Over the coming two weeks, several prominent American tech giants are set to disclose their quarterly earnings reports, concluding on June 30th. These reports will not only cover their financial status but also their advancements in the rapidly growing field of artificial intelligence (AI), a sector currently generating significant worth.

As an observer, I note that for Microsoft (MSFT), June 30 signified the close of its fiscal year 2025 Q4. The company is slated to disclose these results on July 30, providing investors with up-to-date insights regarding their Copilot AI assistant and expanding collection of AI cloud services.

Despite Microsoft’s stock having increased by 20% so far this year, making it seem costly, whether or not investors should buy it before the July 30 report depends on their investment strategy and risk tolerance.

Copilot adoption will be front and center

Microsoft collaborated with its strategic partner OpenAI to develop Copilot, a robust virtual assistant that complements Microsoft’s extensive line of software solutions rather than functioning as a standard standalone chatbot in the industry. Copilot is seamlessly integrated into Windows, Edge, and Bing for free usage, but it can also be purchased as an additional feature for products such as the 365 productivity suite.

Businesses worldwide invest in approximately 400 million Microsoft 365 subscriptions to provide their workforce with applications such as Word, Excel, PowerPoint, and Outlook. By incorporating Copilot for an extra monthly charge, these organizations could substantially boost employee productivity. This is because Copilot can swiftly generate text and visuals on demand, condense lengthy emails, and even create computer programs by itself.

If every customer of Microsoft’s enterprise 365 service were to adopt Copilot, it would result in billions of extra recurring dollars for Microsoft each month. While it may take some time for widespread adoption, CEO Satya Nadella announced during the third quarter of fiscal 2025 (ending March 31) that the number of organizations using Copilot with 365 tripled compared to the previous year.

Satya Nadella noted that the deal size kept increasing due to an unprecedented number of customers coming back to purchase additional licenses. To put it another way, it appears that organizations are experimenting with Copilot among their staff, realizing its worth, and subsequently expanding its use across a larger scale. Investors eagerly await a new report on adoption when Microsoft reveals its fourth-quarter results on July 30.

It’s highly probable that the company will also provide news about additional Copilot offerings. The Copilot Studio empowers businesses by enabling them to develop custom AI assistants for handling customer service inquiries and automating routine tasks. As of the end of the third quarter, it boasted an impressive 230,000 enterprise users. Moreover, there’s the Dragon Copilot healthcare solution, which streamlines the process of tracking patient records for doctors, thereby saving them valuable time and resources.

This might be the most important number to watch on July 30

In simple terms, the Azure cloud computing service, which is a significant sector within Microsoft, consistently experiences rapid expansion. Consequently, it garners considerable attention from investors every quarter. Artificial Intelligence (AI) is increasingly contributing to this growth due to the continuous addition of innovative new services in its portfolio.

Azure AI grants access to essential components for building AI applications: advanced data center architecture that ensures sufficient processing power, and pre-built, cutting-edge large language models (LLMs) developed by industry leaders such as OpenAI, enabling developers to expedite their AI software development process.

