Over the past three decades, I’ve witnessed a multitude of promising trends and groundbreaking inventions that have caught the eye of investors. These innovative ventures are frequently associated with vast, seemingly unreachable markets, which often result in these pioneering companies being highly valued.

Over an extended period, certain bubbles are more apparent to identify compared to others as they tend to recur in the financial world of Wall Street.

With a trading history spanning over two and a half decades in the stock market, I’ve encountered numerous high-priced companies at the forefront of emerging trends. Though some of these industry titans have managed to defy my expectations by maintaining their premium, many ultimately crumble under the pressure of longstanding market forces.

Right now, artificial intelligence (AI) is the newest sensation on Wall Street, reminiscent of how sliced bread made heads turn! Among all the players in this AI game, none has caught my attention more than Palantir Technologies (PLTR). This megacap stock, with a market cap over $200 billion, seems to me the most overvalued I’ve ever come across.

Palantir’s sustainable moat has made it one of the tech sector’s most important companies

I want to make it plain that my criticisms of Palantir, which I’ll delve into shortly, are primarily centered around valuation concerns. The dramatic increase in Palantir’s market capitalization, from $15 billion at the end of 2022 to a staggering $352 billion as of July 22, isn’t merely coincidental. This surge reflects investors being enthusiastic about the company’s durable competitive advantage, rapid growth rate, and strategic placement under the Trump administration.

On Wall Street, there’s nothing investors prize more than uniqueness. When your business provides something that no other company can offer on a large scale, it frequently leads to investors assigning a higher market value to your shares.

Palantir’s two main divisions – Gotham and Foundry – indeed match this description. Gotham is a software-as-a-service platform that leverages AI and machine learning to gather, analyze data, and aid in military mission planning and execution. There isn’t anything similar to Gotham, making it unique, which results in the multiyear contracts it secures leading to highly consistent annual sales and cash flow.

Simultaneously, Foundry provides assistance to companies by helping them understand complex data, often involving enhancements in supply chain management and automation of specific decision-making steps. Foundry is a rapidly expanding segment, resembling a vigorous plant in growth due to its subscription model.

Regarding expansion, Palantir typically keeps a steady pace, with its yearly sales increase falling between 25% and 35%. This consistent growth can be attributed to several significant long-term government contracts, some spanning over four to five years, which have contributed significantly to its persistent strong revenue growth.

Additionally, Palantir achieved recurring profitability much sooner than anticipated by financial analysts. This consistent profitability supports the effectiveness of Palantir’s two-tier business structure and provides ample time for their rapidly expanding Foundry platform to reach its full potential.

In summary, investors value Palantir’s status as a vital defense stock under the unified Republican administration. Given that President Trump prioritizes national security during his second term, this aligns seamlessly with Palantir’s Gotham platform.

Palantir is the priciest megacap stock of the century

Among countless publicly traded companies in the stock market, I can easily identify several whose estimated worth appears illogical. However, when it comes to the elite group of industry pioneers and businesses significantly impacting Wall Street, no megacap stock this century has come close to matching Palantir’s valuation.

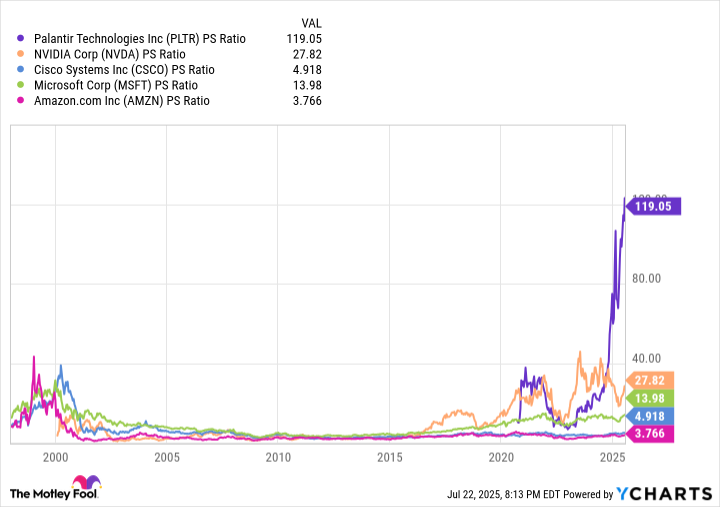

Over the last three decades, several pioneering businesses have reached price-to-sales (P/S) ratios around 30 to 40. For instance, before the dot-com bubble burst, companies like Cisco Systems, Amazon, and Microsoft had trailing-12-month (TTM) P/S ratios that ranged from 31 to 43.

In the past few months, tech giant Nvidia saw its Price-to-Sales (P/S) ratio soar beyond 42 last summer. While its present Trailing Twelve Months (TTM) P/S ratio of 28 remains significantly high, it’s far from reaching the levels observed in Palantir Technologies.

It’s clear that Palantir’s TTM Price-to-Sales (P/S) ratio of 119 is significantly higher than the temporary price spikes experienced by companies such as Cisco, Amazon, Microsoft, and Nvidia in the past.

Independent of the size of the potential market or investor excitement, no megacap stock has consistently managed to sustain a Price-to-Sales (P/S) ratio of 30 or more for an extended timeframe. It’s astonishing that Palantir’s stock is valued at four times this significant threshold, showing just how significantly its valuation has soared beyond historical norms.

Here are some points to ponder when it comes to Palantir: Its stock price is currently trading at a high multiple (119 times TTM sales), which might be something to consider. However, there’s uncertainty surrounding defense spending after early 2027. Despite President Trump remaining in office until January 2029, midterm elections in 18 months could lead to changes within Congress. It’s unclear whether defense spending will continue to be a top priority beyond the next six quarters.

It’s crucial for investors to understand that although Palantir’s success with Gotham has been remarkable, the market it serves is relatively small due to its limited availability. The platform is currently only accessible to the United States and its closest allies. This restriction significantly reduces the potential income opportunities on a global scale.

A concern arises that groundbreaking innovations like Palantir often experience a drop following initial bursts in the early stages. Even with its multiyear government contracts and recurring subscription revenue, it might not be immune to an immediate decline in sales. However, during such a market correction, the negative investor sentiment could potentially make Palantir’s stock vulnerable to sell-offs.

The primary concern that exacerbates Palantir’s high valuation is the nature of its profits. It would be more fitting if Gotham and Foundry contributed nearly all of Palantir’s earnings. Unfortunately, in 2024, about 40% of its pre-tax income originated from interest on its cash holdings, which lacks innovation and long-term viability.

To make things clear, I’m not predicting an exact peak for Palantir stock, but it’s highly likely that we’ll experience a significant drop in value at a relatively close timeframe.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2025-07-24 10:16