Few people may not recognize the name ASML, or be able to describe its business. However, it’s likely that you’ve used a product that owes some part of its existence to this company. In today’s world, items like computers, smartphones, and even cars wouldn’t exist without an essential component – lithography. Remarkably, ASML is a leading player in this market.

Over the past ten years, the firm’s significant influence in lithography technology has translated into substantial profits for its shareholders. To put it simply, ASML stock has surged by over 600%, a stark contrast to the S&P 500’s 200% growth during the same period. However, it’s worth noting that while long-term gains have been impressive, the company’s recent performance hasn’t been as strong.

On July 16, ASML revealed its Q2 2025 financial results, causing a 8% dip in the stock price within a day. Essentially, investors found something displeasing in the reported figures. Regarding the company’s projected growth in 2026, CEO Christophe Fouquet expressed caution, stating that they cannot verify it yet due to economic uncertainties. This single statement was enough to rattle investors.

It seems ASML investors might be missing a crucial point: Recently, the company has reported significant earnings from their extreme ultraviolet (EUV) lithography machines. This fact is pivotal in understanding ASML’s trajectory moving forward.

ASML is still booking billions

In the realm of semiconductors, components and systems are becoming increasingly miniaturized and intricate, necessitating more sophisticated machinery. This is where ASML steps in; they manufacture sophisticated lithography machines that dominate a significant portion of the market. Microchip manufacturers heavily rely on these advanced machines provided by ASML.

Among ASML’s diverse machine offerings, it is their EUV (Extreme Ultraviolet) machines that garner the most popularity, making up a significant 48% of Q2 net system sales. These EUV machines are particularly effective due to their ability to work with the world’s tiniest chips, thanks to their ultraviolet light wavelength being sufficiently short.

In the second quarter, ASML surpassed expectations with their financial results. Their net sales for Q2 amounted to 7.7 billion euros, which was more than anticipated. Similarly, the Earnings Per Share (EPS) came in at 5.9 euros, exceeding expectations as well.

In comparison to analysts’ projections, ASML significantly surpassed expectations regarding its Q2 net bookings. Analysts had anticipated net bookings of approximately 4.2 billion euros, but the company actually reported a net booking figure of 5.5 billion euros – a difference of about 30%. To clarify, net bookings occur when a company receives a written order, while net sales correspond to the delivery or installation of the product.

Remember that an EUV machine from ASML typically costs approximately $280 million. As a result, even a few unexpected orders can significantly impact the number of orders. The 30% better-than-expected performance, however, implies continued strength in the semiconductor manufacturing industry.

So what’s the problem?

In the forthcoming years, it is virtually certain that semiconductor producers will invest substantial resources. This is due to the fact that advancements in areas like artificial intelligence (AI), autonomous vehicles, and renewable energy are expected to boost demand beyond previous levels. As a result, manufacturers will need to invest in equipment to expand their supply capabilities. The question isn’t “if” they will invest, but rather “when” this investment will occur.

Instead of making immediate capital investments, executives prefer to postpone them until the current uncertainties subside, given the volatile nature of tariffs that makes it difficult to estimate future costs accurately. If feasible, it might be wiser to let the situation stabilize first.

I’ve been considering Fouquet’s forecast about ASML’s business scenario in 2026, and it seems that their products continue to hold significant market power, with customers still dependent on them. The question, however, lies in whether these customers will make their purchases in 2026 or perhaps at a later date. This uncertainty has caused some hesitation among the management team, which may be one of the reasons behind the recent dip in the company’s stock value.

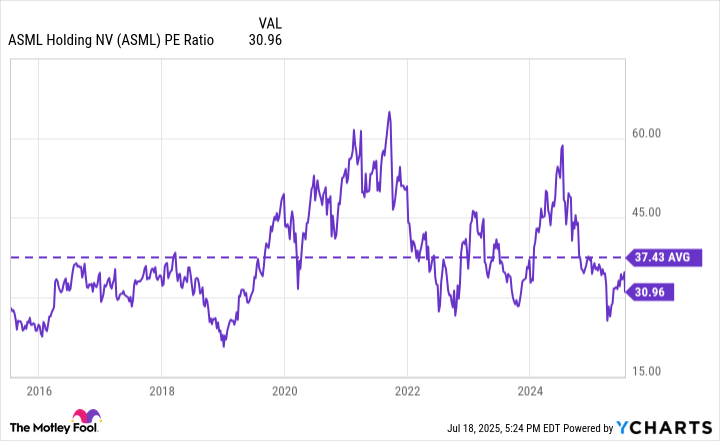

Investing in ASML stock might be advantageous for those who adopt a long-term perspective. The graph demonstrates that the stock’s Price-to-Earnings (P/E) ratio, currently at 31, is significantly lower than its average valuation over the past decade.

Moving forward to the year 2030, ASML’s expectations remain unaltered. The company anticipates earning a revenue between 44 and 60 billion euros by that time. To give you an idea, it projects to earn approximately 32.5 billion euros in revenue this year.

Given that ASML reaches the halfway point of its 2030 target, it’s projected to earn approximately 52 billion euros over a five-year period. This represents a significant growth of around 60%. Considering the company’s dividend and share repurchase plan, investing in ASML stock could potentially outperform the market.

A beneficial aspect for investors looking at ASML stock currently lies in its stability. While it’s theoretically feasible for another firm to innovate a device rendering ASML’s own outdated after all, anything can happen ASML stands as a frontrunner in a crucial market, ensuring robust profit margins for their business. This competitive edge has significantly contributed to the establishment of a solid financial foundation for the company.

In summary, I firmly believe that ASML’s stock will continue to generate profits for investors throughout the next five years. The company’s robust business and crucial product offerings make this a strong assumption. However, fluctuations in order timings might lead to temporary dips in stock price, such as the one we are experiencing now. For long-term investors who trust ASML’s vision for 2030, these stock price declines could present attractive buying opportunities.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 39th Developer Notes: 2.5th Anniversary Update

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2025-07-22 03:25