The market has reached unprecedented peaks since April 3rd, in an astonishing comeback following the tariff uncertainty. However, it’s important to note that the market is not completely free from tariff concerns yet. In fact, valuations have significantly increased compared to just three months ago.

In the current market landscape, there aren’t too many opportunities that seem like good deals left. Interestingly, I’ve noticed three particular stocks that haven’t kept pace with the market’s rebound due to distinct situations within each company. However, given their current standing and considering today’s valuation norms, they appear as potential bargains from a long-term viewpoint.

ASML Holdings

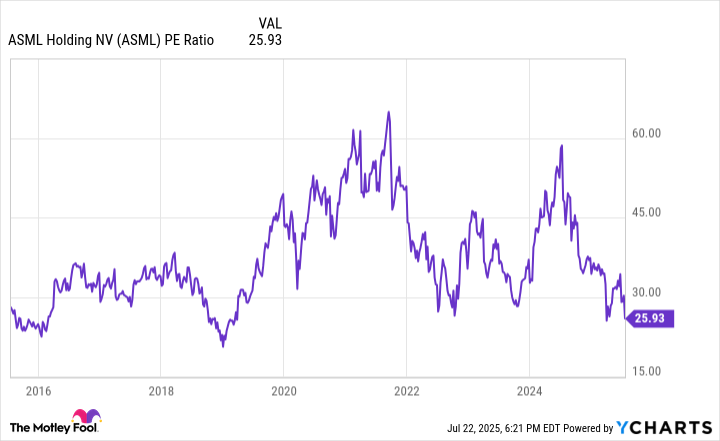

ASML Holdings (ASML), a leading name in semiconductor equipment, may not appear inexpensive at first glance, but upon closer inspection, the stock is significantly less expensive than its historical norms. Currently, it trades at approximately 26 times earnings, which makes it cheaper than it has been over the past decade, with the exception of late 2018 – a time when EUV machine sales were about to surge dramatically.

In simpler terms, ASML’s shares have been trading at a premium due to its unique dominance over EUV technology, an essential component for manufacturing semiconductor chips with transistors spaced 7nm apart and smaller. The production of such chips started around 2019, while the chip industry is now producing 3nm chips and preparing to move towards 2nm chips later in 2022 or early 2023.

Although ASML has historically been priced higher than its peers, its valuation has recently aligned more closely with other semiconductor equipment companies. The recent decline in the stock occurred this month following Q2 earnings, during which management withdrew their prediction for 2026 as a year of growth due to uncertainty surrounding tariffs in non-AI markets.

Although the leadership continues to forecast a robust 15% expansion for this year, the possibility of a potential decrease or stagnation in 2026 has unsettled investors, causing the stock price to drop approximately 15% from its previous earnings high.

Despite not noting any slowdown in AI-related growth factors, the management maintained its 2030 revenue forecast ranging from $44 billion to $60 billion, with projected gross margins between 56% and 60%. This is significantly higher than the earlier expectations for 2025, which included a revenue of $32.2 billion and gross margins of only 52%.

Despite temporary hesitation from ASML’s customers due to ongoing tariff disputes and geopolitical issues, these short-term challenges might not significantly affect the stock’s inherent worth if ASML’s competitive advantages and growth momentum driven by artificial intelligence continue to persist. At this point, it appears that these crucial factors are maintaining their strength.

Booz Allen Hamilton

Despite consulting firm Booz Allen Hamilton being over 40% below its peak prices from last fall, there are concerns about potential cost-cutting measures by the government. With nearly all its business stemming from the U.S. government in 2025, Booz Allen has become a significant player, leading investors to be wary due to the company being synonymous with government efficiency department cuts (DOGE).

Essentially, Booz Allen focuses on crucial, advanced projects within the defense, space, and intelligence sectors, accounting for about 65% of their total income. This segment of their work isn’t just expanding rapidly, but it’s also expected to withstand significant government spending cuts due to its nature.

Approximately 35% of Booz’s business lies within civil services, and it is this sector that will feel the impact of recent DOGE reductions this year. In their latest earnings call, Booz Allen’s management predicted a substantial decline, around low double digits, in their civil business for this year. They referred to this decline as a one-time “realignment.

Despite the current forecast predicting 0% to 4% growth for the entire company in the fiscal year, as the defense/intelligence sector continues integrating cutting-edge AI technologies into government resources, there is potential for growth stabilization in the civil business next year. This could lead to a renewed acceleration of growth for Booz Allen Hamilton from this new foundation.

If the situation remains as it is, the current price-earnings ratio of merely 15 times for Booz Allen appears strikingly undervalued.

Booz Allen Hamilton is continuing its pursuit of tech-driven growth opportunities and has upped the ante by investing $300 million into its venture portfolio, Booz Allen Ventures. This fund supports groundbreaking defense and cybersecurity technology startups – a significant boost from the initial $100 million investment. The company plans to invest in around 20 to 25 budding firms over the coming years. If one of these investments proves to be highly successful, it could significantly impact the stock’s value, which currently stands at $14 billion and is trading at a lower valuation compared to previous years.

Kulicke & Soffa

tech packaging pioneer Kulcike & Soffa (KLIC) has experienced a challenging stretch lately. While it thrived during the pandemic, its main ball bonder business has been struggling in the aftermath, as sectors such as PCs, smartphones, and automotive industry have grappled with lingering effects.

Additionally, the company has recently had to cancel and write off a couple of substantial projects. In 2024, K&S wrote off approximately $100 million from their advanced display division following Apple’s decision to abandon its microLED project, where K&S had been investing resources. Then in May, K&S announced it was shutting down its loss-making electronics assembly business, leading to another write-off of around $87 million.

Despite these closures being regrettable, neither company was primarily involved in K&S’ key semiconductor packaging sector, where K&S maintains a leading position. To add some optimism to this, K&S management mentioned recently that the usage of their tools in Taiwan and China – regions housing most non-automotive electronics manufacturing – has risen to 80% or higher. This level of utilization is typically when customers start ordering more tools consistently.

I’ve noticed that according to K&S, customers have been hesitant due to concerns about tariffs. However, this hesitation can only last for so long if demand remains steady. Since this downturn has persisted longer than usual, it seems we might be on the brink of a robust comeback.

As a tech enthusiast, I’m thrilled to share that K&S, apart from its established ventures, is venturing into thermocompression bonding (TCB) – a technology that plays a significant role in artificial intelligence logic and high-bandwidth memory advanced packaging. This emerging business segment is projected to hit approximately $70 million this year, accounting for more than 10% of our projected revenue for the year. However, what’s truly exciting is management’s prediction that this sector will surge due to increased AI demand, potentially reaching over $100 million by fiscal 2026 – that’s a whopping 50% growth!

A favorable wind from artificial intelligence in TCB, along with a revival in the fundamental tire cord bonding industry, might bring substantial growth potential. Notably, the shares of K&S are currently about 53% below their peak record value.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The Sega Dreamcast’s Best 8 Games Ranked

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Gold Rate Forecast

- DeFi’s Legal Meltdown 🥶: Next Crypto Domino? 💰🔥

- Ethereum’s Affair With Binance Blossoms: A $960M Romance? 🤑❓

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

- 20 Movies to Watch When You’re Drunk

2025-07-24 14:32