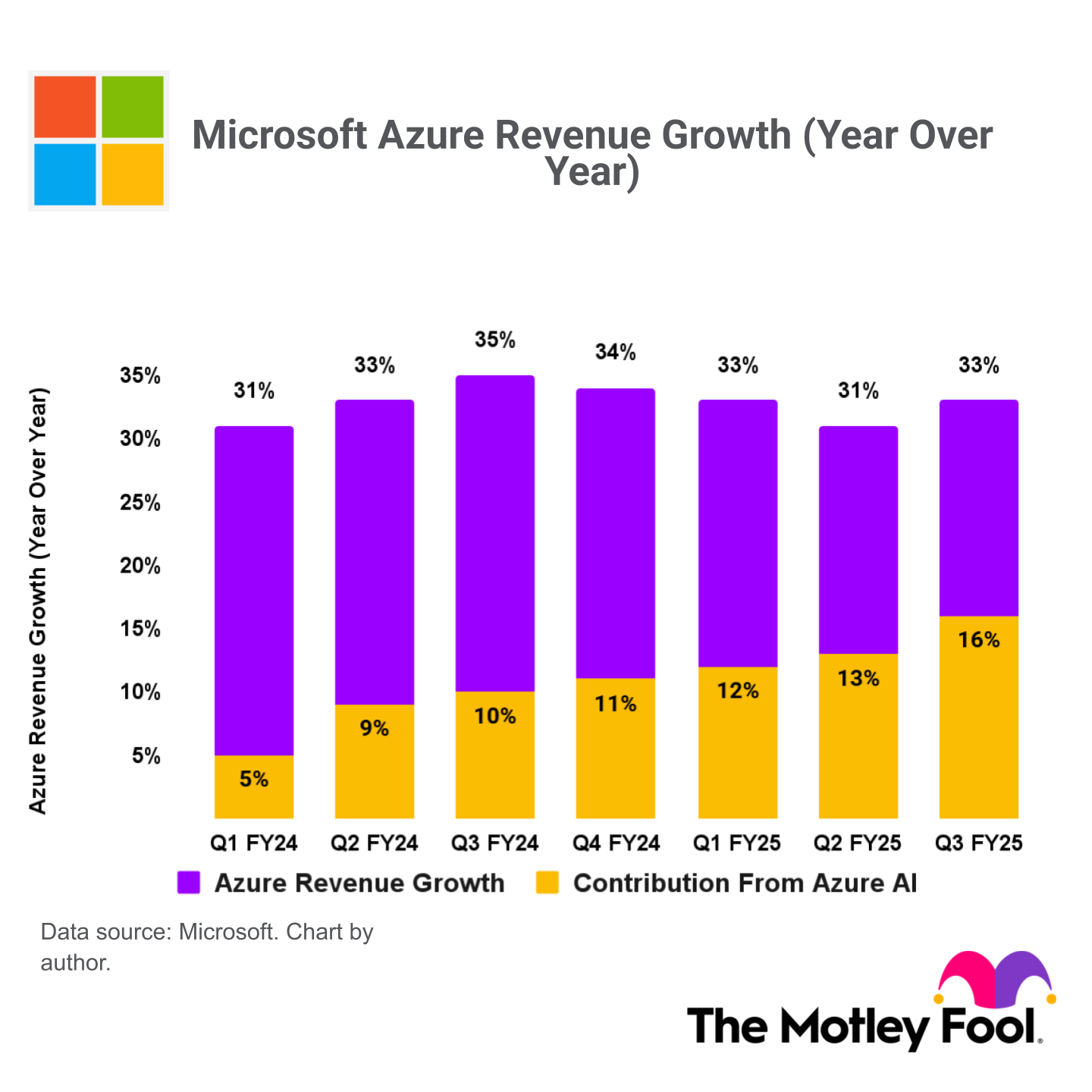

In the whirlwind of the third quarter of fiscal year 2025, I’ve been thrilled to witness a staggering 33% year-over-year revenue surge for our Azure cloud platform! A significant chunk of this growth, an impressive 16 percentage points, can be attributed to our cutting-edge Azure AI services. The momentum behind Azure AI is palpable and it’s poised to take the lead as the main engine fueling our cloud platform’s expansion. It’s an exciting time to be part of this journey!

In the upcoming July 30 report, investors might find it significant that Azure AI could potentially generate more revenue growth than any other service in Azure’s cloud offerings during the fourth quarter. This development would underscore Microsoft’s considerable investments in artificial intelligence, demonstrating a strong return on their investment of over $60 billion (for the first three quarters of fiscal 2025) in AI data center infrastructure and chips, a figure expected to exceed $80 billion for the entire year.

Microsoft currently holds an impressive $315 billion worth of orders from customers, with these clients eagerly awaiting the deployment of additional data centers. Microsoft’s CFO, Amy Hood, has indicated this figure. It is possible that on July 30th, Microsoft may announce plans to boost capital expenditure once more in fiscal year 2026 to address this substantial demand.

Should you buy Microsoft stock before July 30?

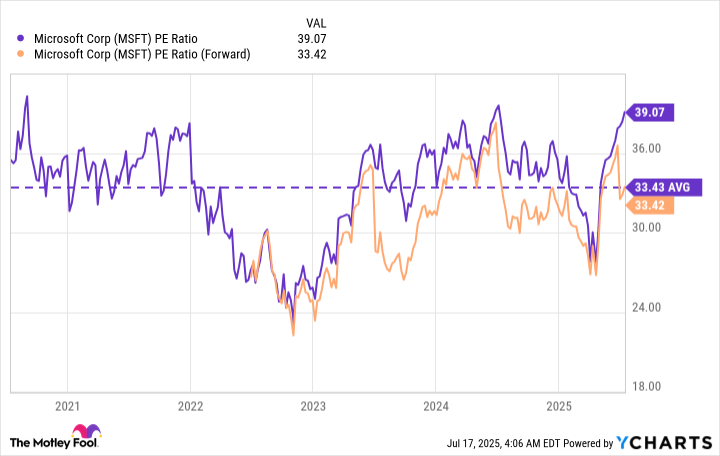

Currently, Microsoft’s shares seem relatively expensive due to their 20% increase this year. This has pushed the price-to-earnings (P/E) ratio up to 39.1, which is higher than its average over the past five years, specifically 33.4.

Based on predictions from Wall Street and Yahoo! Finance, Microsoft’s earnings per share might increase by 13% in fiscal year 2026, giving the stock a forward price-to-earnings ratio of 33.4. This doesn’t automatically mean it’s a bargain, but for investors prepared to hold onto the stock for at least the next two years (ideally five years or longer), there’s a good chance they could see a profit, as long as Microsoft’s earnings keep climbing.

As an investor, you might wonder if buying Microsoft stock before July 30 is a good move. One single quarterly result isn’t likely to alter the company’s long-term course significantly. It all depends on your investment timeline. If you’re aiming for short-term profits within the next year, you may find yourself falling short due to the stock’s high valuation, which might cap its potential growth. However, if you’re willing to hold onto it for a few years, I believe you’ll come out on top in the end.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-20 12:17