As an auto enthusiast, I can’t help but marvel at the storied history of Ford Motor Company (F). From pioneering the moving assembly line, revolutionizing manufacturing in the industry’s early days, to standing tall during financial crises without relying on a government bailout, Ford has consistently proven its resilience and innovative spirit. And let’s not forget, it manufactures more vehicles within the U.S. than its fellow Detroit competitors, a testament to its commitment to American manufacturing.

Regrettably, Ford has gained notoriety for issues that aren’t positive: vehicle recalls and high warranty expenses, and this has been an ongoing concern for some time. Let’s delve into the latest recall by Ford and estimate its potential impact on their profits.

Recalls. Recalls everywhere.

First off, it’s important to understand that recalls are common in the automotive business. Generally speaking, these events don’t usually affect the stock market for car manufacturers. The reason being, when a vehicle is sold, the manufacturer makes an educated guess about future warranty costs and sets aside money to cover those expenses. However, trouble arises when the actual warranty costs significantly surpass initial predictions. This is when additional costs can accumulate and negatively impact the profit margin.

This year, Ford has issued over 90 recalls for their crossovers in the U.S., one of which is due to a fuel leak problem that could potentially cause fires. This number exceeds the combined total of the next five automakers’ recalls. Furthermore, Ford’s 2025 recall count surpasses General Moters’ previous record of 77 recalls in 2014, during its ignition switch controversy, as reported by the National Highway Traffic Safety Administration (NHTSA).

It’s important to remember that not all recalls have the same impact on a company’s resources. Software updates, which can often be done remotely, are typically less expensive for the company compared to situations where physical servicing, parts replacement, or manual labor is needed. However, it’s not wise to make hasty judgments based solely on 90 recalls without considering additional information.

For instance, Ford has disclosed that 33 of their recalls in 2025 were linked to software audits they initiated in March. These types of recalls should be less costly compared to other types of recalls.

To put it simply, remember that last year, Ford experienced an increase of approximately $800 million in warranty costs during the second quarter, which led to missed earnings and a drop in their stock price. However, this latest recall is unlikely to result in the same outcome, generally speaking.

What’s the damage?

Ford announced that the estimated cost of the recall solution amounts to approximately $570 million. This expense will be categorized as a “special item” in their second-quarter financial report, meaning it won’t affect the company’s core earnings figures (the adjusted earnings), EPS (Earnings Per Share), or free cash flow that Wall Street analysts focus on.

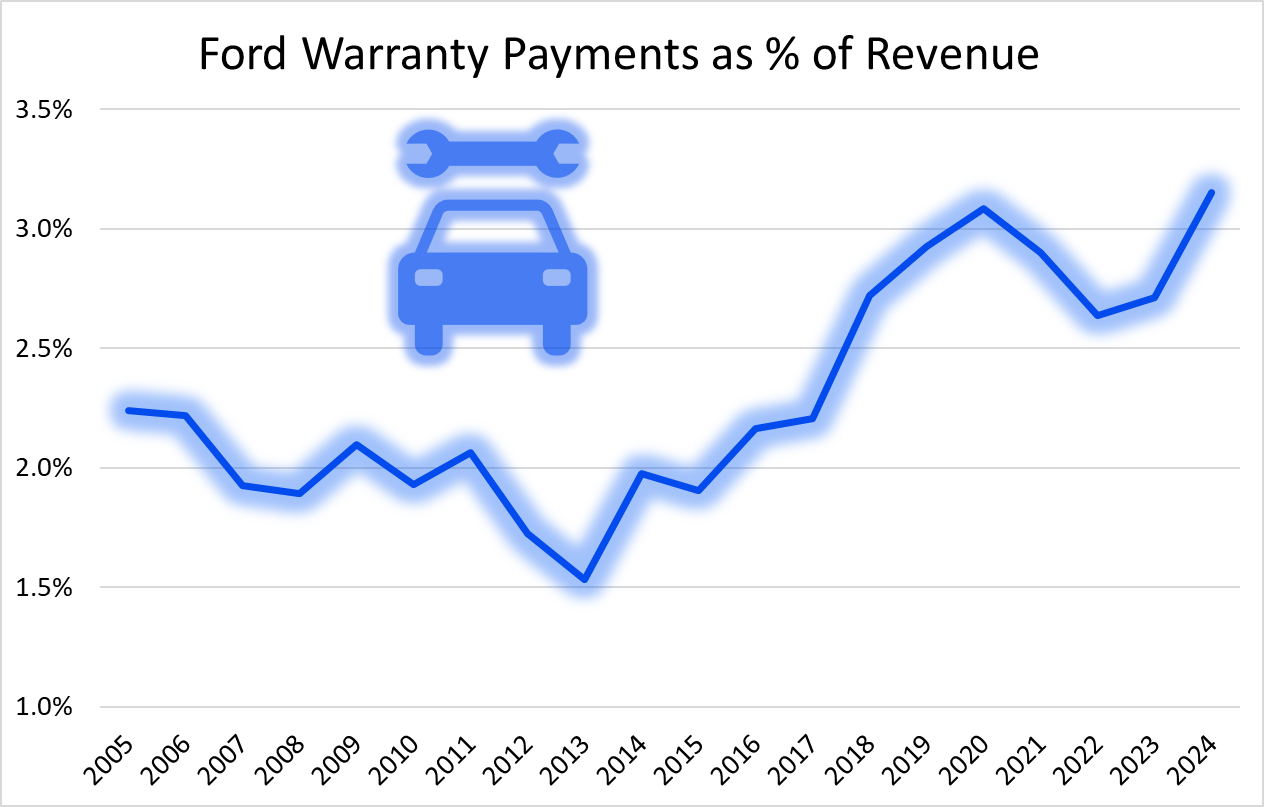

During the early 2000s, Ford’s warranty expenses were significantly lower compared to its overall earnings. However, this ratio jumped up to approximately 4% during the second quarter of last year, which is relatively high for automakers, as Ford endured a substantial financial loss due to increased warranty costs. Here’s a look at how Ford’s warranty expenses have changed over the past 20 years:

In 2024 and 2023, the proportion of revenue used for warranty payments by a competitor (General Motors) was approximately 2.4% and 2.3%, respectively, indicating a relatively small expense compared to their total income.

Ford maintains that they are achieving substantial quality upgrades, and they mentioned that the quality of the 2024 models, within the initial three months of use, improved by approximately 30% as compared to previous model years.

At present, the potential expenses related to warranties and quality concerns are significant doubts for investors regarding Ford. Although Ford claims to address these issues correctly and promises improvements in quality, investors have been underwhelmed so far. This is an aspect worth considering in your investment strategy concerning Ford, as warranty costs and recalls will likely remain key factors over the next 18 months. Hopefully, quality enhancements take effect during this period, leading to a decrease in recalls.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2025-07-20 08:56