![]()

It’s a wild ride in the stock market, my friends, and as the clock ticks toward August’s ominous deadline for reciprocal tariffs, the atmosphere crackles with uncertainty. Investors hover over their screens, fingers twitching nervously as they anticipate the economic fallout. Yet, amidst this swirling chaos, one company emerges like a high-tech phoenix: Taiwan Semiconductor (TSM). CEO C.C. Wei, a modern-day oracle of chip-fueled industry, made a bold proclamation during the Q2 conference call: “We haven’t seen any change in our customers’ behavior so far.” Is it a sign that the rest of the market is losing its grip in some tariff-fueled panic?

Let’s take a cold, hard look at the semiconductor game. Right now, semiconductors are enjoying a fleeting moment of peace, blissfully exempt from the tariffs roiling the rest of the economy—floating free in a tariffic sea. This current state of affairs is crucial: as August 1 approaches, uncertainty looms like a shadow, ready to snatch that exemption away.

Semiconductors: The Untouchables of Tariff Town

First order of business: DO NOT confuse the semiconductor sector with the other poor slobs potentially facing heavy tariff kicks to the gut. The exemptions currently in place mean that these little chips, the unsung heroes of the digital realm, continue to trot through the legislature unscathed. But here’s the kicker—if the tariffs come crashing down on non-semiconductor goods, you might find that chip users remain undeterred in their purchasing quests. The consumers, the myriad beasts of this market jungle, show no signs of slowing down.

Now, let’s pour ourselves a drink and examine Taiwan Semiconductor’s enviable position in the high-stakes poker game of chip fabrication. With heavyweights like Intel (NASDAQ: INTC) muddying the waters and Samsung struggling to keep up, TSMC stands proudly at the pinnacle, undisturbed. They’re the gold standard, the only game in town when it comes to high-end chips. Major players like Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA) are practically chained to TSMC’s output—tariffs be damned!

But TSMC isn’t just sitting pretty. Nope, they’re knee-deep in strategic maneuvering—building shiny new production facilities in Arizona to dodge any foreign tariff traps. It’s a tactical withdrawal into the heart of the U.S. landscape, a glimmer of foresight in an industry teetering on the brink of absurdity.

While TSMC appears to be basking in tariff immunity, anyone looking to extrapolate its experience across the broader market must take a moment to recalibrate their expectations. TSMC operates from a unique stratosphere, compelling clients to dance to its tune. But trust me, it won’t last forever; that sweet tariff escape hatch may close sooner than expected.

With such a potent market position, TSMC transforms into a tantalizing stock for those with a taste for risk and reward. Few companies command a more dominant place in this digital age than TSMC, the titan of chips.

Investing in Taiwan Semiconductor: A Gamble Worth Taking

The bull case for Taiwan Semiconductor is delightfully straightforward: as the relentless march of technological advance continues, clients will demand more chips—each one more powerful than the last. When management forecasts a 45% compound annual growth rate for AI-related revenues through 2025, you know they’re not just blowing smoke.

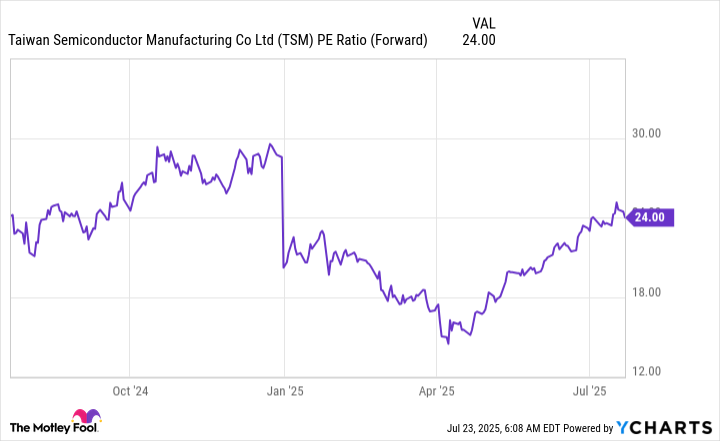

So, while the world panics over tariffs, it’s clear that TSMC is gearing up for a blissful revenue surge—projecting total revenue growth at a nearly 20% CAGR. Yet, surprisingly, their stock trades with a forward P/E ratio that’s practically mind-boggling, almost identical to the S&P 500‘s (^GSPC) 23.8 times forward earnings. With a specified rate of growth set to beat the socks off market averages, paying that price feels like a downright steal.

So, in this volatile cocktail of tariffs and market angst, navigating the chips with TSMC appears to be a winning hand—a thrilling gamble that might have the market players shouting unprecedented DEALS. Stability is a rarity in the chaos, but if you’re gripped by the thrill of investing, Taiwan Semiconductor looks like a thrilling ride into the future. Just watch your step as you teeter on the edge of your seat. 🥃

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-07-27 13:45