Ah, the automotive stage! What a splendid comedy of errors it presents, where tariffs dance like mischievous sprites, and manufacturers—our dear Ford Motor Company (F) among them—strut about, pretending mastery over forces beyond their control. The Trump administration, that grand impresario of economic theater, has orchestrated a production where costs rise, consumers groan, and Ford, ever the cunning protagonist, attempts to turn misfortune into farce.

With the flair of a seasoned thespian, Ford has played its hand: marketing its American roots like a badge of honor, offering employee-level pricing as if dispensing alms to the masses. And lo! The crowds have cheered. Second-quarter sales soared, market share expanded, and now, a new promotion—lower up-front costs—to keep the audience enthralled. But let us not mistake spectacle for substance. Where shall this stock, this mercurial player, stand in three years’ time? Let us lift the curtain and peer behind.

Act I: The Farce of Tariffs and Volume

Ford, that proud American marque, is nonetheless a citizen of the world, its supply chains and sales as global as the sun’s reach. Yet here we are, entangled in the absurdity of tariffs, those capricious levies whose effects are as predictable as a jester’s next jape. The Trump Administration, that master of inconsistent messaging, leaves even the keenest analysts scratching their heads.

Ford’s management, ever the optimists, anticipate a $1.5 billion blow to 2025 EBIT. But what is adversity if not an opportunity for grandstanding? Thus, the “From America, For America” campaign was born, a patriotic pantomime where buyers were granted the sacred privilege of employee-level pricing. And how the masses responded! Q2 2025 sales leapt by 14.2%, a veritable triumph:

- F-Series trucks enjoyed their finest Q2 since 2019.

- Electric vehicles? Record sales, as if the future had arrived ahead of schedule.

- The Lincoln brand, that forgotten aristocrat, saw its highest volume since 2007.

- Ford Pro software subscriptions grew by 20%, proving that even machines must pay their dues.

Yet, let us not forget the high fixed costs of these automotive theatrics. Factories are expensive stage sets, and investors await Ford’s Q2 earnings on July 30 with bated breath. Can volume offset tariffs? Can market share be won without sacrificing profit? The plot thickens.

Act II: The Resilient Fool

Tariffs loom like a storm cloud, yet Ford, that stubborn protagonist, insists the show must go on. Wall Street, ever the chorus, has already sung its dirge: earnings per share may plummet from $1.84 to $1.12. But Ford, ever the resilient fool, remains profitable. Why else would it launch another promotion if not to prove its mettle?

The dividend, that sweet siren song, yields over 5.3%, a mere 54% of 2025 earnings. The balance sheet, that sturdy scaffold, boasts $27 billion in cash and $45 billion in liquidity. Ford, it seems, has the means to weather this tempest—or at least to pretend it does.

Act III: The Uncertain Finale

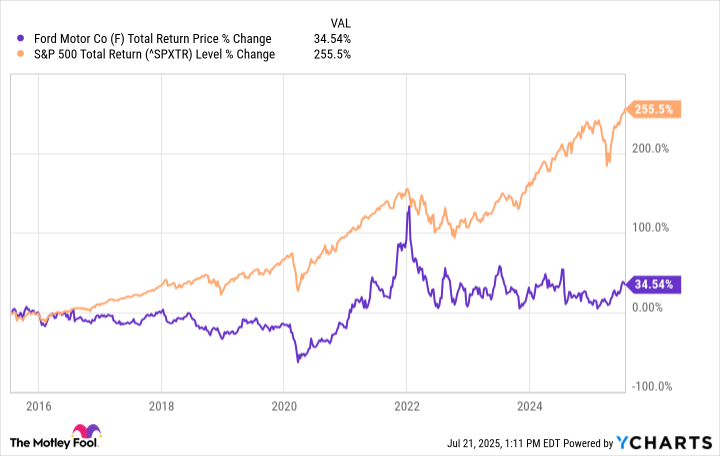

Ah, the auto industry! That grand arena where fortunes are made and lost, where factories demand ceaseless investment, and where Ford, despite its stature, has long lagged the broader market. Even if it navigates these tariff headwinds, there is no guarantee of applause.

Free cash flow yield stands at 20%, in line with its decade-long average. But can the stock rise while tariffs weigh upon it like an ill-fitting costume? Ford may sell more vehicles at thinner margins, hoping free cash flow grows. Q2 earnings will reveal whether this gambit succeeds or whether the farce turns tragic.

I suspect Ford shall spend the next few years clawing back to 2024 profits. Tariff costs and higher sales may cancel each other out, leaving the stock price unmoved. The dividend, that 5.3% consolation prize, may well be the star of this show.

Thus, dear audience, it seems Ford’s upside is limited for now. But as with all good farces, the script may yet change. 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2025-07-25 15:56