Approximately every few years, an exceptionally high-performing investment is frequently likened to tulips or tech stocks from 1999. As Bitcoin (BTC) surpasses $118,000 and has increased by 407% over the past three years, such cautions are resurfacing once more. Mistiming these market swings can result in missing out on extended growth periods, or even worse, purchasing right before a correction occurs.

There’s likely no cryptocurrency bubble at this point based on three key factors. These elements suggest market excitement, but they don’t show the extreme passion characteristic of a bubble. Let’s delve into each one to understand better.

We don’t think the crypto market is in a bubble right now because of three main points. These points indicate that people are interested, but it’s not the kind of crazy interest that marks a bubble. So let’s take a closer look at each point.

1. The “rainbow” chart

Every four years, there’s a decrease of about half in the production of new Bitcoins, which is referred to as the “halving” event.

By slowing down the production of new coins each time there is a halving, this action typically adjusts the market’s supply and demand equilibrium. As a result, the coin’s price often follows a somewhat unstructured, approximately four-year pattern that encompasses periods before and after the event. Therefore, analyzing historical data on how the coin performed before and after previous halvings can help construct a model for predicting future prices at specific points in time.

As an enthusiast, I find myself captivated by BitBo’s renowned Halving Price Regression (HPR) chart, affectionately referred to as the “rainbow” chart. This visual tool transforms Bitcoin’s patterns into a comprehensible gauge, serving a dual purpose: it predicts Bitcoin’s future trajectory and places its current price in context with where it stood after equivalent timeframes since previous halvings.

This method establishes a logarithmic regression line based on Bitcoin’s price at each previous halving event, and then extends this pattern into the future. The line is enveloped by seven different colored regions.

-

In simpler terms, the curve that represents Bitcoin’s price trend has a blue border around it, indicating that Bitcoin’s current price is aligning closely with its historical patterns following previous halving events. This suggests that Bitcoin isn’t either undervalued or overvalued at the moment.

-

In simpler terms, the green zone signifies stages where the coin’s value is somewhat elevated compared to the time elapsed since its last halving event. However, it’s probably a good idea to continue buying or accumulating this coin during these periods.

-

In simpler terms, as the yellow, orange, and red zones on the graph move progressively higher above the normal trendline, they represent periods where the price of the coin has run ahead by one, two, or more years compared to predictions based on halving events. When the price of the coin is in these zones, there’s a greater likelihood that it will revert back towards the average price level (mean) rather than continuing its upward trend.

Currently, Bitcoin resides within a stable or “green” range, sitting at least two levels below the “yellow,” “orange,” and “red hot” zones which corresponded to peak bubbles in late 2021 and 2017.

To put it simply, according to the rainbow chart, the Bitcoin’s price appears to be well-balanced considering where we are in the halving cycle. This reading indicates a generally positive market sentiment towards Bitcoin, but it’s still quite a ways off from reaching an overly optimistic or euphoric level.

2. Market leaders haven’t reclaimed their old peaks

Typically, bubbles form when leading assets reach new highs and continue to climb without pausing, but this is not the case in the cryptocurrency market as we see it now. Instead, it’s more like a steady progression rather than a bubble-like surge.

As of now, Ethereum (ETH) is trading close to $3,700, which represents a drop of about 25% from its all-time high in November 2021 of $4,878. On the other hand, Solana (SOL) currently stands at around $200, remaining approximately 32% lower than its peak price of nearly $293 in 2021.

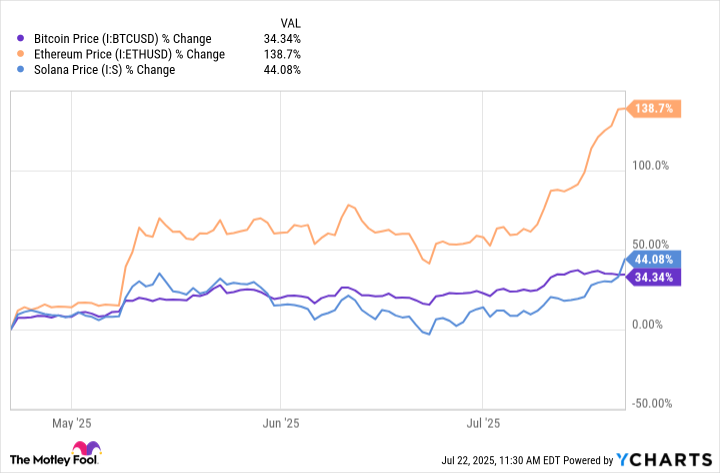

It’s true that they’ve gained a lot in the past three months — just look at this chart:

Nonetheless, it’s important to note that they have yet to challenge their historical price highs, a feat that might occur within the next year given the likelihood of these peaks approaching.

As an enthusiast, I’ve noticed that established cryptocurrencies often struggle to venture into uncharted territories, making it challenging to ignite a sustained frenzy, much like a bubble. Of course, some unique meme coins are speeding ahead, but they always seem to do so, and we haven’t witnessed any truly extraordinary price surges this year yet.

An authentic surge in value requires established cryptocurrencies such as Bitcoin, Solana, and Ethereum to reach new highs and subsequently surpass them. As long as this doesn’t occur, it’s less likely that the overall market is excessively overvalued compared to some sensationalized news articles might suggest.

3. Big money is only starting to dip its toes

In simpler terms, numerous true bubbles appear when many high-level investors have invested all they can (fully allocated) and are using borrowed funds (leverage) to increase potential profits from their investments.

As a passionate follower of the crypto world, I must confess that we’re still quite a distance from hitting those significant milestones. In a survey conducted by Coinbase in March, an impressive 86% of institutions expressed their intention to hold cryptocurrencies. However, only about 59% are aiming to invest more than 5% of their portfolios into digital currencies this year. As we stand here in mid-July, it seems that not many have followed through with these plans, as very few institutions have actually made the move yet.

Currently, the total Bitcoin held by corporate treasuries is relatively small compared to what it might become in the future. Approximately 130 publicly listed companies collectively possess around $87 billion worth of Bitcoin, which represents only about 3.2% of the maximum number of Bitcoins that will ever be created.

In a scenario where people genuinely think that the value of cryptocurrencies will never decrease substantially again (a genuine bubble), the proportion of companies investing in Bitcoin would significantly increase above current levels, with many public businesses including it in their financial holdings. Until this point is reached and most companies publicly adopt a Bitcoin reserve strategy, it’s challenging to view the crypto market as excessively bubbly at all.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

2025-07-24 18:22