Ah, the grandiose theatre of capitalism—a sparkling stage where players flaunt exquisite masks, yet beneath them, a deeper narrative unfolds. General Motors (GM), that venerable titan of automotive ambition, has oft danced to the intoxicating cadence of rising share prices and ebullient shareholder delight. However, as the curtains drew back this week, revealing a not-so-dramatic act of a 35% plunge in net income, one wonders if the audience fully comprehends the labyrinthine choreography behind this decline.

Tariffs: A Collision of Commerce

Picture, if you will, the economic landscape as a ponderous sea, beset by squalls and surges. Amidst these tempests, GM, ever the audacious navigator, reported commendable second-quarter earnings on July 22, rather like a ship piercing through a turgid wave. Yet, lurking in the shadows of success, the omnipresent specter of tariffs looms formidable. Indeed, a staggering 45% of GM’s vehicles—a veritable flotilla—sailed into the American harbor from foreign shores, most notably Mexico and South Korea, thus exposing them to the unrelenting tide of import tariffs.

In a whimsical journey through fiscal geography, GM noted that these tariffs drained its coffers to the tune of $1.1 billion in the second quarter alone, with ominous forecasts of a full-year impact between $4 billion and $5 billion. Yet, undeterred, our indefatigable protagonist manifests resilience, proclaiming it can offset at least 30% of this tidal wave of costs through a concoction of cost initiatives, imaginative pricing, and strategic manufacturing adjustments.

Alas, the tapestry woven from tariffs is wrought with darker threads. The pall of tariffs indeed cast a shadow over GM’s most vital territory—North America, where pre-tax profits faltered by a lamentable 46%, collapsing to $2.4 billion. The grand narrative, with its rising ebbs and plunging flows, culminated in a 32% descent in overall adjusted earnings before interest and taxes (EBIT), now a scant $3.04 billion.

“Tariffs are obviously a big story for us,” murmured CFO Paul Jacobson on CNBC—a wise man amidst a tempest, yet perhaps too cognizant of his narrative’s woe. “We’re in a bit of an adjustment phase right now, but I think the team is really firing on all cylinders.” But lo, as the plot thickens, an inevitable crescendo looms: a forecasted uptick in tariff burdens during the third quarter, no less, even as GM girds its loins to invest approximately $4 billion in the development of more gasoline-powered vehicles, the Chevrolet Equinox lured back to Kansas, like a prodigal child, and the Chevrolet Blazer, once exiled to Mexico, now returns to the warm embrace of Tennessee.

Sunny Interludes Amidst Gloom

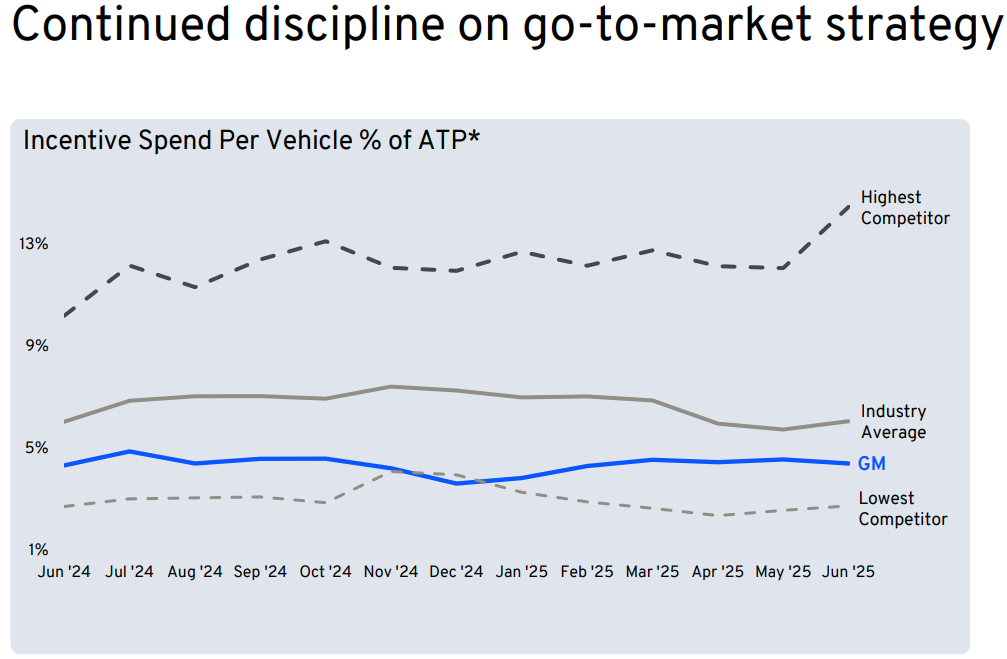

Yet, dear reader, let us not merely dwell in the solemnity of fiscal woes; for within GM’s second quarter resided a few dawns of brilliance that would make even the most prudent contrarian muse. Consider, if you will, the average transaction price (ATP) that surged past $51,000, while incentives, those pecuniary sweeteners so often estimated as vital for customer capture, dropped a phenomenal two points beneath the industry average—an opus of efficiency worth applauding.

Furthermore, let us turn our gaze eastward, to the fabled markets of China, a realm where GM had previously stumbled through a thicket of trials. Fortitude and strategy bore fruit (and one hopes, jubilation) in the form of a $71 million equity income—an invigorating revival compared to the oppressive $104 million loss racked up in the same quarter the previous year. As the saga unfolds, we witness a sustained climb in sales driven by GM’s newly launched energy vehicles (NEVs), heralding a competitive gain of market share greater than any foreign rival—a subtle sonnet amidst the cacophony of commerce.

Illuminating Futures

As we stand on the precipice of automotive evolution, GM navigates a tempest not merely fashioned from tariff winds but also the capricious, uncharted waters of the electric vehicle (EV) domain, which unfurls its sails with a pandemic slowness. Yet, whispers of supremacy emerge—for the future undeniably belongs to EVs, and GM is resolutely casting its net wider into this burgeoning harbor of opportunity, recently securing a second-place honor for sales volume in the U.S. market.

In the intricate loom of quarterly reports, GM has crafted a fabric of potential, ripe with promise and laced with peril. Investors may need to embrace the virtues of patience as the company endeavours to dismantle the heavy chains forged by tariffs—yes, those rusty anchors grappled to the sleek hull of its financial vessel. In this seeming dichotomy of riches and ruins, we find the melodrama of business—in its essence, a continuous dance between dreams and doubts. 🚗

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

- ONDO’s $840M Token Tsunami: Market Mayhem or Mermaid Magic? 🐚💥

- Games That Removed Content to Avoid Cultural Sensitivity Complaints

2025-07-25 19:42