Since hitting a high of 9.1% in 2022, U.S. inflation has dropped significantly and now stands at 2.7% as of June. Over the past two decades, from January 2005 to June 2025, inflation averaged approximately 2.6%. As such, the current rate aligns closely with this long-term average.

However, these rates surpass the Federal Reserve’s goal of 2% and inflation, although typical in a robust economy, erodes your wealth if your funds are not invested in assets that yield returns.

Cryptocurrencies like Bitcoin (BTC) have gained popularity as a defense against rising inflation rates. However, investing in Bitcoin can be quite challenging due to its high price which currently stands at approximately $119,000 (as of July 22). If you’re seeking an alternative inflation hedge that doesn’t require a six-figure investment, Cardano (ADA) could be the answer. It’s priced under $1 and shares a significant similarity with Bitcoin.

Cardano’s economic structure makes it a potential hedge against inflation

As I observe the world of cryptocurrencies, I notice that they are categorized as either inflationary or deflationary, depending on their tokenomics. An inflationary coin, as I understand it, is one whose supply expands gradually over time, which in turn tends to decrease its value due to dilution. On the other hand, a deflationary coin boasts a fixed maximum supply. This limited quantity inherently creates scarcity for these coins, potentially increasing their worth over the passage of time.

Bitcoin stands out as the well-known representative of a deflationary currency. It boasts a capped total supply of 21 million coins, and when all these coins are mined, no additional ones will be produced. Similarly, Cardano is characterized by its deflationary nature, with a maximum issuance of 45 billion ADA tokens. Despite having a larger potential supply compared to Bitcoin, the number of ADA tokens in circulation is still limited due to this cap.

At the moment, Cardano boasts a market capitalization approximately $30 billion, positioning it among the top ten largest cryptocurrencies in terms of size. Its current success suggests significant room for expansion and potential growth spikes. Let’s examine if this optimistic outlook is plausible.

A breath of fresh air — in 2021

Cardano is a blockchain that supports smart contracts, and it initially garnered attention by employing a proof-of-stake system for transaction validation. Unlike Bitcoin and originally Ethereum (ETH), which utilize a proof-of-work system, Cardano sets itself apart with its more energy-efficient approach. This mechanism enables investors to earn rewards by locking up their Cardano tokens as stakes.

In the course of its development, Cardano relies on scholarly studies that have undergone rigorous peer-review. Unlike some other cryptocurrencies which prioritize rapid development, the Cardano team chose to follow a more thoughtful and deliberate approach.

In 2021, what set Cardano apart from other cryptocurrencies and made it a captivating investment choice was its energy efficiency, earning it the nickname “green cryptocurrency.” By September 2, 2021, it had surged by an impressive 1,520% year-to-date and reached a new peak of $3.10.

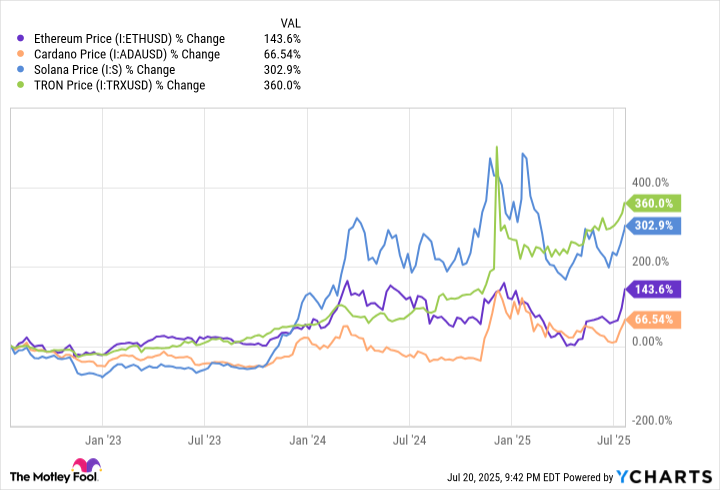

Initially, being a proof-of-stake cryptocurrency was an advantage for Cardano, setting it apart from others. However, as Ethereum and subsequently Solana, BNB, Tron, among many others, adopted this validation method, Cardano’s unique selling point lost its competitive edge. As the graph demonstrates, these major proof-of-stake coins have significantly outperformed Cardano over the past three years.

It appears that the peer-review process has been a setback for Cardano, as competing blockchains have managed to surpass it in terms of user base and value locked. To give you an idea, Ethereum leads with a staggering $98 billion in total value locked (TVL), followed closely by Solana at $10 billion. In comparison, Cardano’s TVL stands at $388 million, positioning it outside the top 20.

Should you invest in Cardano right now?

Despite some challenges, there’s also good news for Cardano. The blockchain unveiled the Voltaire upgrade back in September, which implemented a voting system for network contributors to accelerate development efforts. Additionally, its Layer-2 scaling solution, Hydra, enhances Cardano’s efficiency by handling transactions off-chain. Furthermore, they are planning to debut a side chain named Midnight this November, specifically designed to safeguard both commercial and personal data.

1) Cardano continues to show vitality. Unlike Ethereum, Solana, or even Tron, it boasts an inherent scarcity due to its deflationary nature, which sets it apart from many of its peers. Over the last year, this digital currency has seen a remarkable 96% increase in value.

Currently, I view Cardano as something I’m holding onto for now. It’s a component of my cryptocurrency holdings. While I believe it retains significant promise, I don’t suggest purchasing it just yet. It needs to accumulate more favorable events and attract a larger user base to its ecosystem before I would consider it a good buy.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

- Enduring Yields: A Portfolio’s Quiet Strength

2025-07-23 12:52