Robinhood Markets (HOOD) has transformed itself into a phoenix rising from the ashes within the vast and tumultuous realm of finance. After being thrust into the harsh light of scrutiny due to its payment-for-order-flow model and its entanglement in the whirlwind of the 2021 meme stock phenomenon, the company now stands as a burgeoning force, gathering momentum in its ascent.

In a manner reminiscent of vibrant spring blossoms unfurling towards the sun, Robinhood is acquiring customers and assets with an impressive flourish. With continuous improvements to its platform and a diversified portfolio of investment opportunities, it has even ventured into the realm of company tokens and the intriguing waters of prediction markets.

Yet, one cannot overlook the sheer audacity of Robinhood’s stock price, soaring an astonishing 173% since the dawn of the year. As we stand on this precipice of speculation, one must ponder — is this the moment to embrace the fledgling bird of investment? A closer examination reveals much.

Robinhood’s Revival Amidst Nature’s Cycle

Not so long ago, Robinhood lay ensnared in turmoil, choked by scrutiny and stagnant growth, much like a river stifled by winter’s grasp. Today, it has cast off those suffocating bonds, rejuvenating its trajectory and nurturing a garden of growth strategies.

The introduction of Robinhood Legend, a sophisticated browser-based platform, bathes the trader in a cutting-edge environment, compelling even the most passive of hands to embrace the artistry of active trading. The horizon now stretches wider, as options multiply: index options, futures, and event contracts, all blooming in the fertile soil of emerging prediction markets.

With eyes toward the youthful spirit of its clientele, Robinhood seeks to quench their thirst for financial wisdom and security. It offers the blossoms of wealth management, advisory services, savings, and retirement accounts, all meticulously cultivated to cater to the diverse garden of needs within its customer base.

