In my view, the financial world is constantly on the hunt for the next groundbreaking discovery, and this year, quantum computing has been a captivating subject. If you’re seeking an emerging player in this field, consider taking a closer look at IonQ (IONQ), which has experienced a remarkable surge of around 500% over the past 12 months.

The organization is working on constructing quantum computers, and their CEO aspires that their technology will position the company as a dominant player, similar to how Nvidia stands out in its respective industry.

Will IonQ live up to such great expectations? To find out, let’s examine the current quantum computing marketplace and assess where the company stands and if its shares could continue to be a significant investment for your portfolio.

Quantum computing stocks: The potential and a caveat

Exploring the realm of quantum computing signifies stepping into a cutting-edge technological territory, where calculations that are incredibly complex can be processed at speeds surpassing those achieved by today’s top-tier supercomputers, all thanks to the principles of quantum mechanics.

The primary issue right now is that most of the technology remains in the research phase. Over a dozen entities, such as IonQ, are diligently working on quantum computers. However, their practical application beyond academia is limited due to the fact that existing quantum computers are both unstable and susceptible to errors.

After addressing any potential issues, this innovation might serve as a significant advancement for our society. Predictions from McKinsey indicate that the potential market value could surge to around $100 billion by the year 2035.

It’s important to note that a significant portion of the expected growth will probably happen towards the end of the coming decade. A number of industry professionals, even those leading businesses specializing in quantum computing, concur that the general applicability of this technology is likely to be realized in several more years, at the very least.

Examining IonQ’s place in the quantum landscape

IonQ is working on creating quantum computers based on trapped ions, intended for use within data centers. The key aspect is that their technology is versatile across different vendors. In other words, IonQ’s hardware can be found on all significant cloud platforms, and it works seamlessly with popular quantum computing programming languages as well as software development kits from various sources.

In addition, it has taken over multiple firms to broaden its technological influence. Notably, IonQ revealed a plan to buy Oxford Ionics for approximately $1.075 billion (mainly using stocks), thereby gaining control over Oxford’s quantum processors based on trapped ions.

As a bystander, I’m observing the strategy being put forth by the company – they aim to establish a solid foundation for their quantum computers to transition effortlessly into practical, day-to-day applications.

IonQ is now earning income as well. Notably, it’s teaming up with Amazon (specifically through their Amazon Web Services) and Nvidia to aid pharmaceutical corporation AstraZeneca in applying quantum computing for faster drug development. Additionally, they have secured several contracts from the U.S. Air Force Research Lab, amounting to approximately $94.4 million in value.

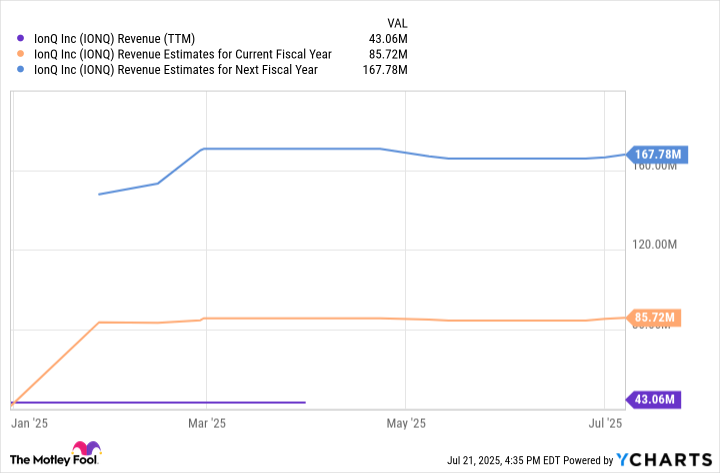

Over the next two years, IonQ is anticipated to experience robust expansion due to its blend of earnings from inherent sources and additional sales from strategic acquisitions.

Is the stock a buy now?

In simpler terms, this stock is quite volatile and comes with significant risks. The company’s aggressive buying strategy might lead to problems if they overpay for other companies or struggle to seamlessly merge them into their existing operations. Moreover, if the company’s own revenue growth doesn’t match the growth from these acquisitions, it could potentially slow down overall growth.

Furthermore, the scene is quite competitive, with established giants like IBM, Amazon, Microsoft, and Alphabet (Google), along with several emerging players such as IonQ, also working on the development of quantum computers.

To wrap up, IonQ currently boasts a market capitalization valued at $12 billion. This translates to a price-to-sales ratio of approximately 71 when considering next year’s projected revenue. It seems plausible that the share price already accounts for a significant portion of the company’s imminent growth and achievements.

In other words, this could imply that the stock’s price doesn’t allow much leeway for a decline if things take a turn for the worse, given the potential risks involved. IonQ, being an untested company with minimal earnings in a fledgling and volatile sector, carries significant uncertainty. A high market valuation suggests there’s more potential for the stock to drop if it fails to impress investors.

A lopsided risk-versus-reward scenario could quickly lead to unfavorable results, possibly causing substantial losses for investors should events take an adverse turn. Consequently, it might be prudent to steer clear of investing in IonQ stocks at this moment.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-07-25 13:43