Approximately two decades back, the world encountered a portable gadget that transformed music listening experiences forever. Subsequently, communication methods underwent a dramatic shift due to the advent of an advanced smartphone. From the iPod to the iPhone, Apple Inc. (AAPL) was renowned for its innovative prowess.

Over an extended period, the company has struggled to generate enthusiasm through its product launches. For instance, the Vision Pro line failed to capture consumers’ interest, and what was once a tech industry frontrunner appears to be tardy in adopting artificial intelligence technology.

In light of a halt in key market sectors’ expansion, Apple has skillfully maintained investor satisfaction by means of continuous share repurchases and cash dividends. However, as artificial intelligence advances, these benefits appear to be losing their allure.

Let’s delve into Apple’s latest activities and understand why their AI investments haven’t managed to attract investors yet. Subsequently, we’ll examine potential strategies that could help Apple revitalize its business.

Share buybacks and dividends just aren’t cutting it anymore

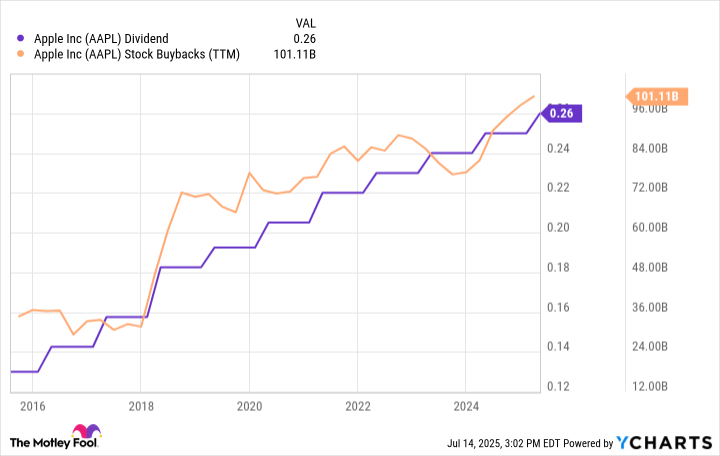

The following graph demonstrates Apple’s dividend payments and share repurchases over the last decade. At first glance, it’s difficult to find fault with a company that consistently enhances shareholder value by increasing its dividends and simultaneously purchasing its own stock, which could suggest that the management believes the shares are underpriced.

Despite being a major backer of Apple, Warren Buffett has been trimming his holdings in the tech giant by selling shares consistently throughout the last year. Eventually, investors may require additional incentives beyond just dividends and stock repurchases to maintain their interest.

Apple’s foray into AI has been uninspiring so far

Interestingly enough, despite the surge of AI advancements in recent years, Apple’s initial spark of innovation seems to have taken a backseat. The company’s primary approach to AI has been through a collaboration with OpenAI, the creators of ChatGPT. This collaboration is embedded within Apple Intelligence, a feature intended to be a significant selling point for their latest devices.

Just recently, there were predictions on Wall Street suggesting that Apple Inc.’s focus on artificial intelligence (AI) might spark a fresh generation of iPhone updates and establish the company as a major player in AI-related investments.

Although worries about recent tariff changes and economic instability might be contributing to Apple’s current moderate growth trend, I believe that Apple Intelligence isn’t compelling enough as a unique selling point to prompt widespread device upgrade.

In my opinion, Apple should start using its funds more wisely by investing in strategic areas rather than just paying dividends and buying back shares.

What can Apple do to get investors excited again?

Dan Ives, an analyst specializing in technology at Wedbush Securities, has put forth an intriguing proposal: Apple might benefit from purchasing Perplexity, a language model similar to ChatGPT.

Loading…

Considering the surge of ChatGPT and the preference for Language Models (LLMs) over conventional search methods, it seems strategically sound to incorporate Perplexity as a built-in feature in Apple’s operating system. There are numerous ways that Apple could enhance its services by introducing a product like Perplexity.

Introducing Perplexity as a new feature in Siri could enable Apple to enhance the intelligence of its voice assistant across all devices. Furthermore, Apple might employ Perplexity within Safari for AI-driven responses to search queries, potentially allowing it to challenge Microsoft’s Copilot or Alphabet’s Google search more directly.

In my view, there are two groundbreaking possibilities that Apple might want to delve into. The first one could be Safe Superintelligence, which seems quite fitting given that one of its founders previously oversaw AI projects at Apple. Unlike other companies like OpenAI, Anthropic, or Perplexity, Safe Superintelligence is primarily in a research and development phase. Although it might be intriguing for Apple to acquire the company, I believe the path to monetization would likely take several more years.

One intriguing opportunity for Apple might be to collaborate with its prominent seven counterparts, such as Nvidia, Tesla, and Amazon, in the cutting-edge field of artificial intelligence (AI) robotics. Notably, Figure AI, a humanoid robotics startup, is one of the pioneering companies making waves in this specialized area of AI technology.

One potential concern I have with humanoid robotics is that it doesn’t naturally align with Apple’s existing lineup of hardware products and services. Most of Apple’s technology, such as the iPhone, MacBook Pro, AirPods, and iWatch, are either portable or wearable. In my opinion, Figure AI presents a great opportunity for Apple, but there’s a chance it could divert attention from the core focus on consumer electronics that Apple has built its empire upon.

In essence, I concur with Ives’ viewpoint that Apple could significantly boost its standing in the artificial intelligence competition by making strategic acquisitions.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2025-07-20 04:36