The earnings reports for the second quarter of 2025 (ending June 30) from numerous corporations in the United States have started to roll out, with a special interest in the massive tech companies driving the advancements in Artificial Intelligence (AI), as these will be closely watched by financial institutions over the coming weeks.

On July 31st, Amazon (AMZN) plans to unveil its second-quarter earnings report. While e-commerce continues to be the primary income source for the company, investors will pay close attention to the Amazon Web Services (AWS), Amazon’s cloud computing platform. This platform houses many of the tech giant’s most valuable artificial intelligence (AI) endeavors.

Should investors buy Amazon stock ahead of the July 31 report?

Cloud revenue growth could reaccelerate in Q2

Amazon Web Services (AWS) is currently the most extensive global platform for cloud computing, providing a variety of services tailored to assist businesses in navigating the digital world, ranging from basic website hosting to intricate software development tools. However, AWS aims to lead not just in cloud computing but also in the three fundamental aspects of the Artificial Intelligence (AI) sector: infrastructure (data centers and chips), large language models (LLMs), and software solutions.

AWS is rapidly expanding its network of data centers and equipping them with thousands of graphics processing units (GPUs) manufactured by top chipmakers such as Nvidia. In addition, Amazon has created their own chips like Trainium2, which can potentially lower the cost of AI training tasks by up to 40% compared to other hardware options on the market.

AWS provides an expanding collection of pre-built Language Learning Models (LLMs) via its Bedrock platform. This assortment encompasses Amazon’s own Nova series of models, as well as models from notable third parties such as Anthropic and Facebook’s Meta Platforms. As both data center infrastructure and LLMs are essential components for developing AI software, AWS’s variety of chip configurations and diverse model portfolio make it an extremely appealing choice for developers.

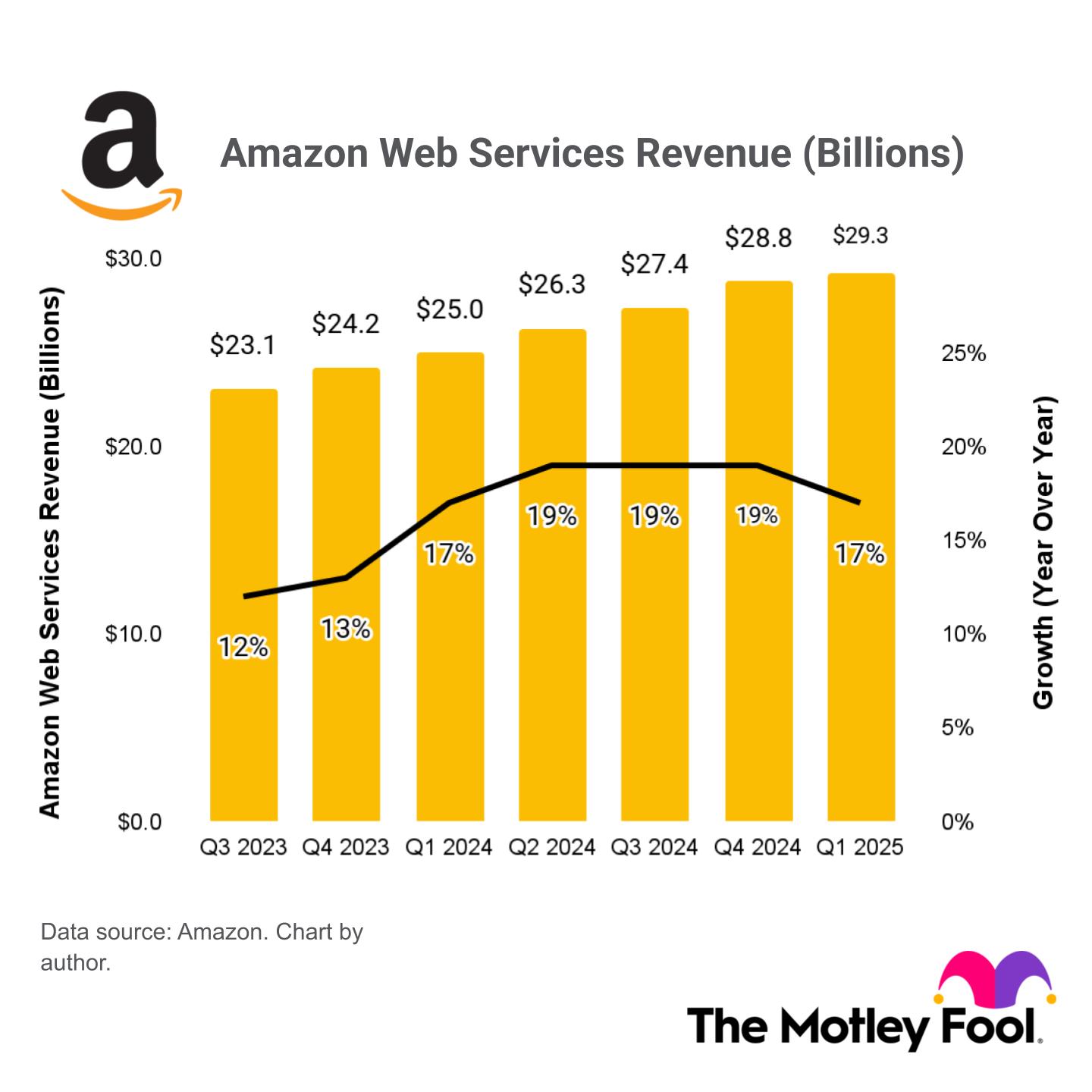

In the opening quarter of 2025 (up to March 31st), AWS reported an impressive revenue of $29.3 billion, marking a 17% rise compared to the same period the previous year. However, this growth rate slowed down slightly from the preceding three-month period, indicating that the cloud segment might be experiencing a slight decline in momentum.

