Last year, stock splits were quite popular among major companies from various sectors. Particularly noteworthy were the ones associated with artificial intelligence (AI). To be specific, Nvidia (NVDA), the foremost AI chip designer globally, and Broadcom (AVGO), a leading player in networking, executed their stock splits in June and July 2024 respectively.

A stock split refers to a company’s action to divide its existing shares into a greater number of shares, while maintaining the same market value. Companies opt for this process to reduce the high cost associated with their overpriced stocks, making them more affordable and accessible to a larger pool of investors. For instance, in 2023, Nvidia and Broadcom announced stock splits as a means to facilitate easier acquisition of shares by employees and investors, given that their share prices had increased by over 200% and about 100%, respectively.

A stock split doesn’t alter the overall market worth of the company or its fundamental aspects; it just means that more shares are distributed to existing shareholders in proportion to the split ratio. For instance, a 10-for-1 stock split implies that if you initially owned one share, you would now possess ten shares following the split, but the value of your holdings remains unchanged.

A stock split by itself should not be the basis for buying or selling a stock. It’s intriguing to examine the performance of companies that underwent a stock split over the past year, so let’s investigate the cases of Nvidia and Broadcom, following their respective splits.

Nvidia

Last year, on June 7th, Nvidia executed a 10-for-1 stock split. Following this, the share price was adjusted accordingly from approximately $1,200 to $120 as of June 10th. Since then, there have been fluctuations in the value of Nvidia’s stock, but it has still managed to yield a return of over 40%.

It’s worth noting that the surge in investors buying Nvidia shares over the past year wasn’t primarily due to this specific operation. Instead, it was fueled by the consistent strong demand for their graphics processing units (GPUs), which are essentially AI chips, as well as associated products and services. A lower share price might have facilitated entry for some investors into this growth story.

Alongside other factors, the success of this AI leader was significantly boosted by an impressive rollout of a major product launch: Nvidia unveiled their Blackwell architecture and chip during the winter, with CEO Jensen Huang describing the demand as “crazy.” The company managed to rake in $11 billion in revenue from Blackwell in its initial quarter on the market, while maintaining a gross margin over 70%, resulting in substantial profits from sales.

Despite initial investor concerns about import tariffs or reduced AI spending, optimism has grown as trade talks promise lighter tariffs than initially anticipated and companies continue to affirm their investment plans in artificial intelligence. This positive outlook has significantly contributed to Nvidia’s share price growth over the past few weeks, propelling the company to a $4 trillion market cap – an unprecedented milestone that makes it the first ever organization to reach this level.

Broadcom

On July 12, Broadcom carried out a stock split, and the shares started trading again on July 15 at the revised price. Similarly to Nvidia, they opted for a 10-for-1 split to lower their share price (from approximately $1,700 to $170). Since the split, Broadcom’s stock has seen an increase of over 65%.

Similarly to Nvidia, Broadcom experienced a surge in its share prices due to strong demand from customers focused on Artificial Intelligence (AI). This company is a prominent leader in the networking industry, producing thousands of products that are utilized in numerous settings – from personal smartphones to large-scale data centers. Notably, the increased demand from major cloud service providers for support in their AI advancements has significantly boosted the company’s revenue.

In the last three months, AI-related revenue significantly increased by 77% to reach approximately $4.1 billion. The company anticipates this growth trend to persist in the current quarter and beyond, through the upcoming fiscal year. This upsurge is driven by a high demand for their connectivity products and Broadcom’s enhanced processing units (XPUs), which are specialized processors designed for AI-related tasks.

The firm attributes its growth primarily to its extensive knowledge in networking, coupled with a diverse product lineup, including switches, routers, network interface cards (NICs), which enable computer-network connections. As cloud service providers expand their artificial intelligence (AI) platforms, these offerings have proven crucial.

In a comparable fashion to Nvidia, Broadcom’s stock dipped in April primarily due to widespread tariff worries. However, it has since bounced back and is currently experiencing an upward trend. Remarkably, the stock reached a new peak only a few days ago when it closed at its record high.

Could the post-split success continue?

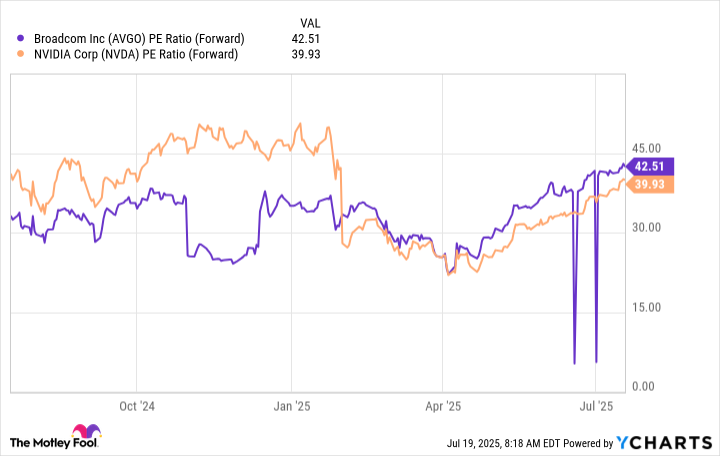

In the past year, both Nvidia and Broadcom have had successful periods after their split, recording double-digit returns. Compared to a year ago, Nvidia is relatively less expensive in terms of valuation, but Broadcom’s valuation has risen significantly.

Despite their impressive earnings history and promising future in the booming AI market, these AI players remain reasonably affordable. While it’s impossible to predict exactly what will happen with these stocks next, the current market climate suggests potential for further growth. Crucially, Nvidia and Broadcom are strategically placed to succeed in the AI sector over the long term.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

2025-07-21 04:32