In recent times, the shares of Arm Holdings (ARM) have not performed as well as the technology sector, and they have dropped around 16% from their peak in mid-2024. Meanwhile, the Nasdaq Composite index, which focuses on technology, has remained near its all-time highs, even after experiencing a challenging period earlier this year.

Looking more closely at Arm’s share price graph indicates that the company is gaining momentum once more. In fact, over the past three months, Arm’s shares have surged by an impressive 56%, outperforming the Nasdaq Composite’s 28% increase. Notably, the stock could experience a substantial rise when it announces its fiscal 2026 first-quarter earnings after the market closes on July 30.

Currently, Arm’s stock is offering a more appealing price compared to its value a year ago due to the 16% decrease. This decline makes now potentially an opportune moment to begin purchasing Arm shares, as it appears poised for further growth in the second half of 2025 and beyond.

Arm’s robust growth has made the stock relatively cheaper

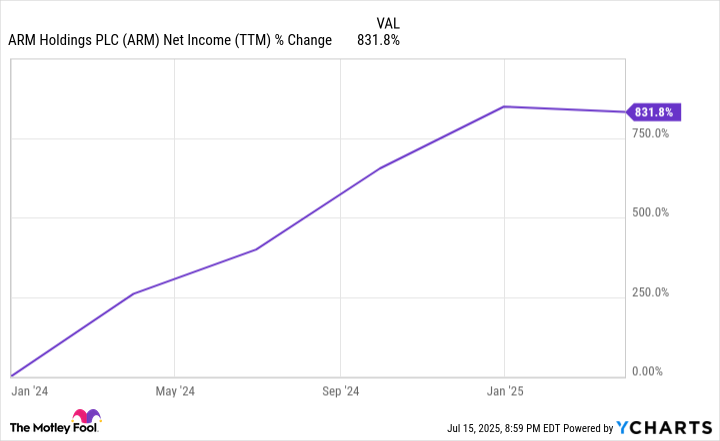

Despite a decline in Arm’s stock prices over the past year, the company has experienced robust growth in its earnings during the last 18 months. This trend is clearly visible in the graph below.

Currently, Arm is available at a relatively lower price because it’s being sold for 193 times its current earnings, which is approximately one-third of its projected price-to-earnings ratio by the end of June 2024. Moreover, a forward earnings multiple of 79 suggests that experts anticipate an increase in Arm’s future earnings.

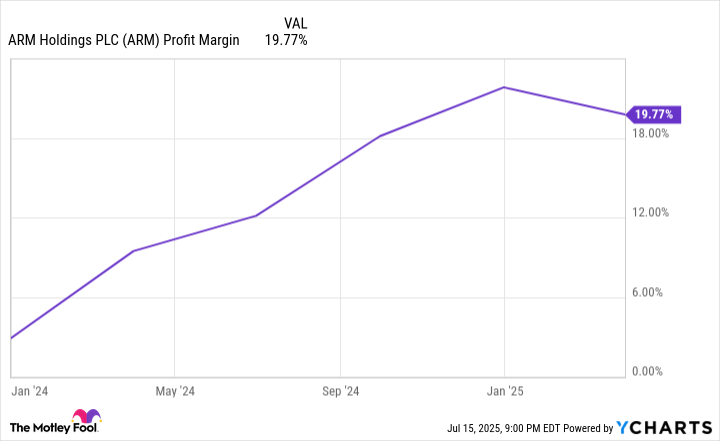

Certainly, Arm’s valuation remains high when compared to the average earnings multiple of 51 in the U.S. technology sector. However, the company can justify this valuation by consistently growing its earnings, which is partly due to the rapid adoption of its new chip architecture. This growth contributes positively to its profit margins.

The company is capable of delivering terrific bottom-line growth

Arm grants semiconductor firms the license for their chip architecture and intellectual properties (IP), which these companies then utilize when designing their own chips. The main source of revenue for this company comes from licensing agreements made with customers, as well as royalties earned on every chip produced using their design blueprint.

It’s advantageous that the need for Arm’s Intellectual Property (IP) and chip design has grown since the emergence of Artificial Intelligence (AI). This isn’t unexpected, as processors built on Arm’s architecture are often more capable of handling complex AI tasks while also being energy-efficient, according to external assessments.

In the last four years, there’s been an incredible 14-fold increase in the number of customers utilizing Arm-based chips in data centers. Notably, tech titans like Google (owned by Alphabet), Amazon, and Microsoft are designing custom AI processors for their data centers using Arm’s intellectual property. Additionally, Arm has witnessed a substantial 12-fold rise in the number of startups adopting its architecture for chip design over the same period.

Arm’s remarkable advancement in the data center market is significantly influenced by the increase in applications that processors built using its architecture can now handle. The firm emphasizes that the count of applications compatible with Arm-based chips has doubled since 2021, largely due to a 1.5 times growth in developers creating these applications.

Arm is quite optimistic about expanding its share in data center central processing units (CPUs) to approximately 50% by the end of 2025, representing a significant increase over the previous year. Moreover, the company forecasts capturing around half of the PC CPU market by 2029, which would equate to a sixfold growth compared to last year’s figures.

Notably, it appears that the royalties earned by Arm for their newest Armv9 design are said to be twice as high as the earlier generation. This increase has significantly boosted the company’s profit margins over the past 18 months.

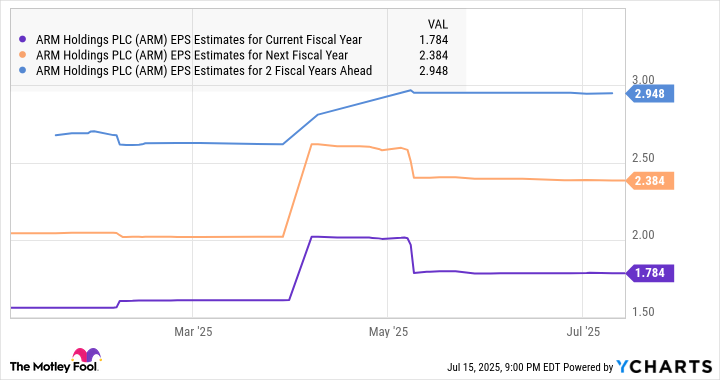

The arm has the potential to consistently increase its profits in the future, and this is exactly what financial experts anticipate from the company.

Yet, you might not be taken aback by Arm’s profits growing at a quicker rate than what analysts anticipated. This growth can be attributed to a mix of increased market share and higher royalties for AI-centric chip designs. For those seeking to incorporate a fast-growing stock into their investment portfolio, Arm could be an appealing choice, given its potential for further heightened profits due to strengthened earnings power.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2025-07-19 13:18