As an observer, I find tech stocks to be quite the sought-after investment, and it’s not hard to see why. The technology sector accounts for approximately one-third of the S&P 500 index, a gauge that tracks the 500 largest U.S.-listed publicly traded companies. Surprisingly, this specific sector has almost doubled the overall index’s performance in 2021 alone.

One possible counterargument about tech stocks is that they don’t pay dividends. Since these companies are at the cutting edge of technology, they tend to reinvest their earnings into their business. This could be to further develop existing successful products, invest in research for new breakthroughs, or spend on advanced hardware like graphics processing units (GPUs) to power their AI systems. Frequently, they engage in all three activities simultaneously.

Investing in these tech stocks offers a unique advantage: they not only have the potential to outperform the market, but also provide substantial dividends that income investors appreciate. These dividends can be used either to augment investment portfolios or cover living expenses during retirement. The recommended stocks for such investments are Cisco Systems (CSCO), International Business Machines (IBM), and Paychex (PAYX). All of these stocks are currently considered good buying opportunities.

Cisco Systems

Cisco is a widely recognized company that offers networking security solutions, software, and cloud services. It designs Internet Protocol-based routers and switches for seamless data transfer across networks. In the third quarter of their fiscal year 2025 (ending April 26, 2025), they reported revenue of $14.1 billion, marking a 11% increase compared to the same period the previous year. Additionally, their earnings per share (EPS) increased by a substantial 35%, reaching $0.62 compared to the same time frame in the preceding year.

In the realm of technology, I’ve been thoroughly captivated by the extraordinary journey of AI within Cisco’s product lineup! Last year alone, AI-driven sales surpassed the $1 billion mark for this tech giant, a figure they aim to double in 2025. The significant expansion of their revenue can be attributed in part to their strategic acquisition of Splunk, a deal valued at a whopping $28 billion that was finalized last year. This move was designed to empower customers by enhancing their networking, security, and AI capabilities. I’m excited to see what the future holds as Cisco continues to innovate in this area!

Cisco, a well-established tech corporation, continues to seek avenues for expansion and market dominance, as evidenced by its 15% increase in value during 2025. Additionally, Cisco stock offers a dividend return of 2.3%.

International Business Machines

One company that readily springs to mind when considering established tech giants is the long-standing IBM, often referred to as “Big Blue.” With roots dating back over a century, this company has significantly evolved from its initial fame in developing personal computers. Nowadays, IBM is predominantly recognized for its expertise in cybersecurity, cloud computing, consulting services, and the operation of large mainframe computers that are estimated to be utilized by approximately 81% of Fortune 500 companies.

Despite its rich past, IBM now operates with agility, similar to a dynamic force in the stock market, having grown by 30% this year alone. The 2019 acquisition of Red Hat has been instrumental in enabling IBM to expand its hybrid cloud-computing business and boost revenue and energy within its software division.

According to analyst predictions on Yahoo! Finance, IBM’s revenue is projected to increase by 5.5% this year, reaching approximately $66.2 billion, and then grow another 4% in fiscal year 2026. This, combined with IBM’s stable dividend yield of 2.3%, makes IBM an uncommon blend of growth potential and income generation in the technology stock market.

Paychex

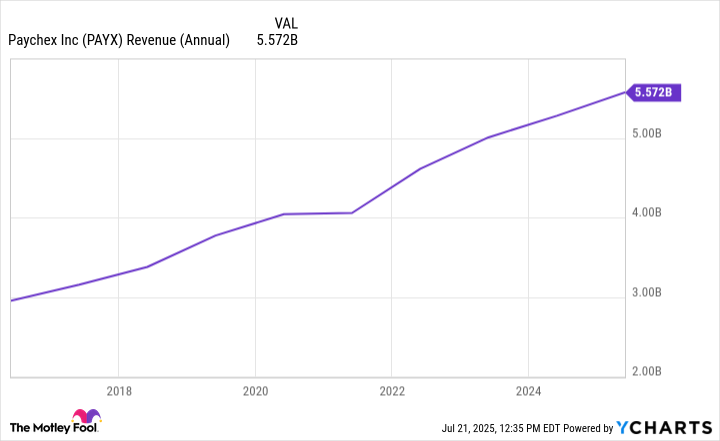

Paychex is a top-tier service provider specializing in payroll, human resources, employee benefits, and retirement solutions for businesses. They manage tasks such as new hire onboarding, performance tracking, timekeeping, and payroll processing. Notably, the company’s earnings have experienced significant growth since 2021, surpassing $5 billion by the year 2024.

Paychex currently serves over 745,000 clients, generating more than half of its earnings from services beyond payroll. The growth of its retirement services sector soared by double digits in the year 2024, now managing assets worth $52 billion. In the fourth quarter of fiscal year 2025 (ending May 31, 2025), the company reported a revenue of $1.42 billion, marking a 10% increase from the previous year. However, operating income decreased by 11% during this period, mainly due to Paychex’s acquisition of another human capital management company, Paycor, for $4 billion, which was finalized in April.

Beyond its payroll services, Paychex’s growth in other sectors, notably following the acquisition of Paycor, is expected to further propel their revenue. The company anticipates a potential increase in revenue for the upcoming fiscal year by 16.5% to 18.5%, with earnings per share (EPS) projected to rise between 8.5% and 10.5%.

This year, Paychex’s stock has only seen a 2% increase, but it appears to be building steam for a significant surge over the next several quarters. Currently, its forward price-to-earnings (P/E) ratio stands at a relatively affordable 26, and it offers an attractive dividend yield of 3%. In my opinion, Paychex is a solid investment choice.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-25 10:56