Why might someone opt for buying more of a dividend-paying stock on the stock exchange, given the numerous attractive investment options available?

Dividends enhance the long-term earnings of investors through two primary methods. Firstly, by opting for a Dividend Reinvestment Plan (DRIP), investors gradually accumulate more shares in the company, eventually leading to larger future dividend payments. Secondly, many firms choose to voluntarily raise their dividends per share, providing a potential increase in returns to shareholders.

Initially, a 2% payout may appear insignificant; however, for investors who opt for a Dividend Reinvestment Plan (DRIP) in dividend-focused firms, the earnings gradually accumulate and amplify total profits over time.

Here’s my take:

I’ve always believed that investing in a dividend stock isn’t about blindly doubling down, but rather about carefully selecting the right businesses. That’s why I’m currently bullish on Target (TGT), Dollar General (DG), and PepsiCo (PEP). These are three dividend stocks that have shown resilience and promise, and I think they’re worth a second look.

1. Target

I’m not anticipating significant increases in Target’s revenue for the near future. In contrast, their management projects a small decrease in sales from 2024 to 2025. Additionally, it’s worth noting that when it comes to increasing its dividend, Target might not stand out. This is because they only boosted their dividend by less than 2% back in June.

It might be beneficial for investors to take a broader perspective regarding Target’s stock. The current dividend yield surpasses 4% and attained its all-time high earlier in 2025. This could imply that investors are concerned about the safety of the dividend, yet an increase in the dividend, even a slight one, underscores management’s dedication to it.

It’s likely that Target will increase its dividend, given its history of doing so annually for more than half a century, making it a Dividend Aristocrat.

The leadership at Target appears to be consistently optimistic about boosting their dividend due to a potentially underestimated growth aspect within their operations. By expanding their advertising efforts, welcoming external vendors on their online marketplace, and introducing the subscription service Target Circle 360, they are nurturing digital ventures that boast higher profit margins.

As an ardent investor, I’ve noticed that many retailers are thriving by following Target’s current strategies. While the 2025 sales forecast might not spark much excitement, the company’s long-term potential for profit growth and continued dividend increases makes it a promising candidate for those seeking lucrative dividend stocks. With its yield still hovering above 4%, this is an excellent time to consider investing more in Target, as its future profits could potentially double!

2. Dollar General

Similar to Target, Dollar General’s stock is characterized by low growth potential. However, the future profitability of this discount retail chain could cause concern among investors. In the year 2024, the company’s Earnings Per Share (EPS) dropped significantly by over 30%. For dividend-focused investors, a steep decline in profits is not an encouraging sign.

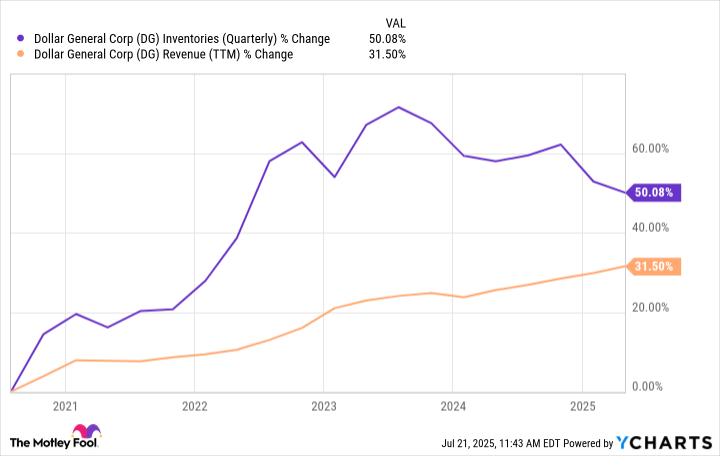

Essentially, Dollar General’s profits have significantly declined over the past few years due to an excess of goods. You can see this trend in the graph, where inventories grew at a faster rate than sales until reaching their highest point in 2023. The management team has been diligent in reducing these inventory levels to more manageable amounts. However, the process of lowering inventories has negatively impacted profitability.

Following some challenging years, Dollar General appears to be regaining its momentum. For the first quarter of 2025, earnings per share (EPS) increased by 8% compared to the same period last year. Management anticipates that full-year EPS could see an increase of more than 10%. However, this progress still has a long way to go before the company reaches its past levels of profitability.

The dividend yield of Dollar General exceeds 2%, which is not common for this company. With its earnings projected to increase in the forthcoming years as management addresses past errors, there will be ample opportunity to enhance the dividend. This is why Dollar General is one more stock that offers attractive dividends and deserves additional investment today.

3. PepsiCo

In summary, among these three stocks, PepsiCo could be the most secure choice for increasing dividends. The stock has experienced a decrease of approximately 30% from its peak in 2023, leading some to think that shifting consumer trends are the cause. However, I’m not convinced that this interpretation aligns with the data at hand.

In the initial part of its fiscal year 2025, Pepsi’s sales for carbonated drinks and other products like snacks and food remained consistent compared to the previous year. However, sales for convenience foods decreased by a slight 2%. Despite this minor dip, sales volume is nearly touching record highs, suggesting that Pepsi’s business is far from fading away.

Regardless of shifts in consumer preferences, Pepsi proves to be a flexible enterprise. In the realm of carbonated drinks, it’s anticipating trends by purchasing prebiotic soda maker Poppi for approximately $2 billion. Similarly, in the food sector, Pepsi is broadening its horizons beyond iconic brands like Doritos through acquisitions, such as the $1.2 billion deal with Mexican-American food company Siete Foods.

Simply put, as one of the global leaders in consumer goods, we enjoy certain advantages. Should consumer preferences change, we can acquire smaller businesses that are at the forefront of emerging trends, allowing us to stay relevant and adaptable.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2025-07-24 14:58