Right. So, the investment thing. It’s all terribly important, isn’t it? Building a future, not ending up eating cat food in a bedsit. Everyone says you need to be ‘invested’ but honestly, the sheer number of choices is… paralyzing. Today’s dilemma: Apple versus Costco. Two behemoths. Two potential lifelines. Or, you know, sources of mild anxiety.

Both, it’s true, have cultivated this almost unsettlingly devoted following. People queue for days for the new iPhone. People pay an annual fee just to buy toilet paper in bulk. It’s a bit like a cult, really, but a financially sound one, presumably. And their stocks… well, they’ve done rather well for those who got in early. Which, naturally, I didn’t. Never do.

I mean, they’re hardly going to double overnight, are they? But long-term? Possibly. Still. One must be sensible. One shouldn’t just throw money at things because they sound…solid. Especially not when things are already, frankly, a bit pricey. It’s all about value, isn’t it? Although, what *is* value these days?

So, the burning question. Which one? Let’s delve in. It’s exhausting just thinking about it.

They’re Still… Functioning

Apple, naturally, does phones. And watches. And things I don’t understand. The iOS ecosystem, apparently, has 2.35 billion active users. That’s a lot of people staring at little screens. Costco is…bigger. Much bigger. And cheaper, generally. A warehouse full of bargains, if you’re willing to buy 48 rolls of kitchen towel. Which I sometimes am. Don’t judge.

Both are established. Both are still growing, albeit not with the youthful exuberance of, say, a tech startup run by a 22-year-old who hasn’t slept in three days. Billions in revenue makes rapid expansion tricky. Still, they *are* expanding. A bit.

Apple is edging into subscriptions now, which is clever. Like a digital leech, gently siphoning off small amounts of money each month. Nearly $53 billion in the first half of the year from services, up 12.7%. Sneaky. But effective.

Costco’s strategy is simpler: get people to pay a membership fee, then lure them in with bulk discounts. Membership numbers are up 6.8% to 79.6 million. It’s a brilliant business model, actually. People feel like they’re saving money, even if they’re probably just buying things they don’t need. (Guilty.) Membership dues are, apparently, where the real profits lie.

The analysts, those oracles of financial wisdom, reckon Apple will grow earnings by 10.6% annually, while Costco is looking at around 9%. Not exactly a landslide victory for Apple, but still. Numbers. They’re so… definitive. And yet, so easily wrong.

Ten Years of…Similarness

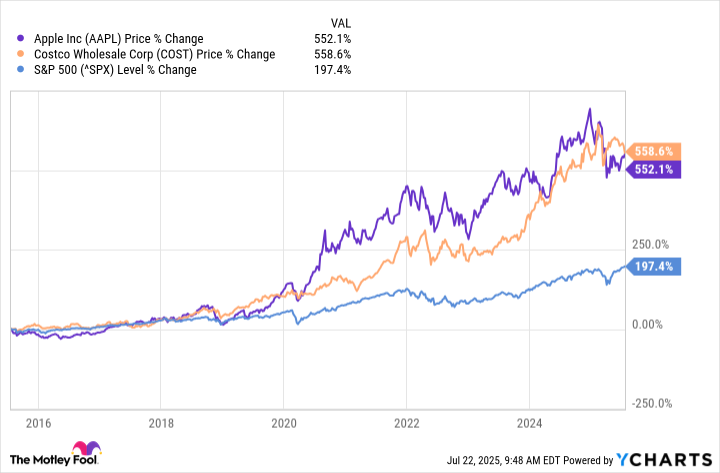

The really weird thing? Over the past decade, their stock performance has been remarkably similar. Honestly, it’s unnerving. Both have outperformed the S&P 500, which is good. Though one always wonders if one could have picked something even *better*. Regret is a constant companion in the world of investing.

Both pay dividends. Small ones. Apple’s been increasing theirs for 12 years, Costco for 20. Costco occasionally throws in a “special” dividend, which is nice. Like a little bonus for enduring the crowds. But really, we’re not talking about life-changing sums of money.

The Verdict (Which is Probably Wrong)

The experts suggest Apple has slightly more growth potential, but is also…slightly more precarious. Which, frankly, is how I feel most days.

Apple’s been having a bit of a struggle with the whole AI thing. Apparently, they’ve had to go back to the drawing board. Which is embarrassing, isn’t it? Still, Apple users are fiercely loyal. They’re trapped in the ecosystem. It’s a very sticky ecosystem. But they *need* to get AI right, or they’ll be overtaken by someone who does. The thought is terrifying.

Despite all this, and despite the fact that it feels incredibly risky, I think Apple is the better buy.

Why? Because Costco’s stock price has been inflated by…optimism. It’s gone up faster than its actual profits. It’s trading at a price-to-earnings ratio of 54. Which is, apparently, far too high for a company only growing at 9% a year. It’s a bit like paying £50 for a sandwich.

Apple, at 33, isn’t exactly cheap, but it’s more reasonable. Especially if they can deliver on that double-digit earnings growth. And they buy back loads of their own stock, which helps boost earnings. It’s all a bit complicated, really. But it makes some kind of sense. And right now, sense feels… reassuring. Also, I quite like their phones.

Units of Cryptocurrency Lost: 0 (so far). Hours Spent Watching Charts: 7. Number of Panicked Texts to Friends: 18. 🧘♀️

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2025-07-26 01:14