So here we are, in a month that’s already looking way too good for the crypto market. Bitcoin (BTC) decided to hit a new all-time high just a week ago. Ethereum (ETH) is flexing its muscles too, continuing to rally like it’s training for the Olympics. In fact, the total market cap has already bumped up by a cool $41 billion in the last 24 hours. Yes, you read that right – a *billion*. 💸

Now, analysts are sitting there, scratching their heads, wondering what’s coming next. You know, the usual. Looking at luxury watch prices, old market cycles, and whatever valuation tricks they can dig up from under the rug. Classic. 🕴️

How Luxury Watches Reflect Market Psychology: The ‘Rolex Indicator’ Explained

Forget all those fancy technical indicators and the Fear and Greed Index – the real juice might be in something way less sexy: luxury watches. Oh yes, we’re talking Rolex. Because when people start buying expensive timepieces, you know that someone’s feeling *really* good about the future. 💎

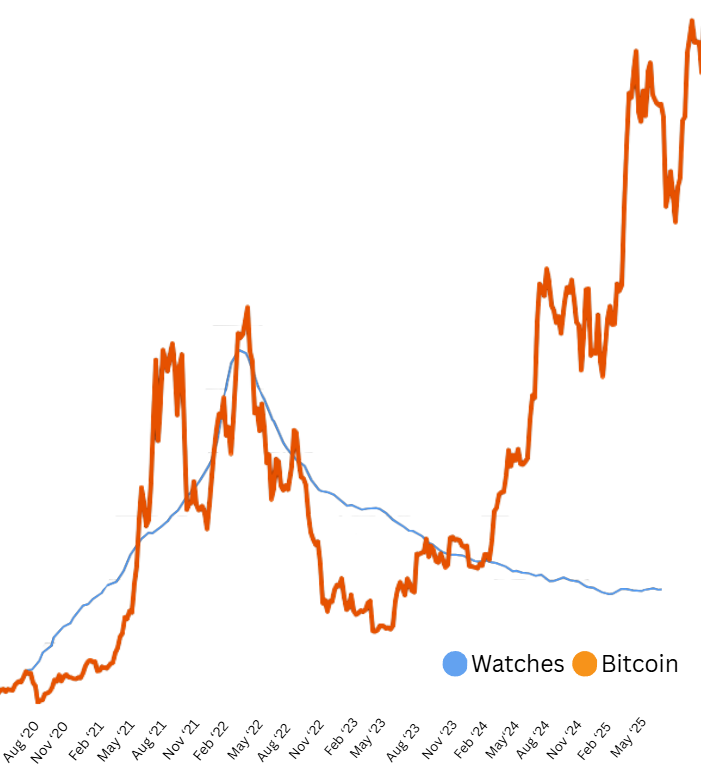

So, there’s this analyst on X (formerly Twitter – don’t ask, it’s a thing now), who goes by the name Pix (sure, why not), and he’s all about this ‘Rolex Indicator.’ The idea? People start buying watches as a way to show off their success when they get rich from crypto. Predictable, right? Well, here’s the twist: Rolex prices don’t spike until after crypto runs up. It’s like the cool kids showing up fashionably late to the party. 🎉

“What makes this useful is that luxury markets lag. Not by much – but just enough. You can see it in the data. Watch indexes trailed crypto on the way up, peaked a little later, and then collapsed almost in sync. Rolex prices fell by nearly 30% in the year following the crypto crash. Not because demand disappeared. But because the kind of demand driving them (status demand) – dried up,” the post read.

And then there’s the little nugget where Bitcoin hits a record peak and altcoins are doing a victory dance, but watches are still sitting in the back, waiting for their moment to shine. Classic Rolex – always late to the party. 🕶️

For token TA and market updates: Want more? Sure, why not. Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. It’ll be a *wild* ride.

“The fact that watches are rising again doesn’t mean we’re at the top. But it does mean we’re already a decent part of the cycle in. People don’t start buying symbols until they feel like the hard part is over. That’s usually the middle. Somewhere around 2/3 through the cycle. The wealth is accumulating. The confidence is returning. But the real spending hasn’t started. When it does, you won’t need a chart to see it. You’ll know,” Pix added.

Another analyst, Atlas (because of course), jumped on the bandwagon, sharing his wisdom. Basically, he says we’re not in the full-on greedy phase yet. Like, people are getting there, but they’re not quite *there* yet. Sounds like the market’s in one of those “almost but not quite” moods. Classic. 😬

“Sentiment shifting but not fully euphoric…..Extreme fear has passed, but peak mania isn’t here yet. We remain in rotation phase with room for upside,” Atlas stated.

