In late 2020, the AI company C3.ai made its first appearance on the public stock market with much fanfare, valued at a whopping $15 billion. As an AI-focused stock, it was ahead of its time, anticipating the widespread AI revolution that would happen a couple of years down the line. However, since its Initial Public Offering (IPO), the stock’s value has plummeted by 84%, resulting in underwhelming returns for shareholders. If you had invested $1,000 when it was at its peak price, you would only have around $160 left today.

Has C3.ai encountered some problems? Given its significant decrease in value, is it worth investing now as a promising AI contender? Let’s delve deeper into the history and operations of C3.ai to determine if it’s an ideal stock addition for your portfolio at this time.

Bringing AI to enterprises, competing with Palantir

C3.ai creates specialized AI software tailored for diverse industries including energy, transport, and defense. They collaborate with major cloud service providers like Amazon Web Services (AWS) and consulting giants such as McKinsey to boost sales of their analytical and management tools. Their aim is to provide a comprehensive analytics platform where large corporations can effectively handle their data, offering agentic AI applications and a no-code AI solution named ex Machina.

This narrative is convincing yet requires more time to persuade companies to outsource their software development tasks to a skilled third party instead of managing it internally. However, the outcomes have not matched those of competitors so far. Notably, Palantir Technologies, which specializes in AI-focused software solutions for large corporations, is significantly larger and growing at a faster pace than C3.ai. Last quarter, Palantir reported revenue of $884 million, marking a 39% increase compared to the same period last year. In contrast, C3.ai recorded revenue of $108.7 million, representing a 26% growth over the previous year.

Other businesses are also targeting C3.ai’s prospective clients. Databricks, a privately-held company with annual revenues of $3.7 billion, offers a comparable data intelligence platform. Despite this, C3.ai continues to be a small fish in the vast ocean of software analytics and AI.

A history of hyped-up narratives

As you delve further into examining C3.ai’s background and business activities, it becomes increasingly intriguing to note a pattern of change. Initially established as C3 with an aim to participate in the carbon market, developing software for managing climate change, the company underwent a transformation in 2016, adopting the name C3 IoT, coinciding with the Internet of Things (IoT) experiencing a massive surge in popularity. A short while later, it shifted focus and was rebranded as C3 Energy to concentrate on that specific sector. Lastly, it changed back to C3.ai just prior to another significant boom in the same sector. This pattern might imply that C3.ai could be more about capitalizing on the current financial market trends rather than developing products that cater to customers’ long-term needs.

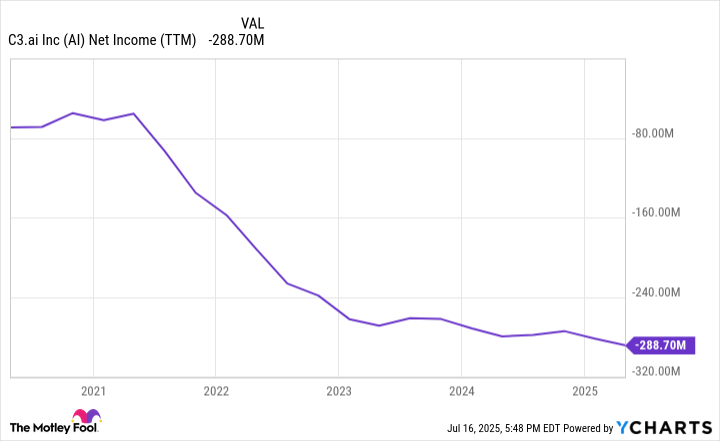

The company’s income statement reveals that despite generating $389 million in total revenue last fiscal year, it reported a significant net loss of $289 million, indicating a lack of focus on profitability. This is further emphasized by the massive spending on marketing and research with no improvement in operating efficiency at high revenue levels, leading to an escalating net loss since going public. This suggests that the business may not be thriving as expected.

Should you buy the dip on C3.ai stock?

It’s worth mentioning that the current trend is excessively enthusiastic about AI, causing a surge in the value of many AI-related stocks. For instance, Palantir’s stock valuation, indicated by its price-to-sales (P/S) ratio, has reached an astonishing 100 or more.

Considering the current trend in AI stocks, C3.ai appears relatively affordable with a Price-to-Sales (P/S) ratio of 9 and steady revenue growth. However, it’s essential not to base your buying decision solely on this P/S comparison. A thorough analysis involving multiple factors is crucial when making investment decisions in the stock market.

As an ardent investor, I’m wary about diving into C3.ai right now, given its substantial losses that don’t seem to be reversing course. The fact that it’s losing ground to competitors in the booming AI market is a red flag. If AI spending was to decelerate, it could significantly harm C3.ai’s business prospects.

As a bystander, I advise keeping a safe distance from C3.ai shares. It appears this company’s operations are currently unprofitable and may persist in underperforming for shareholders.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 11:51