The scent of rain on hot silicon, a smell old Mateo remembered from the workshops of his youth, though those rains fell on vacuum tubes and copper wire, not on the endless, humming cathedrals of servers where futures are now divined. Years later, the newspapers would report the inevitable cooling, the quiet unraveling of fortunes built on promises whispered by algorithms, yet the fever remained, a belief that this time, the cloud held something more substantial than vapor. It was said that the digital lament of overloaded processors could be heard on still nights in the data centers of Reykjavik, a melancholic chorus no one wished to acknowledge as a harbinger.

CoreWeave and Nebius, names that echo faintly with the weight of ambition, have risen with a velocity usually reserved for fallen idols. Investors, caught in the current of a new technological delirium, have thrown capital towards these entities, convinced they hold the keys to a kingdom built on artificial intelligence. The year has unfolded with a grace inversely proportional to the frenzy it has inspired, with CoreWeave ascending a dizzying 224% since its debut in March, and Nebius, a more modest, yet still substantial, 84% climb. Both are merchants of raw potential, renting out the muscle – the graphic processing units – that allow others to breathe sentience into machines, to create phantoms in the digital ether, and, of course, to profit handsomely from the illusion.

But to choose between them? To gamble on one fleeting apparition over another? The market seems to approach it with the same reckless abandon, the same forgetting of history that accompanies every ascent. Let us examine the particulars, then, not with the breathless enthusiasm of a zealot, but with the weary resignation of one who has seen such cycles turn before.

The Allure of CoreWeave

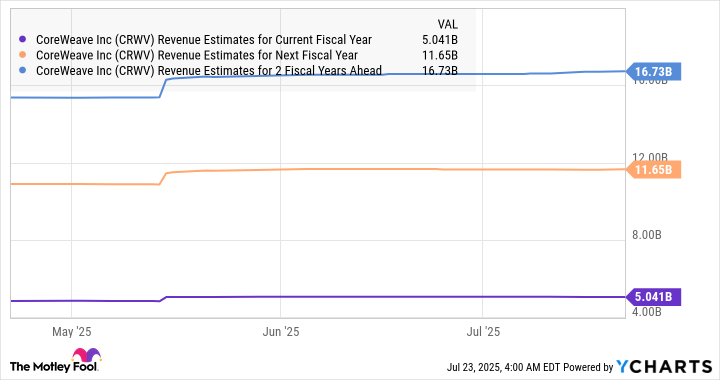

CoreWeave’s ascendance, like many things in this age, is a story of magnified numbers. Its revenue, it is reported, expanded more than fivefold in the first quarter, reaching a sum that would have seemed fantastical a decade past. The backlog, that carefully constructed edifice of future earnings, swelled to $26 billion, a number that carries a weight of both promise and inherent fragility. It grows, yes, fueled by the insatiable hunger for data processing power, by a cloud AI market Grand View Research projects will swell to $650 billion by 2030, a figure so large it becomes almost meaningless. They offer access to Nvidia’s gleaming processors and AMD’s robust architecture, packaging them as a solution to a problem most customers don’t fully understand but believe must be solved. They speak of cost advantages and “best-in-class performance,” words that dissolve quickly in the face of escalating capital expenditures.

The company professes an inability to satisfy demand, a common ailment among those who have successfully stoked a speculative fire. They have secured, or promised, over $21 billion to expand their infrastructure, and now contemplate the acquisition of Core Scientific, a move that speaks to consolidation, to the desperation for scale, and to the willingness to absorb even the most tarnished assets. They forecast savings, of course, some $500 million annually by 2027, a statistic offered with the confidence of a soothsayer reading tea leaves. It is a game of promises, of projected returns, and of a relentless pursuit of capacity, all built on the shifting sands of technological advancement.

CoreWeave, in essence, is a bet on perpetual expansion, a commitment to chasing a market that may, in its own time, choose to chase something else entirely.