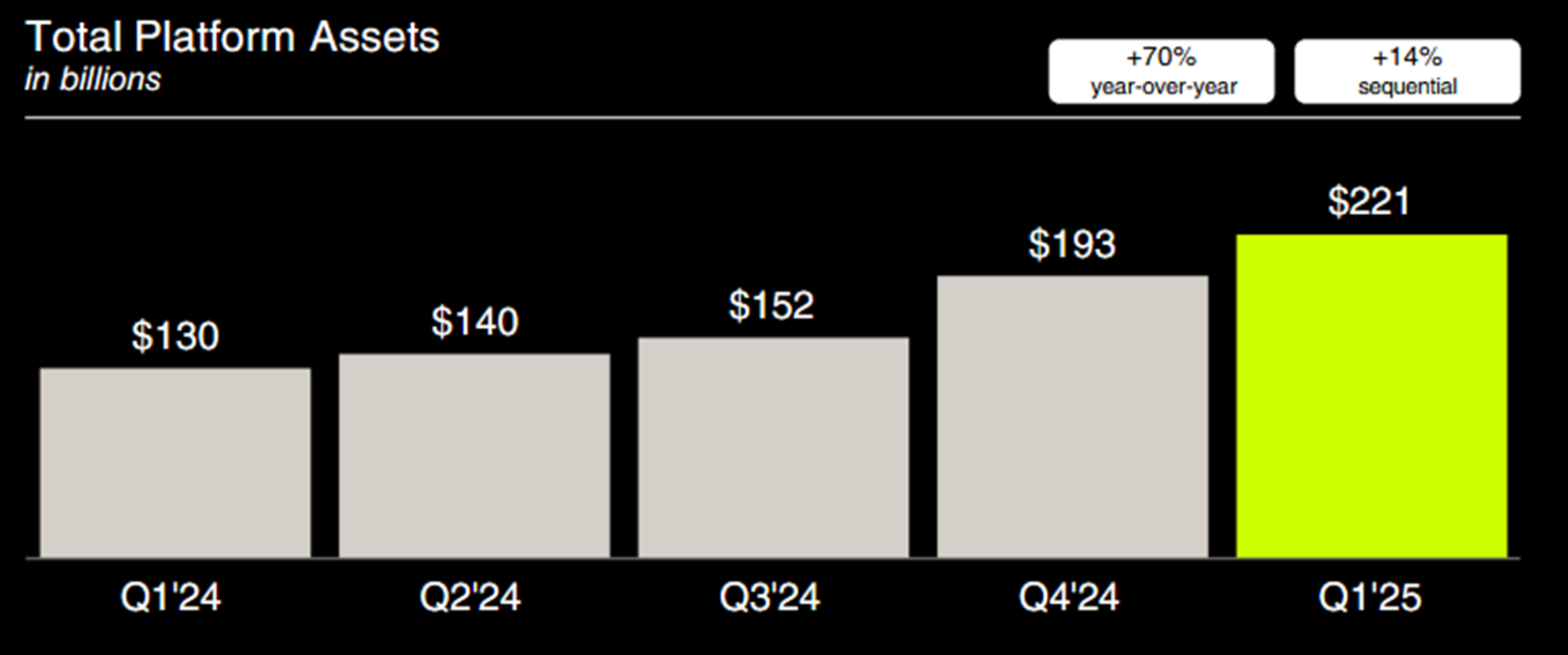

The fruits of these labors are now evident; since the end of 2023, the assets on the platform have swelled from $102.6 billion to $255 billion as of May 31 — a testament to the mighty river of capital flowing freely once more.

A Flourishing Landscape of Opportunity

The youth — Millennials and Gen Z — command nearly three-quarters of Robinhood’s funded accounts. As the tide of wealth shifts towards them, heralding the prospect of a multi-trillion-dollar inheritance over the coming decades, the potential for long-term asset growth blooms like a field of wildflowers.

Earlier this year marked the conclusion of a significant chapter; Robinhood engaged in a $300 million acquisition of TradePMR, effectively honing its skills in the art of professional advisory services — an essential stride towards a robust presence in wealth management.

The digital sheep quietly graze in crypto pastures as Robinhood seals its acquisition of Bitstamp, expanding its echoing presence across Europe and the British Isles. With an ambition rivaling mythic explorers, the company sets sail into the realm of tokenization, keenly transforming traditional assets into the blockchain’s embrace, promising efficiency and liquidity.

Among its recent thrilling announcements, the tokenization of OpenAI and SpaceX for European patrons resonates like a distant echo, allowing retail investors a glimpse through intricately woven veils into the private market valuations of these enterprises.

“These tokens grant elusive access, a narrow window into private markets, made possible through our ownership in a special purpose vehicle,” asserted a Robinhood voice, filled with anticipation for what lies ahead.

A Surge of Ambitious Ascents

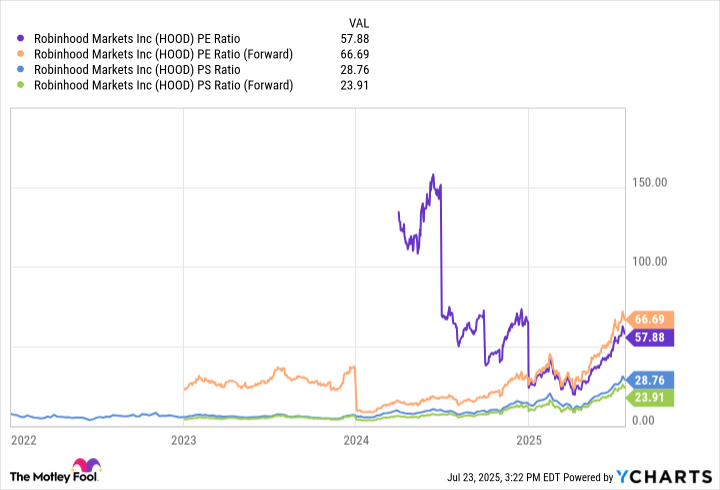

The clouds of optimism swirl, lifting Robinhood stock to dizzying heights, with a staggering increase of 334% over the past year. It presently trades with a price-to-sales ratio (P/S) of 28.7, a figure that carries the weight of its soaring valuation. For the discerning eye, this is accompanied by a stunning forward earnings’ ratio of 66.7.

This exhilarating journey, however, is not devoid of shadows. Robinhood anticipates a swell of expenses, projecting adjusted operating costs this year will range between $2.085 billion to $2.185 billion, with added burdens stemming from the TradePMR acquisition. The cost of upheaval can weigh heavily, yet it also heralds growth.

A Moment of Reckoning

The currents swirl around Robinhood, and as a humble shareholder, my heart swells with optimism. The management has orchestrated a symphony of growth, gathering assets like fireflies in twilight. They tread diligently toward capitalizing on this wealth, exploring innovative offerings that resonate with the restless hearts of their youthful clientele.

Yet, one must tread carefully; the stock carries an expensive price tag. Should you choose to wade into these waters now, be prepared to pay a substantial premium. The stock, with a beta of 2.3, dances with volatility, more than doubling that of the steadfast S&P 500 index, morphing its form in the face of market downturns.

Perhaps the wisest path lies in the delicate balancing of prudence against eagerness — consider acquiring shares, yet let patience be your guiding star. Waiting for a more favorable price to unfold might yield a clearer path through the mist of valuation.

🌱

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

2025-07-27 15:03