It is a truth universally acknowledged that, in the esteemed assembly of investors, the perennial query—”Is this the opportune moment to acquire stocks?”—arises with monotonous regularity. As a growth investor, I have long maintained that the answer is, without reservation, in the affirmative.

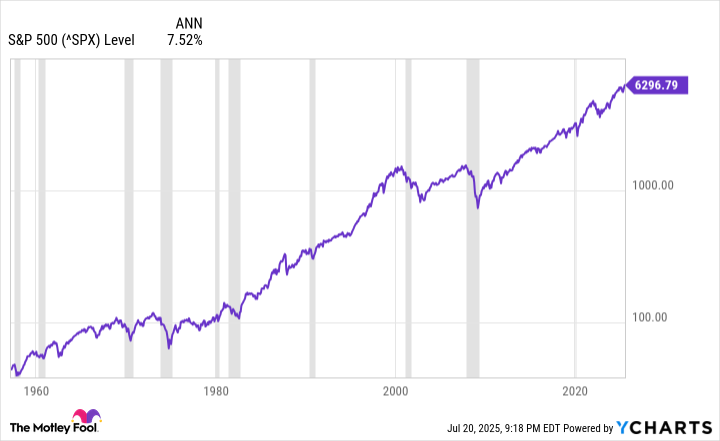

Indeed, one need only consider the venerable S&P 500—a benchmark index whose performance has, over the decades, proven itself an unwavering beacon of prosperity. Since its expansion in the year of our Lord 1957 to comprise five hundred distinguished companies, it has burgeoned with an astonishing vigour, increasing by nearly 14,000 percent. This prodigious expansion, corresponding to a compound annual growth rate of 7.5 percent—even before one takes into account the dividends that have sweetened the yields of the patient investor—is nothing short of remarkable.

Moreover, throughout its storied existence, the index has weathered manifold corrections, endured several bearish seasons, and weathered no fewer than ten full-fledged recessions. Yet, much like a devoted companion who remains steadfast through trials, any investor who has maintained their holdings has been amply rewarded.

Should you harbour lingering doubts, allow the chart that follows to serve as an unassailable testimony to the folly of attempting to time the market’s caprices.

It is an incontrovertible truth that the pursuit of short-term market predictions is as fruitless as a capricious courtship. The sagacious investor, much like a discerning matchmaker, is best advised to eschew such folly, instead committing to the long-term accumulation of wealth. Save with discipline, invest with unwavering resolve, and disregard the transient clamour of market headlines. When uncertainty clouds your judgment, let this chart remind you that patience—akin to a well-chosen alliance—inevitably leads to enduring prosperity. 📈

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-27 13:29