On the bustling streets of Wall Street, it’s rarely a straight path for investments, as trends often extend beyond what they seem to be in the present moment. This inconsistency can sometimes create openings for investment in companies that are experiencing temporary setbacks but show promising growth potential. With this perspective, an investor with $1,000 might find value in exploring these two up-and-coming stocks that have recently fallen out of favor on Wall Street. One of them has even caught the eye of Berkshire Hathaway.

1. Pool Corp. is a Warren Buffett pick

Pool Corp., symbolized as POOL, specializes in selling a variety of pool-related supplies. This includes chemicals, maintenance items, and materials for constructing new pools. It’s worth noting that maintenance items make up the largest portion of their business, accounting for approximately two-thirds of their total revenue. This significant reliance on maintenance sales is crucial because it indicates that Pool Corp.’s business model is inherently geared towards growth. This growth-focused nature could be the reason why Warren Buffett and his team have chosen to invest in the company’s stock.

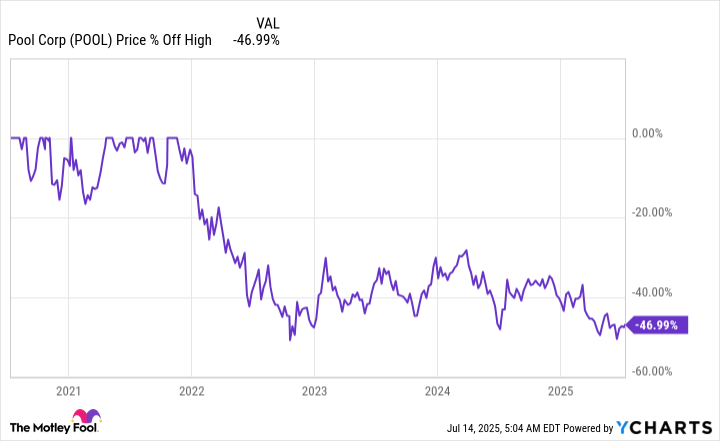

Warren Buffet typically invests in well-managed firms when their valuations are favorable. However, Pool’s stock has dropped approximately 45% from its 2021 high during the pool construction boom caused by the pandemic. This surge in pool building subsided as people adjusted to living with COVID and interest rates increased. Yet, each newly constructed pool expands Pool’s potential customer base because every pool requires maintenance until it is demolished. Consequently, each new pool created potentially boosts Pool’s business growth, making it an appealing long-term investment for Buffet.

Investors must recognize that Pool’s business model in construction can be uneven, leading to Wall Street being pessimistic about the retailer at present. This is because investors are not fully appreciating the growth potential that Buffett sees, and it would be wise for you to do the same. For a $1,000 investment, you could purchase approximately three shares.

2. Hershey is controlling what it can

Hershey (HSY) represents a renowned player in the consumer essentials sector, specializing primarily in confections and snacks. While it’s diversifying its offerings to encompass items such as popcorn and pretzels, chocolate remains a significant cornerstone of their product line. This indulgent yet budget-friendly treat continues to drive sales growth for Hershey, with revenue consistently climbing year after year. The company projects a modest 2% increase in its total revenue by the year 2025.

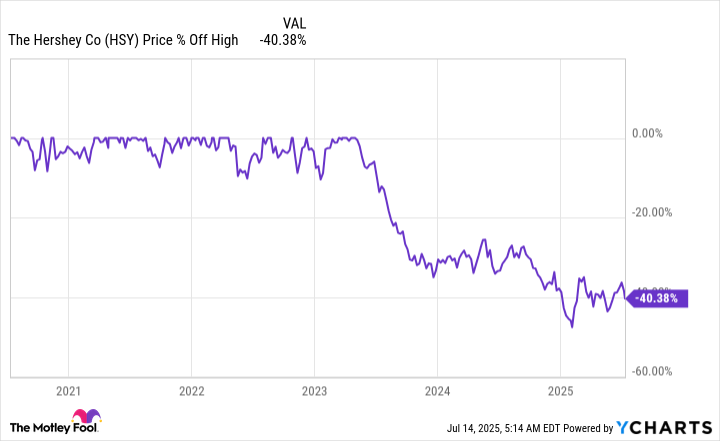

The cost of cocoa, a crucial ingredient for making chocolate, has seen an alarming surge. This unexpected development could cause a 30% reduction in Hershey’s earnings by 2025. Consequently, investors have been selling off the stock, causing it to drop approximately 40% from its peak in 2023. However, Hershey is taking active measures to manage the factors within their control.

Cocoa, being a tradable item, requires Hershey to adapt to price fluctuations. In response, they have raised prices, reduced expenses, and strived to enhance operational efficiency. Ultimately, cocoa prices are expected to stabilize. However, investors seem to think that the high cocoa prices will persist indefinitely. If this is the case, the company’s costs would eventually be shifted to consumers. Given chocolate’s widespread popularity, people are unlikely to significantly reduce their consumption of it. Therefore, Hershey is likely to regain growth at some point, making it a suitable time to invest. A $1,000 investment currently gets you six shares of the company.

Do you follow the pack or are you a contrarian?

Stocks that are currently grabbing attention and soaring might appear to be the best investments. However, it’s crucial to remember that these same stocks can lose steam as investors shift their focus to another trend. Instead, it could be beneficial to scrutinize undervalued stocks, seeking those with robust businesses that offer long-term growth potential. This is a strategy that Warren Buffett claims he employed when investing in Pool Corp., and many chocolate enthusiasts believe the same about Hershey.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-07-19 13:38