Benner or Buffett: The Debate Over the Market’s Next Big Move

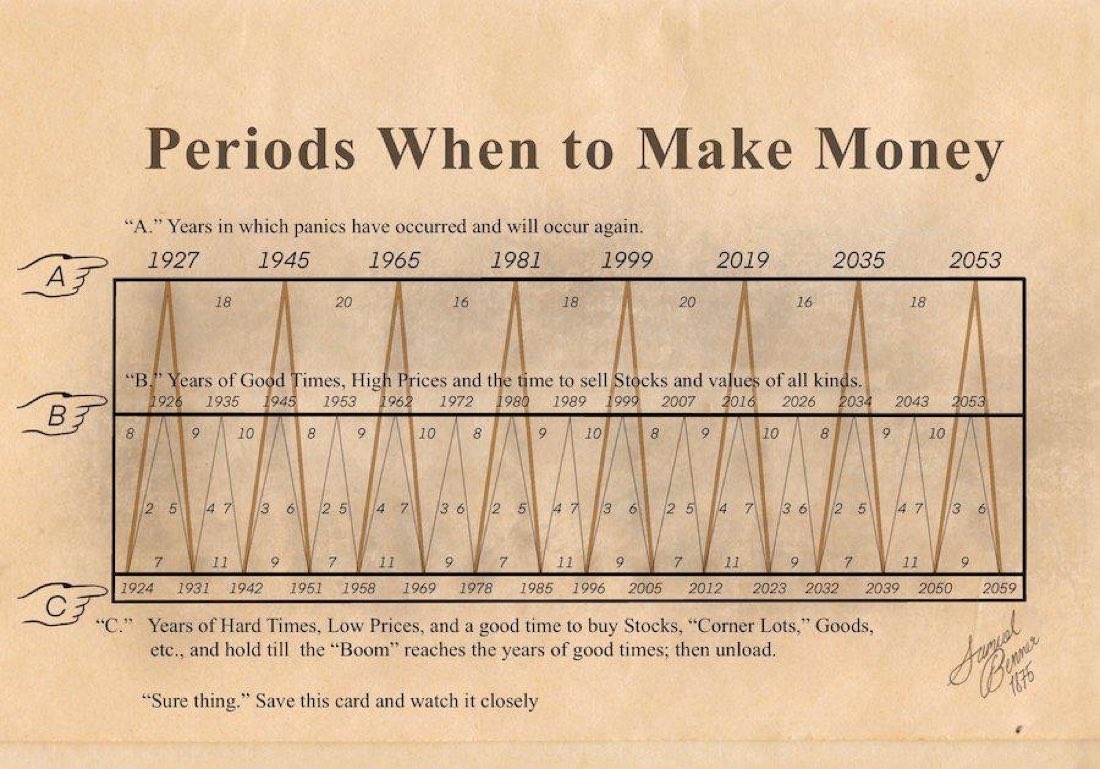

Meanwhile, let’s throw in the Benner Cycle, because why not bring some history into this mess? According to Benner, we’re not at the peak yet. We could get there by 2026. So yeah, get comfortable. It’s a slow burn. 🚀

That means we’re likely still in the accumulation phase, folks. It’s like waiting for a cake to rise. Too bad we’re all so impatient. 🍰

“2026–2032 = ‘B Years’ → Liquidity surge. Re-ratings. Exit zones. 2035–2039 = ‘A Years’ → Panic. Crashes. Mass drawdowns,” a user noted.

But hold on, because here comes the Warren Buffett Indicator. He’s like the grandpa of finance – the one with all the wisdom, but also the one who tells you to *slow down*. Warren’s little metric compares stock market cap to GDP, and guess what? It’s over 200%. Not exactly a great sign. 🚨

“Probably the best single measure of where valuations stand at any given moment,” said Warren Buffett.

So, the market’s probably looking a little… overinflated? Yeah, that’s what we’re saying. Maybe it’s time to call it quits before the bubble pops, huh? 😏

Ladies and Gentlemen, the Warren Buffett indicator has now officially entered the exosphere. 208%

Guess what happens next?

— The Great Martis (@great_martis) July 21, 2025

In conclusion, the crypto market’s in that weird phase where it could either go up or face a serious correction. On one hand, you’ve got the Rolex Indicator and the Benner Cycle giving us hope. On the other hand, you’ve got Buffett saying, “Whoa, whoa, whoa, slow down there.” So, it’s anyone’s guess what happens next. Could be champagne and riches, or it could be a massive crash. Welcome to crypto. 🍾💥

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2025-07-22 14:12