Currently, there’s a higher demand for AI data center capacity on AWS than they can currently meet, which is temporarily hindering the platform’s expansion. Yet, back in May, Amazon CEO Andy Jassy forecasted that these constraints would ease within a few months. Therefore, it’s plausible that AWS will show an uptick in its revenue growth by July 31.

As an enthusiast of AWS, I’ve noticed a surge in demand for AI data center capacity that the platform can’t quite keep up with right now, impacting its growth potential. However, Amazon CEO Andy Jassy predicted back in May that these issues would be resolved within a few months, so we might see a resurgence in AWS’s revenue growth by July 31.

Amazon makes a habit of beating Wall Street’s expectations

Last year, Amazon amassed a staggering $638 billion in total earnings across all its operations. Financial analysts predict that this figure could reach nearly $700 billion by 2025. Over the past few years, the company has primarily concentrated on maximizing profit from sales by enhancing efficiency.

Amazon’s organization relies heavily on AWS (Amazon Web Services) as its primary source of profit. In the first quarter of 2025, AWS generated approximately 62% of the company’s overall operating income, although it contributed only about 19% to the total revenue.

In contrast, Amazon’s primary source of income remains e-commerce, yet it earns profits narrowly due to the company’s commitment to providing customers with extremely low prices. As a result, the management has been concentrating on reducing expenses and enhancing efficiency in this area, rather than raising prices for their customers.

By 2023, Amazon divided its U.S. logistics system into eight regions, with each fulfillment center now stocking goods tailored to their specific geographical region. As a result, frequently bought items move shorter distances to reach customers, leading to reduced costs and quicker delivery times. The company is also enhancing the use of AI tools within its warehouses, such as Project Private Investigator, an AI and computer vision system that helps identify and prevent shipping of faulty products. This not only minimizes refunds and returns but also saves money.

Amazon experienced remarkable growth in its AWS sector and e-commerce efficiency over the past few years, leading to a significant boost in its earnings. In 2024 alone, it reported $5.53 in earnings per share (EPS), marking a staggering 90% jump from the previous year. Interestingly, Amazon outperformed Wall Street’s expectations for all four quarters of the year, surpassing them by an average of 23%.

In the first quarter of 2025, I witnessed Amazon surpassing expectations by delivering an Earnings Per Share (EPS) of approximately $1.59. This figure represented a substantial 62% increase compared to the same period the previous year. Interestingly, this figure was significantly higher than the Street’s forecast of $1.36. The analysts I follow anticipate that Amazon might even exceed expectations again in the second quarter, potentially delivering another impressive beat with an estimated EPS of around $1.31.

Should you buy Amazon stock before July 31?

A single quarterly report may not significantly alter Amazon’s future course. However, given that the company’s stock is currently expensive, the decision to invest before July 31 might hinge on an investor’s investment timeline.

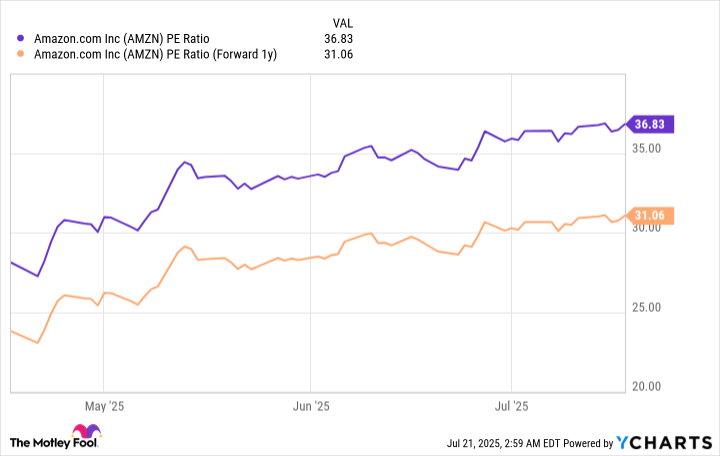

The stock is currently priced higher than the typical price-to-earnings (P/E) ratio for the Nasdaq-100 index (which stands at 32.5), with a P/E ratio of 36.8. As a result, those seeking quick returns within the next several months may find themselves coming up short.

Despite the current valuation, considering Amazon’s future earning potential through estimated earnings per share (EPS) of $7.29 in 2026 paints a positive outlook. The collective Wall Street forecast indicates this could translate into a forward P/E ratio of approximately 31 for the stock. This implies there might be growth opportunities over the next 18 months, particularly if we take into account Amazon’s history of surpassing analysts’ predictions.

Individuals seeking to maximize their earnings from investments would be wise to consider holding Amazon shares for a duration of five years or more. This extended holding period allows the company ample time to realize value from its initiatives in sectors such as Artificial Intelligence. Those who adopt this strategy could potentially benefit significantly if they purchase the stock before July 31, even given its current high valuation.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2025-07-23 12:59