Investing wisely involves purchasing assets when they’re cheap (low prices) and later selling them for a profit (higher prices). However, some investors might perceive this strategy as simply buying a stock at a lower cost initially and then offloading it once the price goes up.

A different perspective could suggest that one should purchase when the value is low and sell when it’s high; or to put it another way, buying when a business’s fundamentals are weak and selling when they reach their peak.

Let’s dive into an example with Apple (AAPL).

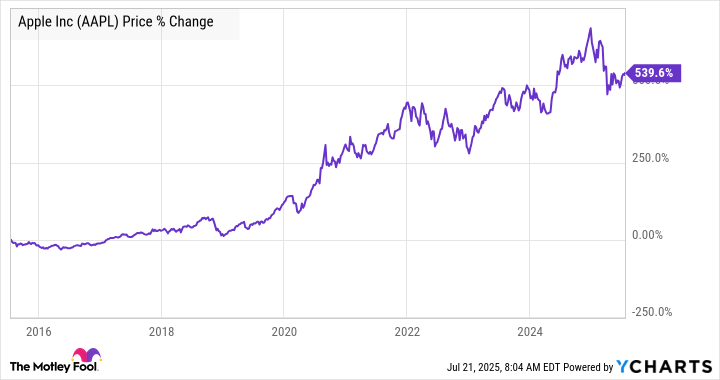

Apple stock price

According to the graph, it’s quite common for investors to sell their investments at a higher price (sell high) after buying them at a lower price (buy low) over the past ten years. However, in most cases, making that sale would have been a mistake.

It’s perfectly fine to realize a gain or adjust your investment size to maintain a well-balanced portfolio. However, someone who simply looks at Apple’s price chart and assumes they are buying at an elevated price might overlook two crucial indicators suggesting that Apple’s earnings growth could persist for a substantial period ahead.

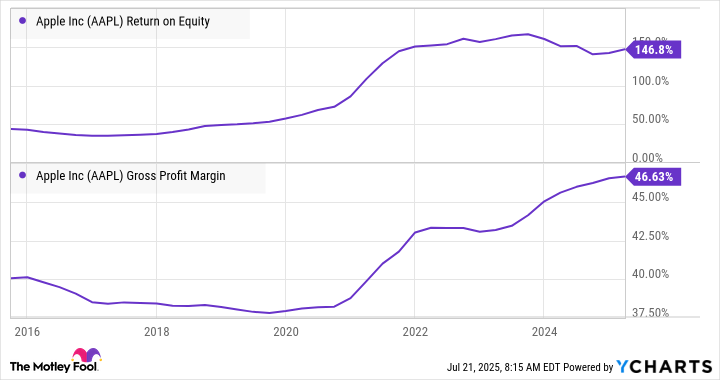

Over the past ten years, the company’s profitability compared to equity investment from shareholders (return on equity) and its profit margins have experienced substantial growth.

A significant factor behind the enhancement is the continuous expansion of Apple’s service ecosystem, focusing on high-profit services that are marketed to an extensive user base of Apple hardware products.

This trend shows no signs of slowing down, and even though Apple’s stock price has significantly increased over the past ten years, it appears there’s still potential for further growth.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Sega Dreamcast’s Best 8 Games Ranked

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Umamusume: All G1, G2, and G3 races on the schedule

- Ethereum’s Affair With Binance Blossoms: A $960M Romance? 🤑❓

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

2025-07-24 17:29