The best investment outcome comes from discovering an exceptional business that consistently delivers high productivity, and more importantly, has the potential to expand significantly for numerous years ahead. This sustained growth will lead to significant profits for those who hold onto their shares over the long term.

In my experience, unearthing such colossal stocks isn’t a walk in the park. Many individuals tend to search for the next groundbreaking opportunity, but quite frequently, the successful investments have been there all along, hiding in plain sight.

Following a thorough analysis, I’ve pinpointed five exceptional companies that currently dominate their industries and hold significant potential for future growth. These market giants are expected to continue expanding, offering long-term investment opportunities that could potentially make buy-and-hold investors quite affluent in the future.

Consider buying and holding these winners for the next 25 years.

1. Amazon

Amazon (AMZN) holds a significant position in the United States e-commerce sector, estimated to control around 40% of the market. Furthermore, it is a powerhouse in cloud computing, leading the global cloud services industry, making up approximately 30% of that market. One of the main reasons for Amazon’s impressive stock performance over time is the consistent growth and success of these two primary business sectors.

I’m absolutely thrilled about the vast potential that lies ahead! Although e-commerce currently represents just 16.2% of total retail spending in the U.S., it’s clear we’ve only scratched the surface. Analysts at Goldman Sachs are predicting a whopping 22% annual growth rate for the cloud services market, fueled by artificial intelligence (AI)! Amazon, with its unique knack for dominating high-growth sectors, is an obvious choice to invest in and hold on to. The future is bright, indeed!

2. Home Depot

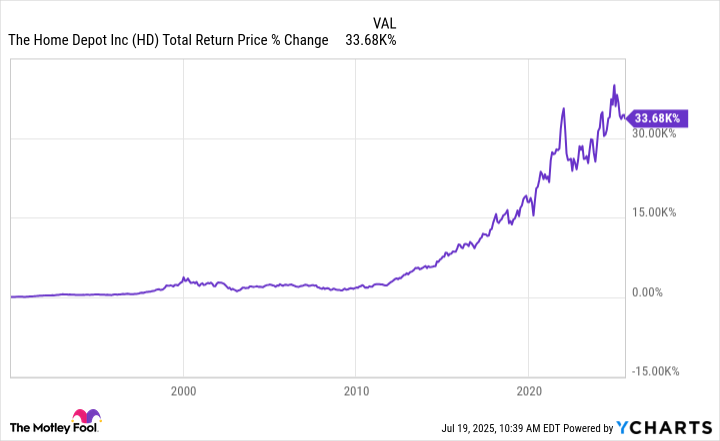

The vitality of consumer spending drives the American economy, with homeownership deeply embedded in our cultural identity. For nearly half a century, Home Depot (HD) has reigned supreme in the U.S. home improvement sector, boasting a staggering market value exceeding $500 billion. Regular maintenance is an essential part of being a homeowner, but discretionary upgrades can be affected by consumers tightening their purse strings during economic downturns.

Looking ahead, it appears that the market is primed to ascend to an impressive $700 billion in North America by 2034. Notably, Home Depot has recently broadened its horizons, venturing into specialized trades like roofing, landscaping, and pool construction through the acquisition of SRS Distribution for a substantial $18.25 billion. This strategic move is expected to bolster Home Depot’s growth trajectory, potentially yielding impressive investment returns in the coming decades due to its consistent expansion and high profitability.

3. Eli Lilly

Pharmaceutical company Eli Lilly (LLY) has moved to the forefront in the rapidly expanding weight loss sector, a market that Morgan Stanley predicts could expand tenfold by 2034. Currently holding an estimated 35% of the market, Eli Lily stands as the second largest player, trailing only rival Novo Nordisk. Eli Lilly’s popular drugs, Wegovy and Mounjaro, both contain the active ingredient tirzepatide, positioning them as significant players in this growing industry.

It is possible that Eli Lilly could expand its market presence as their next-generation drugs become available. The upcoming weight loss medications from Eli Lilly have demonstrated significant potential, whereas Novo Nordisk’s drugs have faced challenges in distinguishing themselves during clinical trials so far. Given the strength of Eli Lilly’s overall pipeline, the outlook for both the company and its investors appears quite promising.

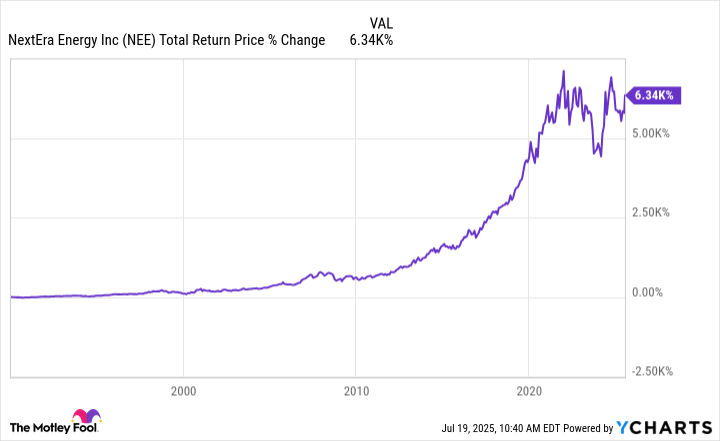

4. NextEra Energy

As artificial intelligence continues to require increasing amounts of energy due to global data center investments, there’s an escalating demand for more energy sources. NextEra Energy, a utility company specializing in wind and solar power production, stands as the leading entity in this sector. Over the last two decades, renewable energy has experienced exponential growth, triggering substantial expansion at NextEra and yielding profitable returns for its shareholders.

It seems this trend is set to persist for some time. NextEra Energy is planning to inject an incredible $120 billion into U.S. energy infrastructure over the next four years. This move should create a strong base for future growth prospects. Moreover, investors will receive a steady dividend of 3%, with management raising it consistently for the past 30 years. If you decide to hold onto the stock, reinvest your dividends, and stay patient, the stock is likely to be generous in its returns.

5. Arm Holdings

I’ve just noticed that the least talked-about yet highly influential tech company is Arm Holdings (ARM). This firm works quietly within the technology sector, specializing in creating unique core designs for silicon chips. They then grant licenses to giants such as Nvidia and Samsung, who employ these designs when developing their own products. Remarkably, ARM’s chip designs have been integrated into a staggering 300 billion devices across various industries, including smartphones, automotive, and more.

Investors find it intriguing that Arm has significantly grown its market share in recent years, climbing from 43% in 2022 up to 47% by year-end. This growth is apparent across various technology sectors such as cloud computing, AI, and more. As the world continues to digitalize over the next few decades, Arm appears poised for significant success.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-22 10:53