Assessing whether a stock is affordable or costly isn’t straightforward. Not even Warren Buffett, the renowned value investor, has avoided purchasing stocks that appear pricey based on conventional measures. This is due to the fact that evaluating worth involves considering additional aspects beyond just metrics.

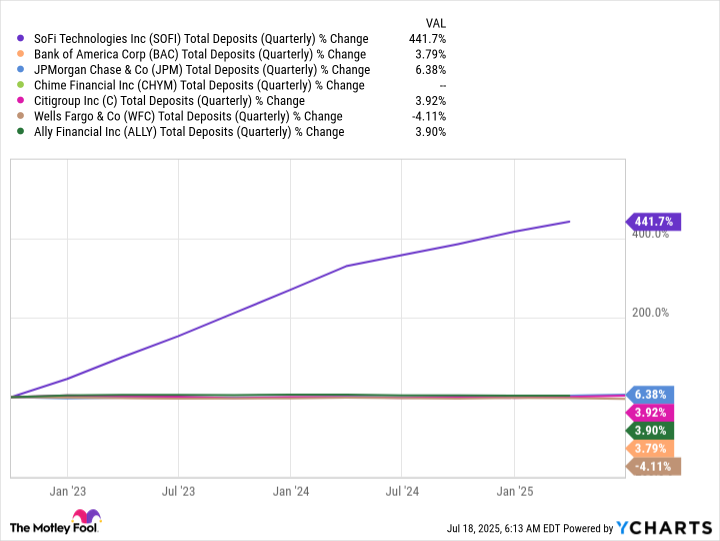

SoFi Technologies (SOFI) serves as an illustrative case. At first glance, its stock appears costly according to conventional valuation indicators and specialized banking metrics. However, the graph below could potentially shift your perspective on SoFi.

Priced for growth

In simpler terms, the stock of SoFi company is valued with a Price-Earnings (P/E) ratio of 51, a Price-to-Sales ratio of 8.6, and a Price-to-Book ratio of 3.5. Notably, the Price-to-Book ratio, often used to evaluate banks, suggests that a value greater than 1 is pricey. While many large banking institutions also have P/B ratios above 1, SoFi’s ratio is significantly higher.

SoFi, originally known for its lending services, has now expanded into becoming a full-fledged bank following the acquisition of Golden Pacific Bancorp in 2022. This transformation allows it to provide a wide range of banking services. While lending remains its primary focus, the non-lending financial services segment is rapidly expanding, nearly doubling in the first quarter of 2025, and contributing significantly to a 33% increase in the company’s overall adjusted net revenue.

These growth spikes surpass what other financial institutions, including giants such as Bank of America, JPMorgan Chase, Citibank, and Wells Fargo, can’t keep up with. Moreover, it’s worth noting that this rapid expansion outpaces the development of newcomers like Chime and digital-only banks such as Ally in terms of deposit growth.

On virtually all fronts, SoFi tends to be pricier than most stocks. However, given its exceptional track record and promising growth potential, it justifies a higher cost. As expressed by CEO Anthony Noto on numerous occasions, the vision is to rank among the top 10 financial services companies. If SoFi maintains this rapid expansion rate, realizing that ambition could very well become a reality.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-22 16:17