Is it wise to invest in a company with a high probability of failing to meet its full-year targets and potentially reducing its highly regarded dividend (currently providing a yield of 6.6%)? Generally, that’s not an appealing prospect for investors. However, in the case of UPS (UPS) and its forthcoming second-quarter earnings report due on July 29, it could be justified. Here’s the reasoning behind it.

The market doesn’t believe UPS will sustain the dividend

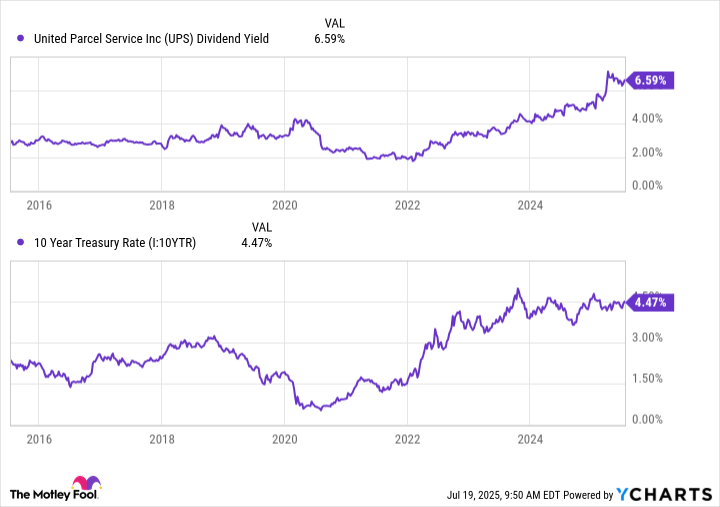

In terms easily understood, The return on dividends for UPS is approximately 6.6%, while the yield on a 10-year government bond is around 4.5%. Apart from the dip caused by the COVID-19 crisis in 2020, such a significant gap between the income generated by UPS and risk-free returns has never been seen before.

The market signals that it considers the dividend uncertain, perhaps even suggesting a potential reduction.

A silver lining

From my perspective, it seems that a dividend reduction could be beneficial for the company I’m observing, given its robust potential for growth in healthcare and small to medium-sized business sectors. As previously mentioned, this organization has been strategically investing in these areas. Moreover, the decision to scale back on low or unprofitable deliveries for Amazon by 50% from early 2025 to mid-2026 appears to be a prudent move aimed at enhancing overall profitability within its network.

This action would make cash available for investing in these activities, along with continuous tech upgrades to enhance its network. These investments could potentially be sped up. Moreover, it would lessen the apprehension regarding the stock and motivate investors to concentrate on its growth prospects instead of worrying about the longevity of its dividend payments.

Despite seeming unusual, if UPS lowers its full-year forecast due to worries about increased tariffs and trade disputes, trimming the dividend might actually be a beneficial decision. At the very least, investors should keep a keen eye on developments, regardless of whether they intend to invest before the earnings release.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- Is Kalshi the New Polymarket? 🤔💡

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

2025-07-20 03:58