As the competition in artificial intelligence (AI) continues, the struggle for dominance in quantum computing is intensifying. Many businesses are battling it out in this domain, yet not all of them represent a wise investment at this moment.

My preferred choices for investing in quantum computing are Nvidia (NVDA), Alphabet (GOOG) and Alphabet (GOOGL), as well as IonQ (IONQ). I strongly believe that by diversifying with these three quantum computing stocks, investors can effectively manage risk while still benefiting from the potential gains this cutting-edge technology holds.

1. Nvidia

While Nvidia might appear unconventional in this compilation, it’s not directly engaged in quantum computing. Instead, it contributes significantly by offering essential tools that key players utilize to incorporate Quantum Processing Units (QPUs) into advanced computing systems. Notably, Nvidia has crafted its CUDA-Q software, a derivative of their popular CUDA software for GPUs.

One key factor behind Nvidia’s dominance in the GPU market and its rise to become a global titan is CUDA. By adapting this essential software for use in the quantum realm, it solidifies its role as an indispensable ally in quantum computing. Furthermore, by merging existing computing systems with quantum ones, it safeguards its current business from being superseded.

Investing in Nvidia could be a smart choice as it serves as a link between conventional and quantum computing, positioning it as a leading stock to consider due to its connections with quantum computing.

2. Alphabet

Google’s parent company, Alphabet, plays a significant role in investor enthusiasm about quantum computing. In December, they made headlines by revealing that their Willow chip had efficiently accomplished a task in just five minutes which would have taken even the most advanced supercomputer an astronomical 10 sextillion years (10 to the 25th power) to complete.

Although Google openly acknowledges that this computational task is ideal for quantum computers and lacks immediate commercial value, it underscores the rapid progress and approaching practical applicability of quantum computing technology. Alphabet stands out as one of my top investment choices in this sector due to its substantial resources allocated towards quantum computing development.

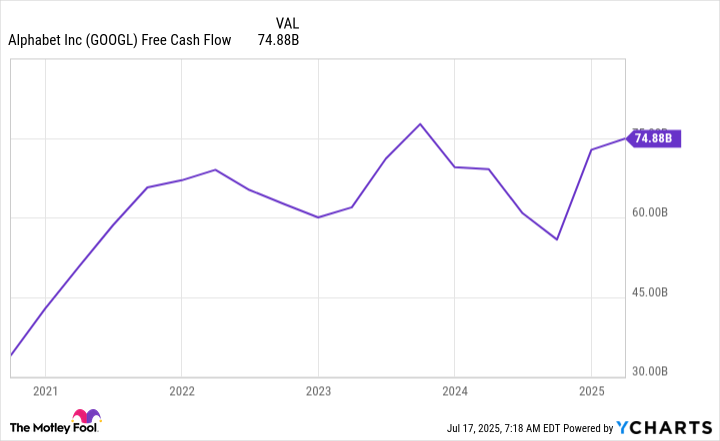

Over the last year, Alphabet has generated approximately $75 billion in cash flow that wasn’t tied up in other obligations. This is a significant amount, and although Alphabet has some ideas for how to use this cash, it also has the opportunity to allocate a portion of it towards its quantum computing division. By doing so, it could provide this division with resources beyond those of many smaller competitors in the field.

Although it doesn’t assure victory, I think it provides Alphabet with a substantial edge over rival companies, positioning it as a leading choice in the quantum sector.

3. IonQ

IonQ is among the smaller companies specializing exclusively in quantum computing. Unlike corporations like Alphabet and Nvidia with diverse business portfolios, IonQ’s success or downfall is entirely tied to the progress of quantum computing. To establish significance within this sector, IonQ must develop technology that sets it apart from its competitors.

Instead of the majority of contenders in the quantum racing competition opting for the superconducting method that necessitates chilling particles close to absolute zero (a costly endeavor), IonQ employs the approach based on trapped ions.

One notable aspect of this method is that it allows for quantum computations to occur at ordinary temperatures, thereby substantially cutting down on the initial expenses associated with a quantum computer. This factor is crucial because, as this emerging technology strives to prove its commercial viability amidst high financial barriers to entry, affordability becomes a critical concern. In simpler terms, using trapped ion quantum computing makes it possible to perform quantum calculations at room temperature, which helps lower the upfront costs significantly.

Moreover, the trapped ion method facilitates interaction between every single qubit within the system. It’s widely known that enabling qubits to communicate with each other helps reduce errors during calculations. On the other hand, superconducting qubits limit interactions only among neighboring qubits. The advantage of the trapped ion approach is that it allows for all qubits to interact, which could lead to improved precision in computations.

I firmly stand by my conviction that IonQ sets itself apart as the premier pure-play quantum computing company due to its unique strategy, distinguishing it from the heavyweights in this competitive field. Unlike many others, IonQ isn’t just following the crowd; instead, it’s blazing a trail with an innovative approach.

Now, nobody can predict the future, but IonQ has shown resilience and determination that gives it a fighting chance to succeed. This tenacity makes it an intriguing investment opportunity in the quantum computing landscape—a potential ticket to a significant payoff if things pan out.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

2025-07-22 12:36