Over the past couple of years, my passion for the ever-evolving world of Artificial Intelligence (AI) has been significantly fueled by one remarkable player in the field: Nvidia, or NVDA as it’s often known. This company has truly stood out in the AI movement!

If Microsoft, Amazon, or Tesla report impressive results from their cloud computing operations, autonomous robotaxis, or humanoid robots, respectively, there could be a temporary surge in the technology sector. However, it appears that attention eventually shifted back to Nvidia, with analysts closely examining the company’s chip and data center service demand trends.

At the start of the year, Nvidia encountered a massive storm that lasted for several months, causing concern among investors about the company’s sustained growth potential. This uncertainty led to extended episodes of selling panic, resulting in a significant decrease in Nvidia’s market value. In total, the market capitalization of Nvidia fell by over $1 trillion.

Currently, after surpassing a market value of $4 trillion, Nvidia has regained its status as the world’s most valued corporation. What’s more exciting is that some analysts on Wall Street predict potential increases of up to 400%!

Let’s delve into the factors propelling Nvidia’s future expansion story and explain why analysts on Wall Street foresee significant potential gains for the leading player in the semiconductor market.

One Wall Street analyst is calling for a $10 trillion valuation for Nvidia

One of Wall Street’s most optimistic analysts about Nvidia is Beth Kindig from I/O Fund. She believes that by the year 2030, Nvidia could reach a market cap of $10 trillion – which represents an increase of approximately 140% from its current valuation. To understand what might drive such growth, let’s delve into the main factors supporting Kindig’s prediction.

Firstly, the growing demand for artificial intelligence (AI) and data centers is a significant factor. Nvidia provides essential technology for both AI and data center development, including graphics processing units (GPUs) and software tools that accelerate machine learning algorithms. As more industries adopt AI solutions, the market for these technologies is expected to expand exponentially.

Secondly, the increasing adoption of autonomous vehicles and gaming is another catalyst for Nvidia’s growth. The company’s advanced graphics cards are crucial in powering high-performance computing systems needed for designing self-driving cars and creating immersive gaming experiences. As the market for these applications expands, so will demand for Nvidia’s products.

Lastly, Nvidia’s strategic acquisitions and partnerships have positioned it well for future growth. For example, its acquisition of Mellanox Technologies in 2019 strengthened its position in the data center market, while its collaboration with automotive giants like Tesla and BMW demonstrates its commitment to the autonomous vehicle sector.

In conclusion, Beth Kindig’s forecast for Nvidia reaching a $10 trillion market cap by 2030 hinges on several factors, including the booming AI and data center markets, growing adoption of autonomous vehicles and gaming, and strategic acquisitions and partnerships that position Nvidia as a leader in these fields.

Based on reports from Microsoft, Amazon, and Alphabet, it’s projected that an astounding $260 billion will be invested in AI infrastructure just in 2025. To add to this, Meta Platforms is estimated to spend approximately $70 billion on capital expenditures this year, which is almost twice as much as they spent in 2024. Lastly, Oracle has been making steady progress in the area of infrastructure services, enabling companies to lease Nvidia GPUs from their cloud-based data center platform. From a broader viewpoint, the increasing capital expenditures by the major cloud service providers are indicative of growing demand for chips.

Kindig proposes an extension of secular advantages, implying that competition from Intel and Advanced Micro Devices may not significantly challenge Nvidia’s leadership. Although it’s difficult to predict how market preferences might evolve in the coming years, current industry research indicates that Kindig’s prediction could be accurate – a notion reinforced by Nvidia’s growing influence in the AI accelerator market.

I believe the aspect of Kindig’s analysis that is being underappreciated the most focuses on Nvidia’s software architecture known as CUDA. Due to its close integration with Nvidia’s hardware, developers find themselves confined within the company’s ecosystem when using CUDA.

As I witness, this development not just strengthens customer loyalty, but also positions Nvidia advantageously for spearheading advanced, progressing AI projects, particularly within realms like robotics and self-driving cars.

What about $20 trillion?

Previously, a consultant in management, Phil Panaro, is more optimistic than Kindig. By the year 2030, according to Panaro, the share price of Nvidia might soar to $800, which would suggest a potential market capitalization of approximately $20 trillion for the company.

Panaro highlights the potential for growth in Web3 development and the expanding applications of AI among businesses and governments for increased efficiency and financial savings, as the key foundations strengthening Nvidia’s optimistic outlook.

Although these tendencies might eventually generate substantial demand for Nvidia’s data center services, the adoption of technology by governments often progresses gradually. Simultaneously, Web3, as a novel idea, may require more time to develop fully than Panaro currently anticipates.

Is Nvidia stock a buy right now?

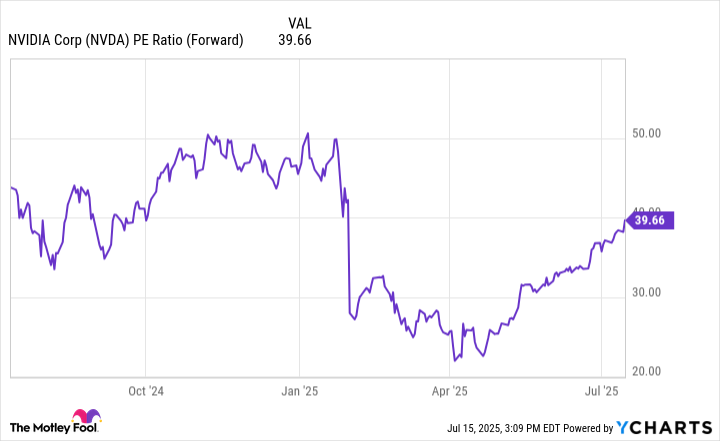

Over the past few months, Nvidia’s stock has been making a remarkable recovery. The increase in its value is evident when considering the company’s growing forward price-to-earnings (P/E) ratio. Despite this, Nvidia’s current forward P/E of 40 is significantly lower than what was observed earlier in the year.

Attempting to predict Nvidia’s maximum value is a task that often results in misleading accuracy, but the main point to grasp is that financial experts on Wall Street are not just anticipating substantial growth for the stock, but they also highlight the groundwork for Nvidia’s future expansion. The key message lies in the fact that Nvidia has potential ventures far beyond chip sales – several of which have yet to generate substantial returns for the company.

It’s clear that I view Nvidia stock as an obvious choice. For investors who have a longer investment timeline, it could be wise to seize the opportunity to purchase shares at their current price, with the intention of holding onto them for several years.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2025-07-20 03:51