As a passionate follower of the cryptocurrency market, I can’t help but marvel at the stellar performance of two standout players in this digital revolution – XRP and MicroStrategy. In the ongoing resurgence of crypto in 2025, XRP has shown an impressive surge of 46%, while MicroStrategy, the pioneering crypto treasury company, has climbed a staggering 49% this year up until July 18th. Simply amazing!

One functions as a reliable processor of genuine transactions for banks and financial institutions, whereas the other is a publicly traded corporation that primarily amasses additional Bitcoins, continuously increasing a towering pile.

Which investment path would yield greater profits for those who have a moderate initial investment sum, approximately $5,000?

XRP is building utility today, and it’s working

Over time, the XRP Ledger (XRPL) is evolving to serve as a foundation for institutional finance, with its progress being driven by the continuous efforts made by its creator, Ripple.

Earlier this month, Circle moved its stablecoin onto Ripple’s XRPL network to streamline on-chain transactions for both traditional financial and decentralized finance sectors. The aim is to strengthen the platform for stablecoins, tokenized U.S. Treasuries, and other real-world assets, followed by the development of necessary compliance and identity verification features that banks and asset managers require. This setup is designed to attract users as it offers a tailored blockchain solution that caters specifically to their unique needs, given that most other blockchains do not offer such a precise fit.

Why does that matter for those considering an investment in XRP?

Every transaction made through the ledger consumes a tiny amount of XRP cryptocurrency that is destroyed once the transfer is finalized. As network activity increases, the supply of XRP decreases, making it more scarce. If the usage of stablecoins and real-world asset settlement expands significantly, the demand for transaction fees and escrow collateral should also rise, potentially causing a modest to moderate increase in the coin’s price due to this increased demand.

Legal overhang is fading too, which lowers the risk of making an investment now.

In March, the Securities and Exchange Commission (SEC) indicated they would stop appealing their lawsuit against Ripple, thereby concluding a four-year legal battle that initially deterred many institutional investors and those wary of investment risks. Although regulatory clarity may not immediately boost asset prices, it eliminates the most significant uncertainty surrounding its adoption, thus reducing a major hindrance to its long-term growth potential.

Strategy is a levered bet on Bitcoin

A corporate strategy might resemble the persistent fervor of Bitcoin enthusiasts (often seen as zealous or even cult-like by others). This implies a focus on acquiring as much Bitcoin as possible, through methods such as selling new shares and taking on additional debt, regardless of Bitcoin’s current market value.

Currently, as of July 14, the holdings consisted of approximately 601,550 bitcoins, acquired at a total cost of around $42.9 billion, with an average price per coin of $71,268. Given today’s Bitcoin price of roughly $119,000, this investment is now valued at approximately $72 billion.

Management is consistently increasing the size of our stack by selling zero-coupon convertible notes, such as an additional $2 billion just last February. This trend is expected to persist for quite some time.

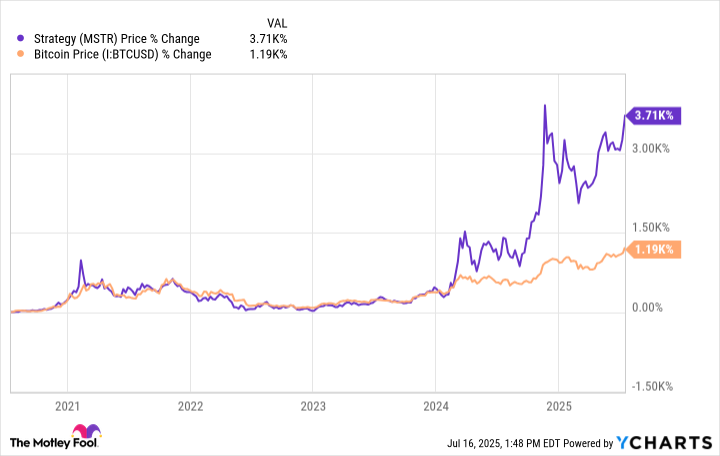

For shareholders, that has paid off fairly well during the past five years.

Users should realize that using leverage amplifies both the gains and losses on a company’s stock, particularly when Bitcoin increases. This means that if Bitcoin rises, the profits from the strategy will be significantly enhanced, but a 25% drop in Bitcoin would wipe out a considerable portion of the company’s worth.

The strategy’s convertible bonds won’t mature until the year 2030 at the earliest, yet historically, Bitcoin has been known to experience significant drops within days or weeks. Despite Michael Saylor, Strategy’s Executive Chairman, having a strong belief in this asset, conviction doesn’t help with paying off debts.

To summarize, it’s important to understand that a Strategy is not like Bitcoin; there are still some additional activities tied to its past as a software business. Essentially, when you invest in this company, you’re essentially covering their operational costs with the hope of gaining exposure to Bitcoin. You could achieve a more straightforward Bitcoin exposure by simply owning the cryptocurrency itself.

Where $5,000 probably works harder

If you’re aiming to gain potential profits in the cryptocurrency market with a level of risk that’s not too high, XRP appears to be the smart choice in this case.

The ledger is attracting genuine income opportunities, such as stablecoin circulation, cross-border payment settlements, tokenized treasuries, and so forth. As it overcomes its major legal hurdles, Ripple appears to be on track to meet its goals. If this happens, institutional interest could surge significantly in the coming years, potentially boosting XRP’s value. While it may not create instant wealth, the risk of a massive collapse seems to have diminished since the lawsuit period, and it is clearly gaining momentum in the areas it aims for.

Investing in Bitcoin can be likened to racing horses for those who enjoy high-risk, adrenaline-pumping activities. However, it may not be suitable for typical investors due to its volatility. If Bitcoin reaches $200,000 by 2026, the gains from XRP could seem minimal in comparison. But, this same volatility could lead to significant losses for shareholders if Bitcoin drops back down to $60,000, a level that would significantly impact the company’s financial stability and cause substantial market fluctuations. Most conventional investors prefer assets that won’t keep them awake at night when considering their retirement portfolios.

In simpler terms, if you have $5,000 to invest today, choosing XRP might be a more suitable decision. Those who are confident in managing the volatility of Bitcoin and are also okay with investing in a software company with significant debt that also operates as a cryptocurrency hedge fund may find their strategy there.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

2025-07-20 14:15