Despite a generally strong year for the markets, with the S&P 500 showing an increase of 7% by Thursday’s market close, shares of electric vehicle manufacturer Tesla (TSLA) have instead moved in the reverse direction, experiencing a decline of approximately 21%.

Over the past few quarters, I’ve noticed that the company has been encountering significant challenges, which have unfortunately been reflected in an influx of unfavorable media coverage about the business and its CEO, Elon Musk. This negative attention seems to have taken a toll on the stock, as it appears to be headed towards one of its poorest showings in recent memory. Interestingly, this struggle occurs under favorable market conditions, unlike the challenging market situation of 2022.

Is it possible that this could mark the beginning of a concerning pattern for Tesla, or alternatively, is this an opportune moment to invest in this automotive company that’s currently facing challenges?

Tesla is on track for an unusually bad year

Over the last ten years, investing in Tesla has generally proven to be a profitable decision. Although it hasn’t consistently beaten the market, its automotive shares have yielded approximately 1700% returns, while the S&P 500 Index has increased by roughly 200% during the same period. In other words, Tesla’s strong years have significantly outperformed its weaker years throughout this time span.

| Year | S&P 500 | Tesla Stock |

|---|---|---|

| 2024 | 23.3% | 62.5% |

| 2023 | 24.2% | 101.7% |

| 2022 | (19.4%) | (65%) |

| 2021 | 26.9% | 49.8% |

| 2020 | 16.3% | 743.4% |

| 2019 | 28.9% | 25.7% |

| 2018 | (6.2%) | 6.9% |

| 2017 | 19.4% | 45.7% |

| 2016 | 9.5% | (11%) |

| 2015 | (0.7%) | 7.9% |

It’s worth mentioning that except for one instance in 2022, when it fell more than 20% in a year, the stock has shown remarkable stability over that period. The unfavorable economic conditions of rising interest rates and high inflation took a toll on Tesla’s stock performance during that time.

This year’s setbacks might not reach extreme levels, but if there isn’t a substantial improvement, the stock could be heading towards a drop exceeding 20%, which would only happen for the second time in a decade.

Can Tesla turn things around this year?

This year, Tesla has faced negative publicity due to Elon Musk’s involvement with Donald Trump’s Government Efficiency department and the subsequent reduction in government spending. Although Musk has since left this role, many investors view this as a positive move for Tesla’s business operations. However, this change hasn’t been enough to reverse the stock’s decline in 2021.

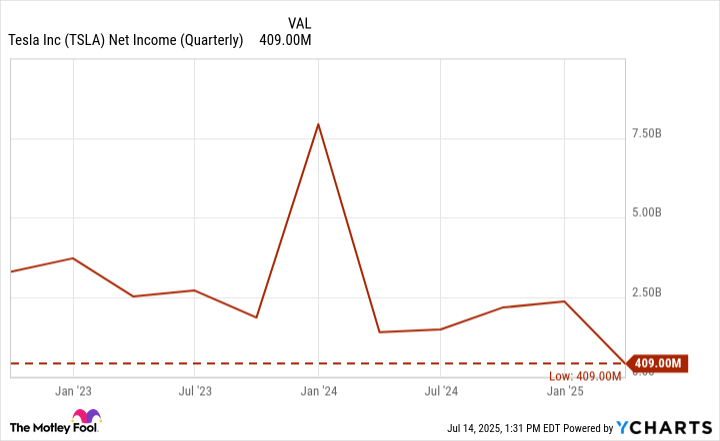

1. This quarter, the company’s earnings have hit their lowest point in years because both tight economic circumstances and increased competition are putting strain on our discretionary spending and reducing our profit margins. (Simplified and more conversational)

or

2. The company has seen its quarterly profits plummet to their lowest levels in years due to two main factors: a squeeze on discretionary spending caused by tough economic times, and increased competition that’s hurting our profit margins. (Similar structure, slightly more formal)

To get Tesla’s stock performance back on track, the company must demonstrate significant improvements in its profit margins, a challenge given the current circumstances. At present, the stock is valued at approximately 180 times its recent earnings, with a market capitalization of roughly $1 trillion remaining relatively large.

Should you invest in Tesla right now?

Historically, Tesla has proven to be a solid choice for growth-oriented investors. However, given its current market valuation, it might not be simple to achieve substantial returns. With such a high price point comes increased expectations, and at the moment, Tesla seems to be falling short of meeting these lofty standards due to its premium cost. For instance, in the first quarter of this year, the automotive segment experienced a 20% decrease in revenue compared to the same period last year.

Despite being a prominent electric vehicle company, its high market value indicates that much of its potential future growth is already factored in. While Tesla has shown remarkable success over the past decade, this does not necessarily guarantee continued high returns for investors moving forward.

As a fervent investor, I’m holding back from diving into Tesla stocks this year. I believe it’s wise to wait until the company demonstrates its ability to revive growth in both its business and financial performance simultaneously.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 14:07