Despite the ongoing competition in artificial intelligence (AI) development since early 2023, numerous stocks continue to be smart investment choices today. The widespread impact of AI on the economy is yet to fully materialize, and substantial infrastructural growth is still required for its complete realization.

In this sector, I’m pouring a lot of my efforts since AI infrastructure is a crucial field where companies are making substantial profits through their AI investments. I’ve picked out 10 stocks that seem promising in this domain and could be worth considering at the moment. This list can serve as an excellent starting point for investors to delve deeper into each company’s details.

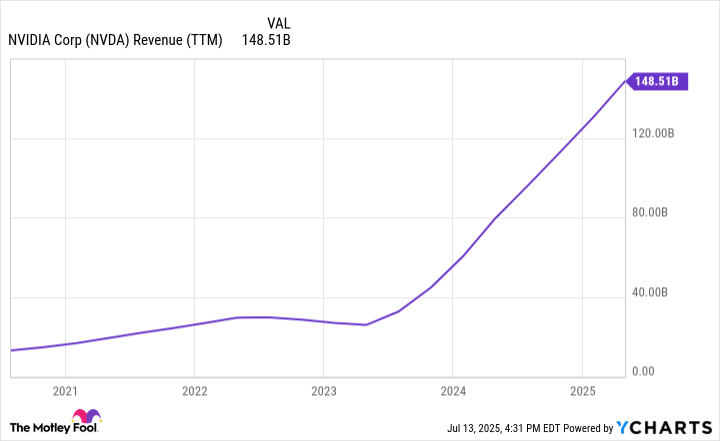

1. Nvidia

A well-rounded AI investment portfolio shouldn’t miss out on the uncontested leader in AI: Nvidia (NVDA). Since the inception of AI models, Nvidia’s graphics processing units (GPUs) have been the driving force behind their computational power, and they remain at the helm of this crucial sector.

The construction of AI technology is ongoing at a substantial scale, and Nvidia’s graphics processors will undoubtedly meet this growing demand. Despite being the biggest player in the market today, there remains significant potential for further growth.

2. Broadcom

Broadcom (AVGO) additionally offers AI computing hardware, which includes custom-designed AI accelerators developed in partnership with the end user. These innovative tools are being implemented alongside Graphics Processing Units (GPUs), serving as an effective method to reduce expenses while expanding inference capability. As Broadcom gains momentum in the artificial intelligence sector, it’s advisable for investors to closely monitor its progress over the coming years.

3. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing (TSM) serves as a manufacturing partner for tech giants such as Nvidia and Broadcom, who don’t have their own in-house facilities to produce chips. Being an integral part of the Artificial Intelligence supply chain, TSM could be one of the most indispensable companies globally.

TSMC’s leadership predicts an impressive 45% yearly increase in revenue related to Artificial Intelligence, over a five-year span commencing in 2025. If this forecast holds true, the company can expect substantial growth.

4. ASML

In my observation, Taiwan Semiconductor’s factories are furnished with equipment from ASML (NASDAQ: ASML), a unique global entity that wields extreme-ultraviolet lithography technology. These machines play an essential role in the fabrication of the intricate electrical pathways on chips, and they are indispensable in every advanced chip manufacturing facility worldwide, given their unparalleled technological dominance.

With an increase in chip production facilities being activated to cater to growing AI needs, ASML is expected to keep selling more machines.

5. Digital Realty Trust

Digital Realty Trust (NYSE: DLR) offers a unique strategy for getting involved in the AI competition. While it might not typically attract tech investors’ attention due to being a real estate investment trust, Digital Realty specializes in constructing data centers that they lease out to clients.

This area is expanding rapidly and becoming increasingly significant, and with Digital Realty offering close to a 3% dividend yield, it also stands out as a reliable source of dividends.

6. Alphabet

Google (GOOG, GOOGL) is strategically participating in the AI competition from two angles. On one hand, they are independently working on creating their own AI models. On the other hand, they are providing a platform for others to develop their AI models as well.

One significant aspect where AI benefits is through Google Cloud’s cloud computing sector. Companies like Google Cloud construct and lease out computational resources (referred to as cloud computing). These resources can be utilized for conventional workloads or artificial intelligence tasks. The escalating demand for AI has sparked a new phase of growth in cloud computing, and it’s anticipated to persist for several years.

7. Amazon

Out of the three topics I’ll cover, it’s worth noting that Amazon (AMZN) boasts the most extensive cloud computing platform – Amazon Web Services (AWS). This service plays a significant role in Amazon’s financial health, accounting for 63% of their Q1 operating profits. Furthermore, AWS demonstrated a robust growth rate of 17% during Q1, suggesting that this primary revenue stream is expanding rapidly for Amazon.

Essentially, Amazon’s future expansion plans heavily rely on AWS (Amazon Web Services), so grasping this aspect is crucial when considering investment opportunities with Amazon.

8. Microsoft

Microsoft (NASDAQ: MSFT) ranks second in cloud computing with its platform, Azure. While Microsoft collaborates with OpenAI, creators of ChatGPT, they also support numerous other AI models on their system. Microsoft’s objective is to offer a platform where clients can develop their own AI models, and this strategy has proven fruitful as evidenced by Azure’s increasing expansion.

Regrettably, Microsoft solely discloses Azure’s growth rate (33% in its most recent quarter). However, it’s plausible that this growth significantly boosts Microsoft’s total income and earnings. Given the promising future of cloud computing, Azure becomes a compelling choice for AI-focused stock investments.

9. Arista Networks

One less frequently recognized entries here is Arista Networks (NYSE: ANET). While it might not be as well-known, its role in data center operations is indispensable. Arista’s networking solutions facilitate the connection of data centers across various locations, a vital component for AI processing and cloud computing, particularly since distributed data processing is key to these technologies.

In essence, Arista’s technology significantly shaped the form that cloud computing and AI have taken in today’s world. Given the extensive data center expansion on the horizon, there is ample opportunity for further growth in their technology.

10. Synopsys

Synopsys (NASDAQ: SNPS) offers a software solution that allows customers to design semiconductors. The absence of Synopsys’ technology would significantly extend the research and development timeline for chips, thereby hindering the speed of innovation in the Artificial Intelligence (AI) sector. Synopsis is integral to AI progression, and its software remains an essential tool for professionals working within the AI field.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Gold Rate Forecast

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Six Stocks I’m Quietly Obsessing Over

- Enduring Yields: A Portfolio’s Quiet Strength

- New Supergirl Spot Reveals More of Jason Momoa’s Lobo

2025-07-23 12:34