Investing in Real Estate Investment Trusts (REITs) can be an excellent choice for those seeking reliable dividend-paying stocks. These trusts typically derive a consistent income stream from rent, which they use to dispense appealing dividends and fund portfolio expansion projects. The growth initiatives undertaken by REITs frequently lead to a gradual escalation in their dividend distributions.

Simon Property Group (SPG) and Federal Realty Investment Trust (FRT) are two of the biggest Real Estate Investment Trusts (REITs) specializing in the retail sector, both offering appealing and growing dividends. Yet, due to portfolio considerations, investors might prefer holding just one retail REIT. With that thought in mind, let’s examine which is the more advantageous dividend stock for purchase at present.

Contrasting their property portfolios

When considering the purchase of a Real Estate Investment Trust (REIT), it’s crucial to examine the quality of its property portfolio. The location and type of investments made by a REIT can greatly impact its capacity to consistently distribute increasing dividends. To maintain profitability, a REIT should own top-tier properties that are in demand due to robust and growing rental market trends.

Over time, the retail industry has experienced a mix of highs and lows. The increasing use of online shopping and economic downturns affecting retail sales have made it challenging for retailers to meet their rental obligations. As a result, there’s been a decrease in the desire for certain types of retail properties.

Example: Malls have been significantly impacted by retailers’ challenges, a point worth considering given Simon Property Group’s emphasis on investing in these properties. As a REIT, they own approximately 232 sites, the majority of which are malls and premium outlets. However, it is important to note that their portfolio doesn’t include struggling, smaller regional malls; instead, they focus on high-quality shopping and entertainment destinations that remain vibrant and attractive.

Over time, traditional outdoor shopping malls have encountered challenges from struggling retail businesses. However, Federal Realty’s primary interest lies not in just any shopping center but in top-tier ones. The company specifically invests in superior quality open-air shopping centers and mixed-use properties situated in the suburbs of major cities with heavy populations of affluent consumers. This strategic choice makes their properties highly attractive to upscale retailers.

A crucial point to focus on is making certain that the REIT possesses top-tier real estate assets, which are buoyed by persistent and escalating popularity. Both Federal Realty and Simon Property meet these criteria.

Analyzing their financial profiles

As a passionate investor, I always emphasize the importance of examining a Real Estate Investment Trust’s (REIT) financial health. Let me share an interesting comparison I came across between two retail-focused REITs:

1. First Retail REIT: This REIT boasts a robust financial standing, with a strong balance sheet and a consistent track record of profitability. Their strategy seems to be working well, as they’ve managed to maintain a healthy cash flow.

2. Second Retail REIT: While this REIT also has its strengths, it appears to be more financially vulnerable compared to the first one. They’ve shown some fluctuations in their financial performance and seem to have a higher debt-to-equity ratio.

This comparison underscores the significance of understanding a REIT’s financial health before making an investment decision. A thorough analysis can help us make informed choices that align with our investment goals.

| REIT | Dividend Yield | Dividend Payout Ratio | Bond Ratings |

|---|---|---|---|

| Federal Realty Investment Trust | 4.6% | 61.4% | BBB+/Baa1 |

| Simon Property Group | 5.2% | 67.1% | A-/A2 |

According to the table, both Federal Realty and Simon Property possess robust financial structures. Federal Realty slightly outperforms in terms of its dividend payout ratio, whereas Simon Property’s bond rating is somewhat superior. This financial advantage enables both REITs to distribute dividends generously and invest substantially in broadening their retail holdings.

Dividend histories

When assessing a REIT, it’s essential to examine its dividend record. Federal Realty stands out with its impressive 57-year track record of dividend hikes, which positions it among the Dividend Kings – an exclusive category reserved for companies that have boosted their payouts consistently for over half a century.

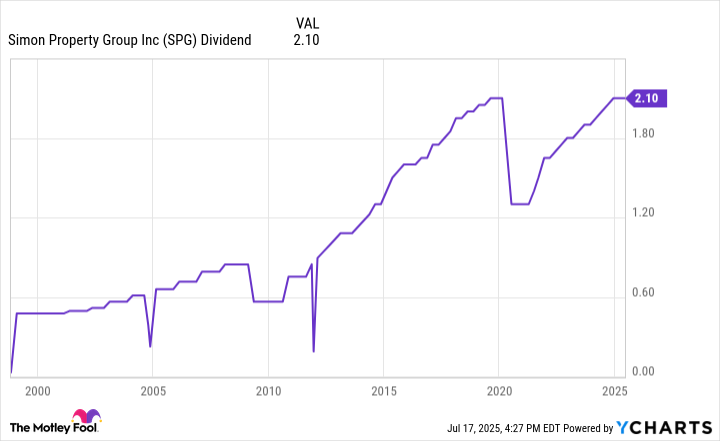

For comparison, Simon Property has had a spottier record of paying dividends:

According to the graph, the company reduced its dividend payments at the onset of the pandemic. However, since then, it has been gradually raising its dividends. It’s worth noting that the dividend payment has just reached its original level before the pandemic.

A look at their growth profiles

When considering a REIT investment, it’s important to examine its growth trajectory. Federal Realty projects a growth of between 5% and 6.8% in funds from operations (FFO) per share for this year. This anticipated growth is fueled by several factors: a 3% to 4% increase in income from rental properties, the acquisition of the Del Monte Shopping Center, additional income from redevelopment and expansion projects, and potentially even more growth due to the recent acquisition of two additional shopping centers. This projected growth may underestimate the actual outcome, given these recent acquisitions.

This year, Simon Property Group projects a growth range of 1.3% to 3.3% in its Funds From Operations (FFO) per share. They believe this growth will be fueled by rental increases, the acquisition of The Mall Luxury Outlets in Italy, and the successful launch of Jakarta Premium Outlets in Indonesia.

A quicker pace of growth for Federal Realty might allow it to boost its dividend payouts more significantly, resulting in increased overall returns.

A top-tier dividend stock

Top retail Real Estate Investment Trusts (REITs), Federal Realty and Simon Property Group, boast robust and premium property portfolios. Their strong financial structures underpin the consistent distribution of high-yielding dividends, making them reliable options for investment in the dividend stock market.

Amongst the two, Federal Realty distinctly excels. It boasts a more robust history of dividend growth and anticipates swifter earnings growth this fiscal year. Compared to its counterpart, it appears to be a sturdier choice for dividend stocks that could potentially offer greater dividend growth and total returns in the future.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 14:07