The Intricacies of Nebius

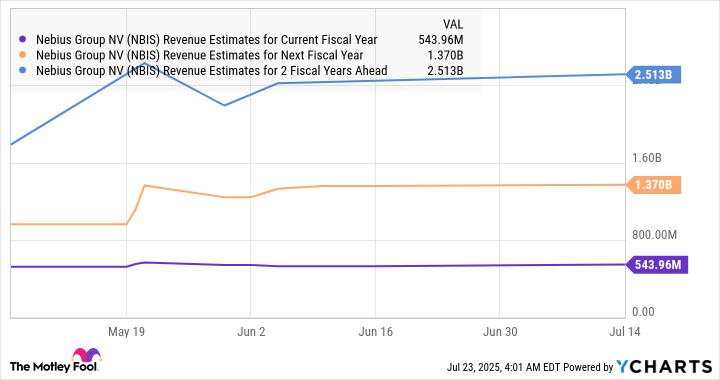

Nebius, a name less readily uttered in the halls of financial power, received a momentary elevation courtesy of Goldman Sachs’ pronouncements, a target price of $68 and a whispered promise of a 31% increase. Such endorsements, steeped in the biases of investment banking, are often self-fulfilling prophecies, provided enough believers can be gathered. Their revenue, a more modest $55 million in the first quarter, nevertheless ballooned 385% year-over-year, a growth rate that, while impressive, carries the scent of a lower base. They speak of a “full-stack” approach, offering not just the raw processing power but also the tools to refine and deploy the resulting intelligence – a more holistic offering, perhaps, but one that inevitably complicates matters.

Arkady Volozh, in a letter to shareholders, described a rapid expansion of their physical footprint, from a single location in Finland to five across Europe, the US, and even the Middle East. A world being covered in data centers, a network of steel and silicon spreading like a vine across the globe. The company, bolstered by a substantial cash reserve, continues to invest, to build, to promise. They offer a balance sheet that appears, at a surface glance, sound, but balance sheets are illusions, fragile constructs designed to reassure where certainty is elusive.

Nebius, then, is a story of ambition tempered by complexity, a more nuanced endeavor with a potentially longer fuse. But ambition, as Mateo knew all too well, is often its own undoing.

The Inevitable Disappointment

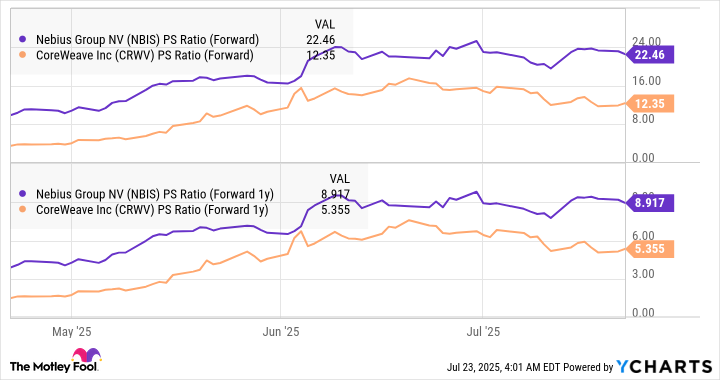

Both companies, growing at rates that defy reasonable expectation, are, in the end, operating in a realm of speculative fervor. To attempt a decisive judgment, to declare one superior to the other, feels premature, even foolish. As valuations are the true measure, and both remain resolutely unburdened by actual profit, we must turn to the ratios themselves.

Nebius carries a price tag disproportionate to its revenues, a symptom of the excessive optimism gripping the market. CoreWeave, for all its recent gains, appears, comparatively, the less reckless gamble. Yet, even this relative advantage offers little comfort. The truth, as whispered by the dusty winds of experience, is that both rely on a continuation of this extraordinary growth, a continuation that is, by its very nature, unsustainable. The clouds are ephemeral, the algorithms fickle, and the market, always, demands its due. The most prudent course, perhaps, is to observe from a distance, to wait for the cooling rains to arrive, and to remember that every golden age eventually remembers its mortality. 😔

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-07-27 04:43