In the year 1965, Warren Buffett acquired significant control over a textile firm known as Berkshire Hathaway (BRK.A) (BRK.B), which was facing difficulties. Recognizing that its original operations were no longer sustainable, he transformed it into a holding company for his diverse investments. Today, Berkshire Hathaway oversees multiple self-owned subsidiaries and boasts a portfolio worth $292 billion, comprising shares and securities of publicly traded companies.

Over the past six decades, Buffett, despite having shares in over a hundred firms, has never explicitly pointed out his favorite. However, if we track his investments, it’s evident that some companies hold more appeal than others for him. As an illustration, he amassed approximately $38 billion worth of Apple (AAPL) stock for Berkshire Hathaway between 2016 and 2023, representing the most significant investment he’s made in a single company.

In a nutshell, Buffett invested significantly more than double the amount he mentioned earlier into shares of a company that has skyrocketed over 4,470,000% since 1965. However, this particular investment is not part of Berkshire’s current holdings.

Buffett uses a simple but effective investment strategy

Buffett prefers to put his investments into businesses that exhibit consistent growth, produce dependable earnings, and boast solid leadership teams. He’s particularly drawn to those companies with shareholder-focused strategies such as dividend schemes and stock repurchase programs, as they accelerate the growth of his capital at a substantial rate. However, his key tool is patience – whenever he acquires a piece of a company, his ideal holding duration is indefinite.

Berkshire Hathaway’s investment in Coca-Cola (KO) demonstrates Buffett’s strategy effectively. Over a span of 6 years, from 1988 to 1994, he acquired approximately 400 million shares of the colossal soft drink company at an aggregate cost of $1.3 billion. To this day, he has not sold any of these shares, and their current worth stands at a staggering $27.8 billion. Additionally, in the year 2024, Coca-Cola paid Berkshire Hathaway a substantial dividend of $776 million, meaning that Berkshire now recuperates its initial investment approximately every two years.

Apple is a company that fits all of Buffett’s investment criteria, and it has generated a significant profit for Berkshire Hathaway so far. As we move into 2024, Berkshire’s $38 billion investment in Apple was worth over $170 billion, making up half of the value of their entire stock and securities portfolio. Buffett and his team have since sold about two-thirds of Berkshire’s Apple shares to realize some of these profits and lessen potential risks.

Some of the other long-term investments held by Berkshire Hathaway, such as Kraft Heinz, Visa, Bank of America, and American Express, still fit with Buffett’s selection standards.

Buffett has plowed $77.8 billion into this stock since 2018

Although Buffett’s $38 billion investment in Apple is his largest in a single stock, it is dwarfed by the massive $77.8 billion he has approved for repurchasing Berkshire Hathaway shares since 2018. Buybacks are one of Buffett’s preferred methods for returning money to shareholders as they decrease the total number of Berkshire shares available, often causing the price per share to increase and giving each shareholder a larger ownership percentage in the company.

In simpler terms, when Buffett believes that Berkshire Hathaway’s stock is undervalued, or if he can’t find appealing alternatives for investment, he tends to invest the money in share buybacks.

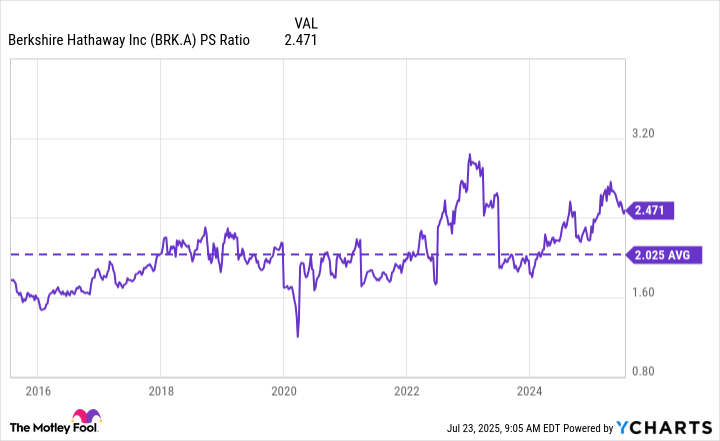

Buffett hasn’t given approval for any share buybacks over the last three quarters, potentially due to Berkshire Hathaway’s shares consistently reaching new peak prices. At present, its price-to-sales (P/S) ratio stands at 2.47, representing a 22% increase compared to its average of 2.02 over the past decade. This suggests that the stock is currently not undervalued.

Berkshire Hathaway can keep making share repurchases as long as it maintains at least $30 billion in cash or similar assets. With a whopping $347 billion in liquid assets currently, Buffett and his team have the flexibility to approve additional buybacks whenever they deem the timing (or price) appropriate.

Berkshire stock has more potential upside

It’s plausible that Berkshire’s buyback program has slowed due to other factors in play. On May 3rd, Buffett declared his intention to retire as CEO by the end of 2025. This could mean he’s delegating significant decisions like share repurchases to his successor, Greg Abel.

Investors can rest assured that Buffett will remain the chairman of Berkshire, so his signature style of long-term investment in value won’t be disappearing anytime soon.

Over a span of nearly six decades from 1965 to 2024, Berkshire stock saw an astounding 4,470,000% increase, equating to a yearly compound return of approximately 19.9%. This staggering growth is almost twice the annual average yield of 10.4% garnered by the S&P 500 during the same timeframe. In cold hard cash, an initial $1,000 investment in Berkshire stock back then would have ballooned to a jaw-dropping $44.7 million at the end of last year, while the equivalent investment in the S&P 500 would have grown more modestly to around $342,906.

Buffett has constructed an asset that consistently generates cash flow, which is expected to endure even beyond his position as CEO. The impressive $347 billion in readily available funds he’s passing on serves as a strong base for his successor to guide Berkshire into a fresh chapter. Given this, I believe the stock possesses the essential traits to keep outperforming the market.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2025-07-25 13:10