful irony, the market has performed a rare feat thrilling enough to arouse the curiosity of even the most jaded observer, accomplished only five times in the span of half a century. History, it seems, fashions its own predictions.

Can the bull market continue its merry waltz?

As our astute chronicler, Ryan Detrick, chief market strategist at the Carson Group, meticulously sifts through the annals of data, he uncovers an enchanting statistic concerning our beloved S&P 500.

On the illustrious day of July 21, the S&P 500 confidently closed above its 20-day moving average for a dazzling sixty consecutive days—an accomplishment that would make even the most seasoned financier raise a polite eyebrow. Investors, akin to skilled alchemists, often employ such moving averages as mystical indicators—signposts on the winding road of charted territory, hinting at possible breakouts, where stocks might ascend or plunge.

This exalted pinnacle, attained only four times since 1975, inspires a glimmer of hope among investors. When the market has danced above its 20-day moving average in this enchanting manner, the ensuing prosperity has often eclipsed expectations, boasting average returns between 20% and 26% over the subsequent year. The specter of decline emerges only on a handful of occasions when drawing back the ceremonial curtain.

“It is what it is, yet another clue this bull market has legs,” quoth Detrick in a note, his tone that of an amused oracle predicting the whims of fate. And as the sun set on the 23rd of July, the S&P 500 appeared to twirl gracefully, about 1.9% above its moving average, cloaked in optimism.

History’s Harmonies and Discords

Ah, history—a splendid tapestry woven with vibrant threads yet often convulsing with the absurdity of human folly. Historically, market downturns and recessions seem to spring from the shadows, defying expectations and rendering predictability a mere chimera. The S&P 500, a creature of myriad moods, has danced with volatility to a symphonic score of uncertainty.

Though it is entirely possible that this erratic performance may continue, let us not forget the art of cautious optimism. The world beyond the stock tickers is rife with turmoil—high uncertainty regarding tariffs, inflation’s insistent whispers echoing through the corridors, and the prospect of an economic slowdown loom large. Yet these grievances, familiar companions, rarely wear new disguises; the data persists in its resilience.

Thus, one might marvel at the recent grand design proposed by Trump—a “one, big beautiful bill” replete with trillions in tax cuts. Could it, in effect, serve to fuel the economic engine in the immediate future? How delightful, the audacity of hope, fluttering before our eyes like a butterfly in a chaotic garden.

Ultimately, dear reader, while the theater of investing may harbor unforeseen turns, those who adopt a long-term view shall wield the greatest advantage. To buy individual stocks guided solely by soaring valuations, detached from their fundamental roots, is akin to purchasing a grand tapestry without examining the weave. Time is an ally, allowing investments to flourish and granting the seasoned player a fortuitous hand. Let us watch this unfolding drama with the bemusement it deserves, casting our lot wisely in the ever-fleeting game of fortune. 🦋

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2025-07-28 08:11