I’m absolutely captivated by AST SpaceMobile (ASTS)! This company’s tale is truly intriguing, and it seems poised for an exciting chapter. However, whether it’s the wisest investment right now is a more challenging question to answer. The wisdom of this investment depends on both your personal perspective and the collective viewpoint of Wall Street regarding the business itself.

What does AST SpaceMobile do?

AST SpaceMobile is currently constructing a satellite network aimed at enabling regular mobile phones to access broadband connections globally, although the service isn’t fully functional as of now. The immediate aim is to establish coverage across the United States, Europe, and Japan initially, with many other regions still to be covered in the future.

Despite the challenge, having mobile connectivity even in remote areas like deserts or mountain peaks is quite appealing. It’s worth noting that AST SpaceMobile isn’t venturing out on its own. Instead, they are teaming up with major telecom companies such as AT&T and Verizon Communications. This means that these giants will offer the cell service to their existing customer base. Essentially, AST SpaceMobile will function as an additional service. There will be monthly subscriptions for regular users, while temporary, lightweight plans will be available for those who require connectivity only for brief periods.

As an enthusiast, I’m excitedly grappling with the challenge posed by AST SpaceMobile’s innovative service, which necessitates deploying numerous expensive satellites into orbit. This process, both time-consuming and costly, has traditionally been a hurdle. However, the financial aspect appears to be progressively manageable, given the impending launch of their service. Recently, AST SpaceMobile secured a substantial $100 million loan, guaranteed by the satellites they are developing, which is indeed promising news!

Don’t ignore AST SpaceMobile’s price tag

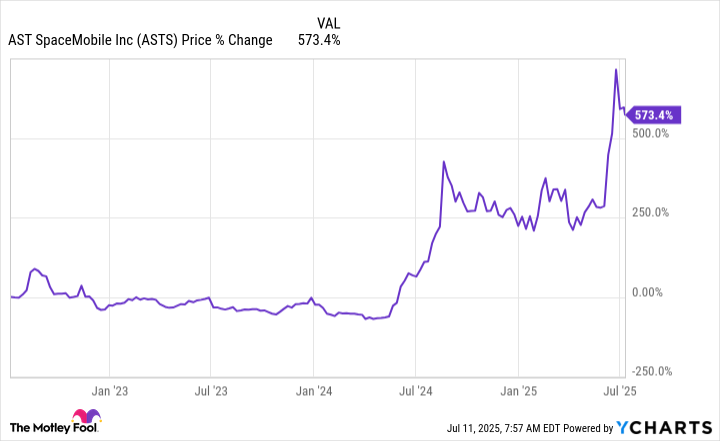

Although the time required to establish the satellite network poses an issue for investors in another aspect, Wall Street finds AST SpaceMobile’s story appealing, contributing to a surge in its stock price by over 500% in the last three years. Even within the past year, the stock has experienced a significant increase of more than 250%.

It appears that AST SpaceMobile’s business is relatively new and growing rapidly, which has led investors to anticipate favorable news in its future. However, since the company is currently operating at a loss, the Price-to-Earnings ratio isn’t useful for evaluating its worth. Moreover, significant investments are yet to be made, so it might be some time before the company starts generating profits.

The price-to-sales ratio, which is one of the older methods used to evaluate companies, stands at more than 1,000 right now. This extremely high number indicates that investors on Wall Street are betting that the company’s future revenue will be enormous. To put it into perspective, AT&T has an average price-to-sales ratio of just 1.1 over the past five years. This means that if you buy AST SpaceMobile, you’re paying a significant premium for a business that is still very young and not yet fully developed.

Is buying AST SpaceMobile smart today?

Since the future is uncertain for AST SpaceMobile’s business, there’s no definite answer to this question. If you think the company has immense potential and are optimistic about its growth, then purchasing its stock today might be an option you consider.

For cautious investors, it might be prudent to proceed with care due to the high price tag of a company yet to prove itself. Value investors, on the other hand, might want to consider finding safer grounds, though they’ll at least have access to cellular broadband if needed.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-19 14:34