In mid-July, the S&P 500 reached a record high, marking a significant recovery from its drop in April. Currently, the index has gained over 7% since the beginning of the year.

However, certain elements within the S&P 500, which include dividend-yielding stocks, have delivered superior returns compared to the index itself. Today, we’ll examine three such standouts.

Big Blue has delivered big returns this year

With a 30% increase since the year’s beginning, IBM, popularly known as Big Blue, stands out as a dividend-paying corporation that has thrived due to its substantial involvement in artificial intelligence (AI). Although it might not share the same level of brand recognition as other AI stocks like Nvidia, IBM’s first-quarter 2025 financial report underscores the strong foundation of the AI sector for this company.

Between the April-June period of 2023 and the January-March period of 2025, IBM’s generative AI business, which is the accumulated value of active contracts and orders they have secured, has reached a staggering $6 billion. This impressive growth is due in part to an additional $1 billion they secured just in the first quarter of 2025 alone.

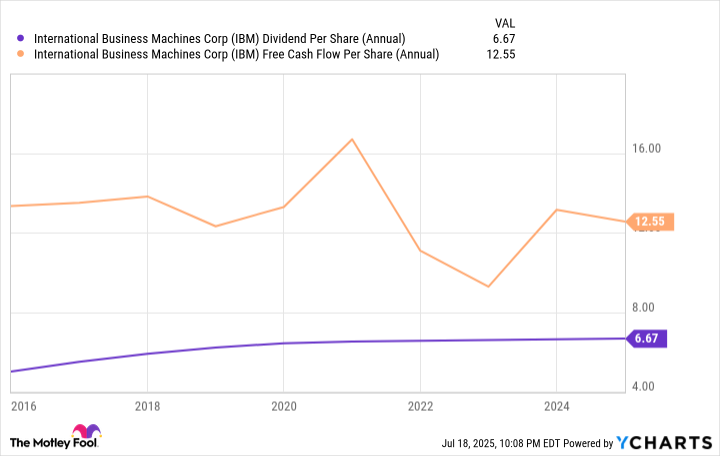

The business is also seeing robust earnings from its cash flow that isn’t tied to operating activities. In the initial quarter alone, they reported a free cash flow of approximately $2 billion, with their leadership anticipating a total of around $13.5 billion by 2025.

For three decades straight, Big Blue has reliably increased its dividends, a remarkable achievement seldom seen among tech companies. With its unwavering commitment to returning profits to shareholders, it’s not surprising that IBM consistently earns free cash flow sufficient for its dividend payouts, and with its significant focus on artificial intelligence, it’s no wonder the stock has experienced growth in recent times.

A flood of free cash flow has Seagate on investors’ minds

In 2025, another notable company fueling investor interest in Artificial Intelligence stocks is Seagate Technology (STX). Remarkably, it has been one of the top performers among S&P 500 components, with a staggering increase of approximately 73% to date. The excitement among investors isn’t solely due to Seagate’s AI-related business; rather, the high demand for its extensive data storage products is driving more cash inflow.

In the first quarter of 2025, Seagate announced a Free Cash Flow (FCF) of $27 million. This was followed by an FCF of $150 million in the second quarter and $216 million in the third quarter. On their latest conference call, management expressed optimism that this cash flow generation will continue to increase steadily throughout the remainder of the year, predicting an improvement in free cash flow generation sequentially for the rest of 2025.

Due to the rise in the company’s incoming cash, investors feel more secure that the existing dividend (which offers a 2% forward yield) is firmly established and likely to continue.

AT&T provides plentiful passive income

In the course of 2024, I observed a significant surge of approximately 35.7% in AT&T (T) shares. Some might have predicted a deceleration in its growth momentum for 2025, but as of now, it appears that the stock’s rapid pace has not shown any signs of abating.

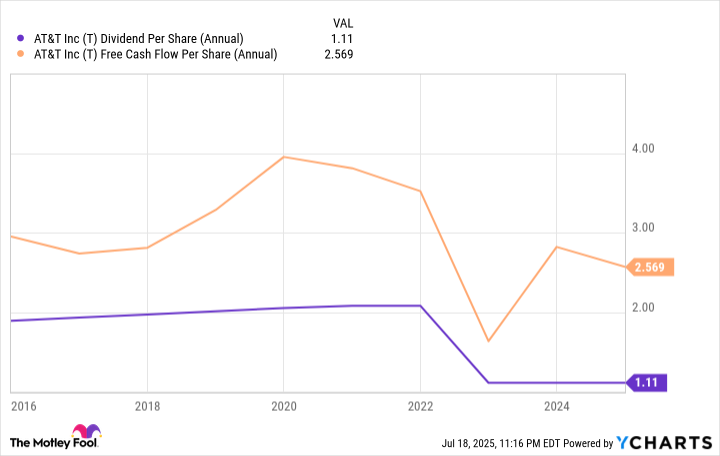

I’ve been thrilled to witness a remarkable 18% surge in AT&T’s stock price so far this year! The positive momentum kicked off at the end of January when the company showcased impressive fourth-quarter 2024 results, leaving analysts and investors alike amazed. Not only did they surpass both top-line and bottom-line expectations, but management also predicted a steady 3% increase in adjusted earnings before interest, taxes, depreciation, and amortization for the year over last, and an impressive $16 billion in Free Cash Flow (FCF) by 2025! What a promising outlook indeed!

Despite concerns among certain companies about the potential impact of the “One Big, Beautiful Bill,” AT&T remains hopeful. In response, their management has stated that they anticipate accelerating investments into cutting-edge network technologies, aiming to add approximately 1 million new fiber customer locations annually, starting from 2026.

At present, the stock offers a forward dividend rate of 4.1%. However, careful investors should not be alarmed by the seemingly high yield as it is supported by the company’s robust Free Cash Flow (FCF), suggesting a stable payout.

Is it too late to click the buy button on these dividend darlings?

Observing the current market scenario, I notice that the stocks of IBM, Seagate, and AT&T have recently surged, trading above their historical valuations. Delving deeper, it seems that both IBM and Seagate hold potential for further exploration, especially as avenues to generate passive income and, more importantly, gain a foothold in the rapidly expanding AI industry.

If you’re focused on potential returns, AT&T could be an excellent choice. However, it might be wise for investors to hold off until AT&T releases their second-quarter results later this month. This way, they can hear any updates to the guidance once the One Big, Beautiful Bill has been passed.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

2025-07-24 15:22