Among many stocks profiting from various ongoing growth patterns, one that’s particularly catching attention is the artificial intelligence (AI) sector. While not all stocks are wise investments at this moment, one seems to shine brighter than others, appearing as a potential stellar choice for investment.

One smart investment choice currently is Taiwan Semiconductor Manufacturing Company (TSM). This company holds a strategic position within the semiconductor manufacturing sector and boasts numerous advantages pushing in its favor. Moreover, it seems reasonably priced given its anticipated growth over the coming years, making it an attractive option for potential investors at present.

TSMC’s new chip node has high expectations

In the semiconductor industry, Taiwan Semiconductor stands out as a leader with an advantageous position. This is largely because of their advanced technology, high production efficiency (superior yields), and impartial stance.

Taiwan Semiconductor (TSMC) boasts a prestigious roster of global tech giants among its clientele, such as Nvidia and Apple. These companies choose TSMC due to the factors mentioned previously, but one key reason is that TSMC doesn’t aim to rival these companies in open market competition. Instead, it exclusively offers foundry services, ensuring its customers that it will not seek to seize their proprietary technology for its own gain.

Taiwan Semiconductor Manufacturing Company (TSMC) stands at the vanguard of innovative chip technology, making it convenient for clients not to switch between different foundries to get access to the most recent advancements. In the near future, TSMC is set to debut its 2nm (nanometer) chip node, with plans for its 1.6nm node to enter production next year. Management is enthusiastic about their 2nm node, as the interest in this technology surpasses that of the releases for 3nm and 5nm. This could be a sign of TSMC’s potential expansion, as the enhancements offered by the 2nm technology are significant enough for companies to consider adopting this cutting-edge tech.

A key advancement in 2nm chips versus their predecessors lies in their reduced power consumption. Compared to 3nm chips operating at the same speed, they consume approximately 25% to 30% less power. Given that power consumption is a critical issue for AI systems, this efficiency could trigger numerous updates, as the cost savings from this technology might cover its operational expenses over its lifespan.

How does the potential growth and valuation of TSMC’s stocks stack up against their projections?

Taiwan Semiconductor doesn’t trade at a premium

In early 2025, management forecasted an exceptional growth trajectory for its AI-related earnings. They predicted a 45% compound annual growth rate (CAGR) over the subsequent five years, which equates to a total revenue rise of nearly 20% CAGR. This projected expansion is truly impressive, and all indications from TSMC’s performance in 2025 suggest this forecast might even be underestimated.

As a tech-loving enthusiast, I’m thrilled to share that TSMC’s Q2 revenue surged an astounding 44% in U.S. dollars, blowing past the projected figures! But wait, there’s more – even more impressive is their forecast for a 38% revenue growth in Q3! Given its colossal size, these numbers truly speak volumes about TSMC’s continuing success and dominance in the semiconductor industry.

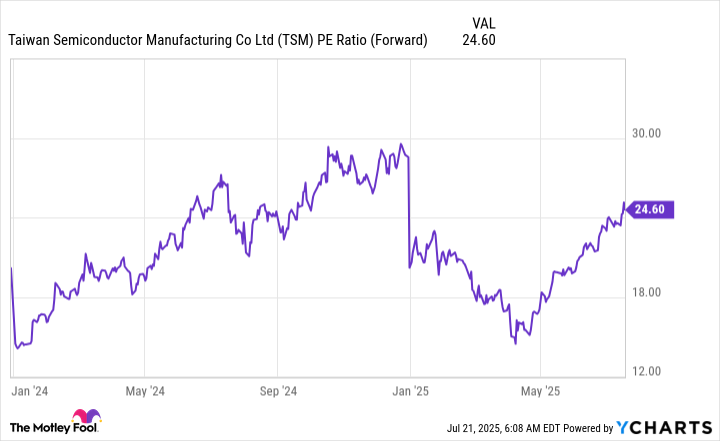

Taiwan Semiconductor is currently experiencing remarkable growth and is projected to maintain this trend for the foreseeable future. Yet, its stock value does not significantly exceed the overall market. Compared to the S&P 500 trading at around 23.8 times forward earnings, TSMC’s 24.6 times forward earnings appears relatively reasonable.

I’m eyeing this company that costs the same as the S&P 500, but it’s projected to grow at double its usual pace over the next decade! It’s like snagging a potential powerhouse for the price of an average player.

In simpler terms, investing in TSMC right now is practically a no-miss opportunity, and I strongly recommend it as an intelligent choice for growth-focused investors.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Movie Black-Haired Beauties, Ranked

- Best Video Games Based On Tabletop Games

2025-07-24 12:17