The S&P 500 climbs to dizzying heights, leaving investors to wonder if there’s any uncorrupted corner of the market left to exploit. In technology, where hubris often masquerades as innovation, stocks like Nvidia and Microsoft trade at P/E ratios that suggest faith, not arithmetic. For the value investor, this is a desert of opportunity. Yet here, in the shadow of these titans, Alphabet is peddled as a “must-buy” AI stock. Let us examine this claim with the rigor it demands—or the lack thereof.

Alphabet’s labyrinth of ventures, from Google to YouTube, is framed as a “matrix of growth.” Yet this metaphor, borrowed from late-night infomercials, obscures a simpler truth: the company’s data hoard is less a treasure map than a cage. Its AI “advantage” rests on the quiet exploitation of billions of users, their searches, their videos, their lives—curated not for enlightenment, but to refine algorithms that sell attention. The notion that AI will “take Google Search to the next level” is less a revolution than a repackaging. AI overviews, a sprout in Google’s garden of half-baked innovations, promise convenience but deliver compliance. The user does not triumph; the interface does.

Google Cloud’s 28% revenue surge is celebrated as a triumph, yet such growth demands a voracious appetite for capital. The cloud, that modern alchemy of data and electricity, requires fortresses of servers and wads of cash. Alphabet plans to spend $75 billion in 2025—enough to sink smaller empires—on AI infrastructure. Profit margins, they assure us, will expand. But margins are promises, not guarantees. Google Cloud’s recent 18% operating margin is a flicker in a storm; scale may amplify it, or it may dissolve into the fog of obsolescence.

Waymo, Alphabet’s self-driving venture, is held up as a beacon. It lurches through American cities, a mechanical tourist in a human world. The company’s “infrastructure, engineering, and AI expertise” are invoked like a mantra. Yet for all its promise, Waymo remains a sideshow—a noble gesture, though one wonders if it’s more spectacle than substance. Alphabet’s growth, it seems, is a mosaic of half-realized ambitions, each hyped to distract from the others’ shortcomings.

The arithmetic of profit margins is treated as prophecy. A 33% operating margin, “a record,” is extrapolated to 40%, matching Microsoft’s shadow. But numbers, when divorced from context, become weapons. If Alphabet’s $359 billion revenue grows to $500 billion, a 40% margin would indeed yield $200 billion in operating income. Yet this is a fantasy built on the assumption that the world’s most profitable company will emerge unscathed from the chaos it helps create. Capitalism’s finest hour? Or a house of cards dressed in spreadsheets?

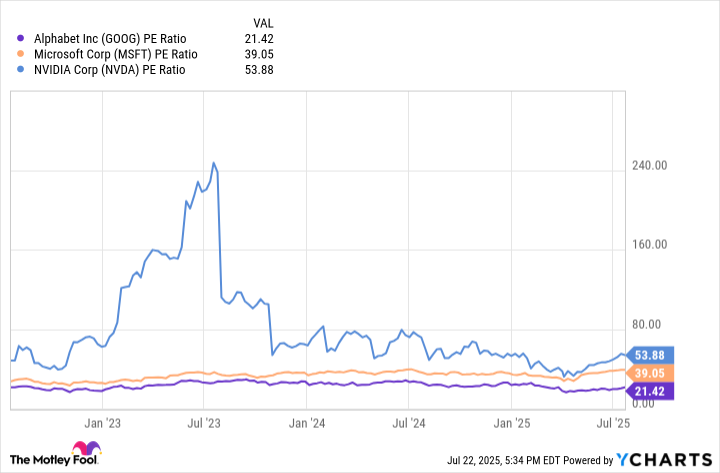

Buybacks and dividends are framed as shareholder generosity. A 0.42% yield, “set to grow,” is a sop to patience. The reduction of shares outstanding by 12% over a decade is cited as proof of prudence. Yet these gestures, while not insignificant, are the corporate equivalent of polishing the spoon while the pot boils dry. Alphabet’s P/E ratio of 21 is called “the cheapest among the Magnificent Seven.” But valuation is a language of comparison, not virtue. At 21, it is not a bargain—it is a relic of a bygone era, a price tag on a company that has long since outgrown its humility.

Alphabet, for all its data, its clouds, its bots, remains a study in contradictions. It is both relic and revolutionary, both parasite and savior. To call it a “fantastic stock to buy” is to mistake the fever for the cure. The market’s all-time highs are not a recommendation but a warning. In the end, Alphabet’s AI gambit may yet pay off—for its executives, if not its shareholders. For the rest of us, it is a reminder that in the theater of finance, the curtain never falls. 🤖

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2025-07-26 10:35