Investment in Artificial Intelligence (AI) remains a key trend in the market, with companies pouring billions into this cutting-edge technology. We’ve only begun to imagine what an economy led by AI might look like, and to bring that vision to life, we need to expand our computational capabilities substantially.

Here’s my take: “I’m thrilled about the bullish trends in this sector, and I’ve got a hunch that four companies are smart bets at the moment! If you’ve got a thousand dollars (or any amount) ready to invest, starting with these four could be an excellent move. After all, every journey begins with a single step!

AI hardware: Nvidia and Taiwan Semiconductor Manufacturing

In terms of hardware, Nvidia (NVDA) has reigned supreme in the realm of artificial intelligence since its inception. Their Graphics Processing Units (GPUs) are extensively utilized across AI applications and have become the preferred choice, boasting a market share of approximately 90%.

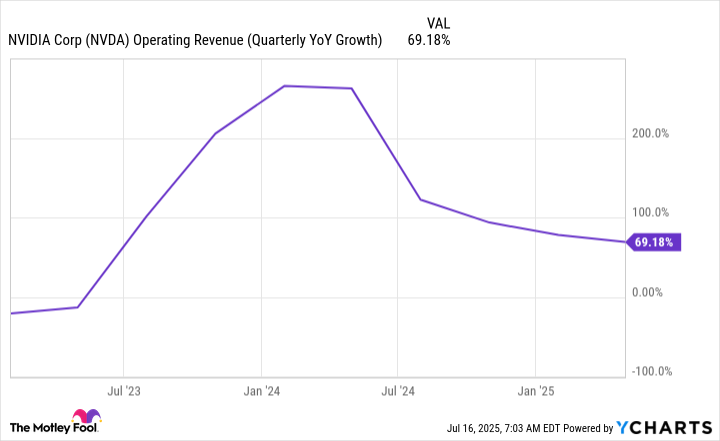

Nvidia stands to see a boost in its growth, as it reapplies for an export license to resume shipping GPUs to China and receives positive signals from the U.S. government about approval. This move could significantly accelerate Nvidia’s expansion rate, with the company predicting a 50% increase in second-quarter revenue compared to last year. If Nvidia had been able to sell in China during Q2, its projected growth would have been an impressive 77%.

Such a substantial increase will empower Nvidia to maintain its extraordinary expansion pace well into the coming years. This optimistic indication strongly suggests that Nvidia’s stock is poised to thrive, highlighting that they remain a significant player in the realm of Artificial Intelligence.

Nvidia relies heavily on Taiwan Semiconductor Manufacturing Company (TSMC) as they don’t manufacture their GPU chips in-house. Instead, Nvidia buys these from TSMC, the foremost chip foundry. TSMC’s rise to prominence is due to its innovative technology and superior chip yields, which translates to less waste, resulting in higher profits for TSMC and more affordable prices for their clients.

For the foreseeable future, TSMC anticipates substantial expansion in the AI sector. At the outset of 2025, their projections indicated an impressive 45% yearly increase (CAGR) for a five-year span. Given that chip orders are frequently placed far ahead of time, investors should heed management’s warnings of impending growth in this area.

It’s a smart move to consider investing in either Nvidia or TSMC right now, as both companies seem set for substantial expansion in the future, making them potentially profitable investments for a longer-term portfolio.

Cloud computing: Amazon and Alphabet

One sector that’s profiting greatly from AI implementation is cloud computing. Due to the high costs associated with constructing a data center that might not be fully utilized, many businesses find it more practical to lease computing power from providers such as Amazon (AMZN) through Amazon Web Services (AWS), or Google Cloud, which is operated by Alphabet (GOOG) (GOOGL).

According to Grand View Research, it’s predicted that the worldwide cloud computing market will grow substantially – from approximately $750 billion in 2024 to an estimated $2.4 trillion by 2030. This expansion is driven by a variety of workloads, both AI-based and traditional, moving into the cloud. Major players like Amazon and Alphabet are strategically positioned to capitalize on this growing trend.

Each component plays a crucial role in its corporate parent’s financial outlook. In the first quarter, Amazon Web Services (AWS) made up 63% of Amazon’s operating profits, despite representing just 19% of overall sales. AWS serves as the primary profit generator for Amazon, and with its exceptional growth trajectory, it is expected to keep pushing Amazon’s share prices upward.

Google Cloud is striving to match AWS’ substantial 39% operating profit margin, having posted an 18% margin in Q1. Yet, it’s growing at a faster pace than AWS (28% versus 17%) and could significantly contribute to Alphabet’s earnings structure in the future years. Companies offering cloud services, like Amazon and Alphabet, are capitalizing on the surge of Artificial Intelligence. Given that the cloud computing market is projected to grow rapidly in the upcoming years, these stocks might be a wise investment choice now.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 02:12