So, bitcoin decided to throw on its little red cape and soar past $120,000—because why not? 🚀 And guess who showed up to the party like the cool kid in high school with a keg? Binance. Yeah, that exchange just casually snatched the crown for both bitcoin and altcoin trading while the rest of us were Googling “What even *is* a derivative?”

Bitcoin Breaks Records, Exchanges Start Beef (But Binance Wins) 💪

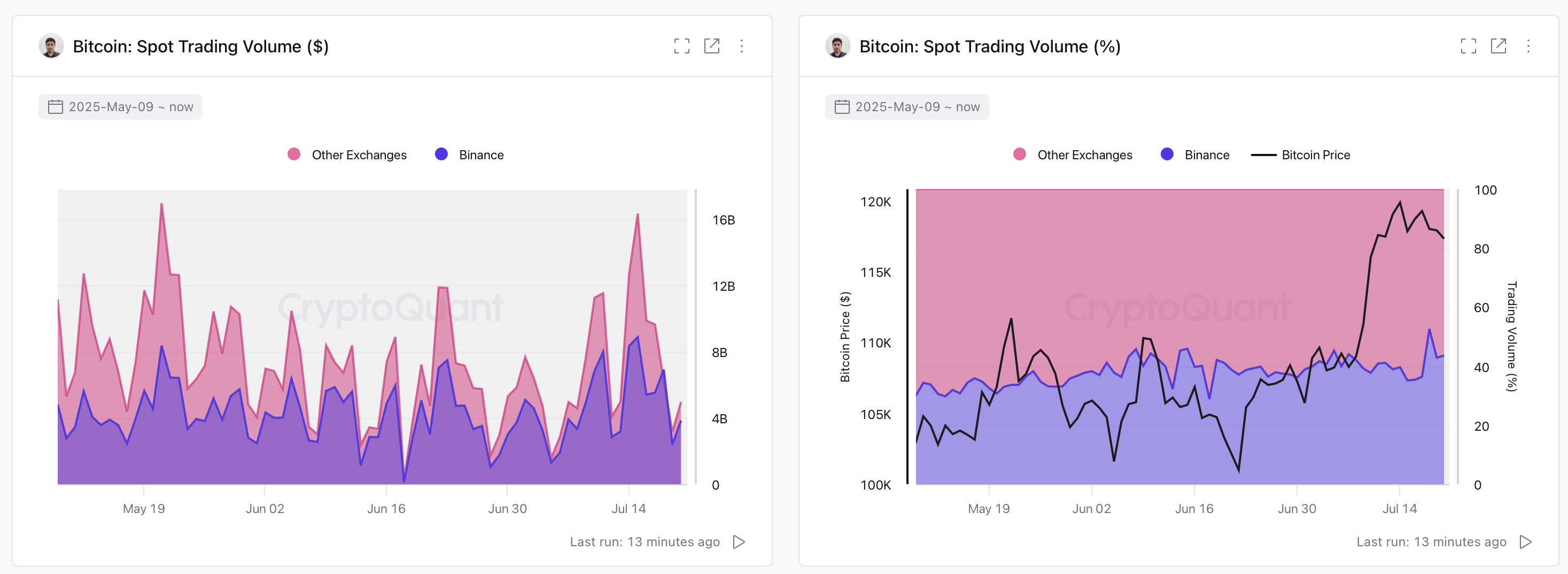

Let’s rewind to July 13 and 14, when bitcoin flirted with its all-time high like it was auditioning for a rom-com. Suddenly, spot trading went full-on Black Friday chaos. Binance’s bitcoin spot volume skyrocketed from $3.1 billion to $8.4 billion—nearly tripling overnight. Meanwhile, other exchanges were busy patting themselves on the back for their measly 2.6x growth. Kudos to Julio Moreno, head of research at cryptoquant.com, for crunching these numbers so I didn’t have to.

And oh, the altcoins! They weren’t about to sit this one out either. Binance’s altcoin spot volume exploded from $11.5 billion to $20.4 billion—a 77% increase that screams, “Take notes, people!” Meanwhile, other platforms limped along with a respectable-but-still-jealous 51% bump. Altcoin momentum? Check. Institutional hype? Double-check. Eth leading the pack? Triple-check. 🐳

Binance didn’t just grow; it devoured market share like a plate of nachos at 2 a.m. Its slice of the bitcoin spot pie swelled from 39% to 48%, and its altcoin dominance shot up from 34% to 47%. By July 18? Oh, you better believe they hit 52.6% of bitcoin trades and 49.41% of altcoin action. Poor Bybit, OKX, and MEXC looked like extras in a movie where Binance is clearly the star. 🌟

And let’s not forget the derivatives drama! When bitcoin peaked, perpetual futures open interest hit a jaw-dropping $43 billion across centralized platforms. Who led the charge? You guessed it: Binance, flexing $14.1 billion in open interest. Close behind were Bybit and Gate.io, clinging to their $9 billion each like toddlers holding onto candy. Over the previous 30 days, Binance added $3.6 billion to its cumulative open interest, leaving Gate.io ($2.3 billion) and Bybit ($2.5 billion) eating dust. Traders betting big? Absolutely. Smart money flowing in? Duh. 🤑

Even after bitcoin crossed $120k, Binance kept strutting its stuff. On July 15, its 24-hour bitcoin spot volume hit $8.8 billion. Other exchanges? Not so much—they dropped 25%, settling at $9.5 billion. Moral of the story? Binance doesn’t just ride waves—it makes them. 🏄♂️

MEXC tried to steal second place in altcoin spot volume with 10.4%, followed by Bybit (8.11%), OKX (7.88%), and HTX (7.35%). But honestly, it’s clear where everyone was flocking during this rollercoaster of volatility: straight to Binance. Liquidity hunters unite! 🦈

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-07-22 22:58