In volatile and unpredictable stock markets, it’s comforting to have a dependable source of income. Dividends serve that purpose well, offering a steady income stream that remains constant, irrespective of fluctuations in stock prices.

Investing in dividend stocks can provide a steady income stream, even amid market fluctuations and uncertainties, but it still carries some level of risk associated with stock investments. To enhance safety and diversification, explore the possibility of investing in exchange-traded funds (ETFs) that focus on dividends. These ETFs can offer yields comparable to individual stocks, yet they are generally more stable due to the collective efforts of multiple companies.

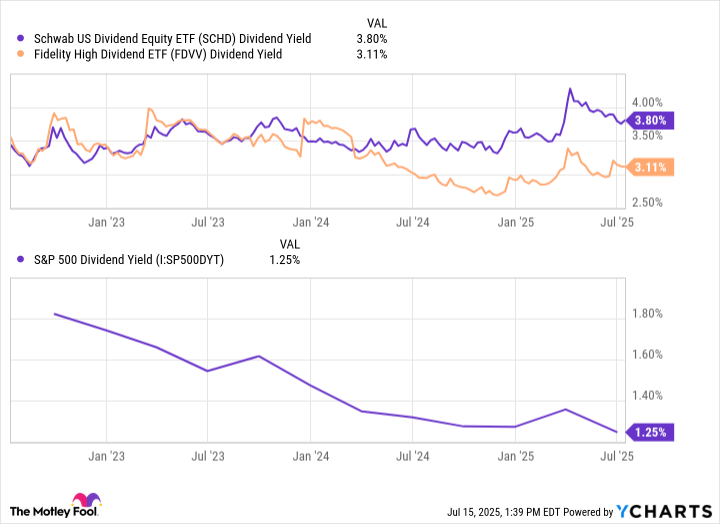

If you’re seeking reliable income over an extended period, the Schwab U.S. Dividend Equity ETF (SCHD) and Fidelity High Dividend Yield ETF (FDVV) could be excellent choices. They deliver dividend yields that are more than twice the average of the S&P 500, which gives me confidence in their potential as reliable long-term investments.

1. Schwab U.S. Dividend Equity ETF

This Exchange Traded Fund (ETF) follows the Dow Jones U.S. Dividend Index, a market segment concentrating on firms that exhibit a record of regular dividend distributions and robust financial health. It’s widely recognized as one of the top dividend ETFs available on the stock exchange, boasting holdings of blue-chip dividend stocks such as Coca-Cola, Altria, and AbbVie – all of which are categorized as Dividend Kings.

Schwab ETF selection prioritizes mature, resilient companies that have proven themselves over time. This is an appealing choice for long-term investors, as it minimizes the risk of encountering companies needing to reduce or halt their dividends to stabilize their financial situation during tough periods.

The dividends distributed by ETFs can vary due to different companies making payments on diverse schedules. However, the Schwab fund has consistently provided a dividend return of 3.1% or more over the last three years. Its most recent payouts were $0.2602, $0.2488, $0.2645, and $0.7545, resulting in an average yield of around 5.6%, based on its price of $26.90 at the time this text was written.

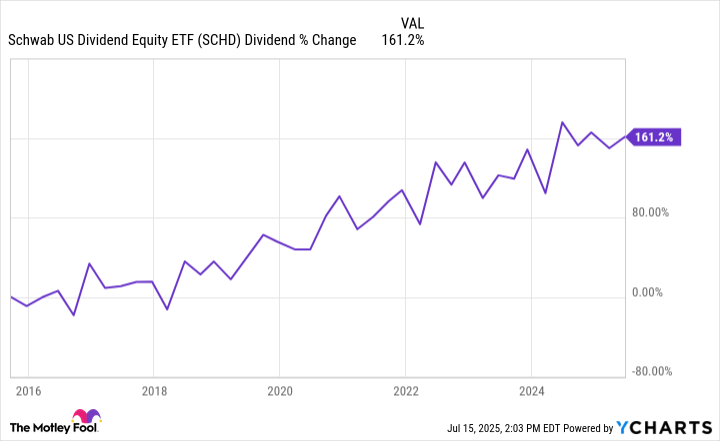

It’s particularly significant for long-term investors to note that Schwab U.S. Dividend Equity ETF has managed to boost its dividend at a remarkable rate of over 160% in the last decade.

2. Fidelity High Dividend Yield ETF

While the Schwab ETF focuses primarily on companies that lean towards value, the Fidelity ETF combines firms offering both steady income and growth potential. As of June 30, its top three investments are Nvidia, Microsoft, and Apple, collectively making up more than 16% of the fund. Notably, the tech sector takes up over a quarter of the Fidelity fund (in contrast to only 7% in the Schwab fund).

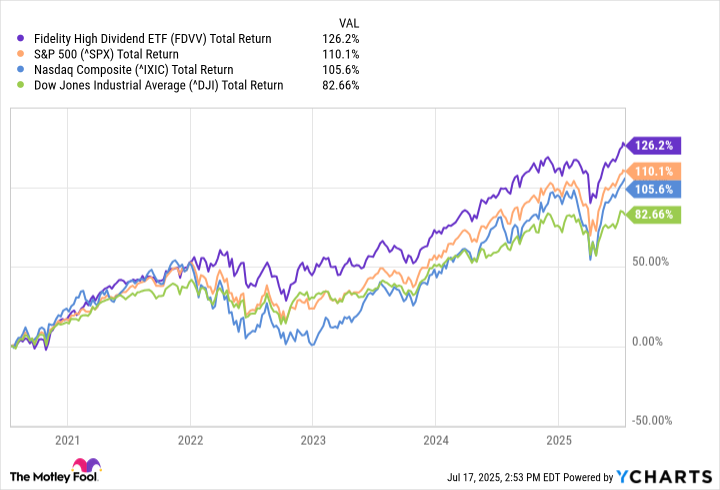

The yield from the Fidelity ETF’s dividends might not initially grab your attention (with a rate above 3% being quite notable for a broad ETF), but upon closer examination, it essentially doubles when you factor in its growth in share price. Over the past five years, this ETF has consistently outperformed each of the major stock market indices.

In most cases, a Dividend Exchange-Traded Fund (ETF) doesn’t have a high concentration of tech stocks because many tech companies often reinvest their profits for growth instead of paying dividends. However, in the case of Fidelity High Dividend Yield ETF, this is an exception due to its top holdings being mature tech companies that generate substantial cash flow, allowing them to invest in growth while also paying dividends.

You don’t have to pick one ETF or the other

In essence, if you’re considering these ETFs, here’s something to note: They offer broad coverage without significant overlap. While it’s typical for ETFs with similar themes to share numerous stocks, that’s not the case with these two funds. In fact, only around 19 stocks are common across both ETFs, which is quite a small number when you consider that each fund has over 100 holdings.

By allocating funds towards both the Schwab U.S. Dividend Equity ETF and the Fidelity High Dividend Yield ETF, you can enjoy the stability and low-cost advantage that the former offers, as well as the blended combination of growth potential and income generation that the latter provides.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2025-07-22 13:44