Ah, Ki Young Ju, the esteemed oracle of CryptoQuant, has audibly proclaimed that the time-honored Bitcoin cycle theory is no more. Imagine the shock! 🎭

One cannot help but chuckle at the irony; this bold proclamation also serves as a jovial admission that his once-certain predictions now sit in the attic of obsolescence, collecting dust. It’s as if he looked into the mirror of the market and said, “You’re not the person I used to know!”

Why Has the Traditional Cycle Theory Collapsed?

Once upon a time in the enchanted land of crypto, our dear Ki Young Ju built the Bitcoin cycle theory on two mighty pillars: buy when the whales tap dance with accumulation and sell when the retail investors start their awkward shuffle. Such lovely choreography it was!

His predictions leaned heavily on these two guiding stars — including his audacious declaration in March that the bull had waved its last goodbye. It was a spectacle to behold!

Alas, as the winds of market dynamics shifted, Ki found himself grasping at the fading glimmer of that theory. How he apologized, like a child caught with his hand in the cookie jar, fearing that his prophetic musings might have led the innocent astray. “My bad!” he seemed to say, with that air of remorse that resonates deeply in the crypto universe.

“#Bitcoin cycle theory is dead.

My predictions were based on it—buy when whales accumulate, sell when retail joins. But that pattern no longer holds.

Last cycle, whales sold to retail. This time, old whales sell to new long-term whales. Institutional adoption is bigger than we…”

— Ki Young Ju (@ki_young_ju) July 24, 2025

But what, pray tell, is the key difference that drove him to abandon this once-beloved theory? The behavior of the whales, my friend! In days gone by, the majestic whales would generously distribute Bitcoin to their retail fans. Now, however, we see the old whales delicately passing their treasures to a new breed of long-term whales — like a passing of the torch! 🐳✨

This complex evolution has led to an interesting twist — the number of holders now outweighs the traders. Oh, the irony of it all!

In a plot twist that even the finest authors could not have anticipated, Bitcoin’s institutional adoption has spiraled well beyond anyone’s expectations — a veritable tsunami of institutions! Analysts are scratching their heads, perhaps with the same expressions as a cat gazing at a quantum physics book.

Recent investigative endeavors on CryptoQuant stand in accord with his reflections. One analyst, known ominously as Burakkesmeci, noted that the on-chain data does not echo the long-sought “retail investor frenzy” of yesteryears. Instead, it’s the quiet, calculating funds and institutions still masked in the shadows.

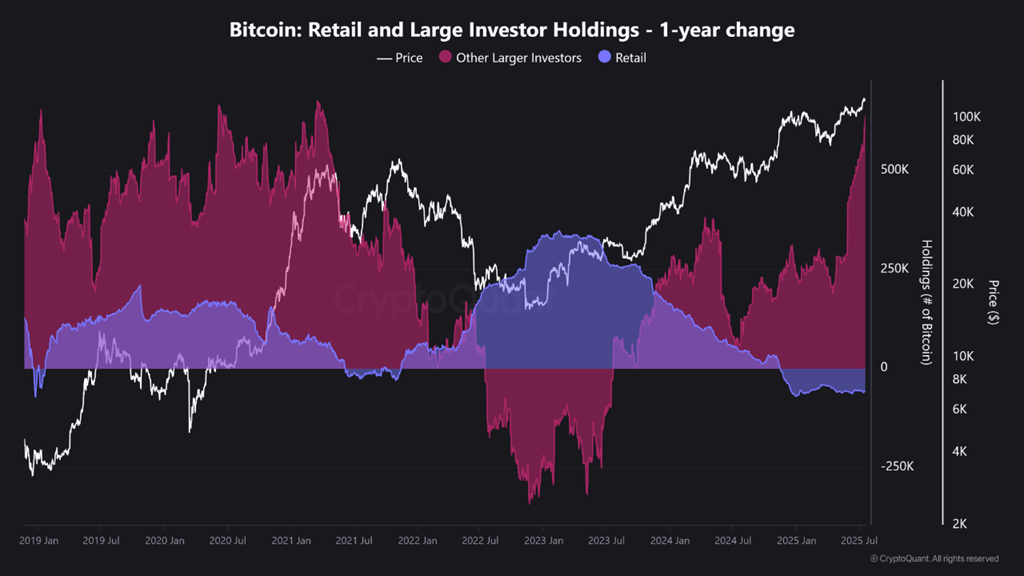

Charts painted in bright colors reveal something rather tragic; since early 2023, retail investors have been joyfully offloading BTC like a kid selling lemonade on a hot day, while institutions, valiant and poised, have been scooping up Bitcoin like there’s no tomorrow.

“This cycle looks nothing like the madness of 2021. There is no mass euphoria, nor is social media overflowing. Quiet and smart money is currently on stage — and most people are still watching from the sidelines,” Burakkesmeci mused, perhaps with a hint of bemusement.

However, this brave new market landscape also brings forth a conundrum — forecasting has become akin to trying to predict the weather in a land where it could rain cats and dogs! 🐱🐶

Once upon a time, investors recognized bear markets as a chaotic frenzy among retail holders; now, we face a rather pressing question: what would a bear market even resemble if the noble institutional investors were to panic instead? It seems the greatest challenge lies before today’s risk managers, clutching at their pearls in marveling dread.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-07-25 10:47