This year, Nvidia (NVDA) achieved remarkable feats, marking significant milestones. It ascended to become the world’s leading company in terms of market value, surpassing a staggering $4 trillion – a figure unmatched by any other corporation before. To achieve this impressive feat, it outperformed tech titans like Apple and Microsoft, who had held the top spots in terms of market value for quite some time.

The significant increase in Nvidia’s market capitalization can be attributed to its leading position in the rapidly growing field of artificial intelligence (AI), where it excels by producing the most demanded AI chips, commonly known as graphics processing units (GPUs). These and other products have played a crucial role in boosting the company’s profits, which has caught the attention of investors who have subsequently flooded the market with purchases. This influx of demand has, in turn, caused Nvidia’s market worth to surge.

However, the current valuation of $4 trillion for Nvidia is not its ceiling, and speculation among investors arises as to when this rapidly growing firm may surpass $5 trillion in market capitalization. Is it possible for this to occur in the present year?

Nvidia’s path to $4 trillion

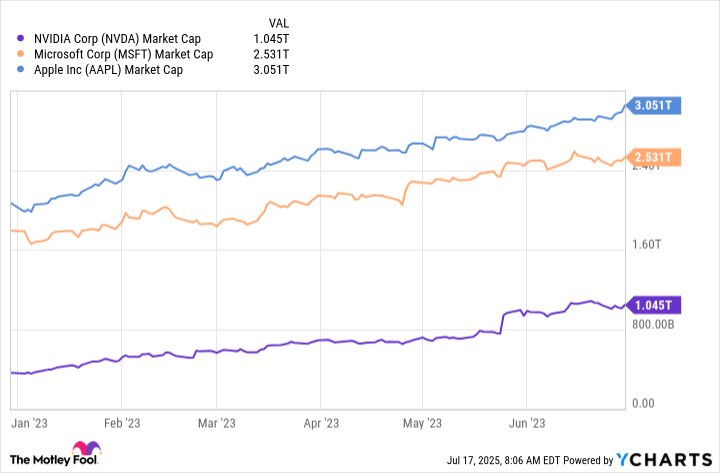

Looking back, I’ve been captivated by the remarkable journey of Nvidia towards a potential $4 trillion market cap. Just a blink ago, in June 2023, its market value was barely scratching a trillion dollars. At that point, giants like Apple and Microsoft were significantly ahead, as the chart below clearly demonstrates. But what an exciting ride it’s been since then!

As the AI sector experienced rapid growth, Nvidia’s income and investor attention towards their stock significantly increased, propelling them forward among tech titans. Although these giants also operate within the AI domain, Nvidia holds a pivotal position and has reaped the most advantages from this technology to date. For instance, in the recent fiscal year, Nvidia’s revenue skyrocketed by triple digits, surpassing $130 billion, as clients eagerly sought their chips and associated products and services.

There’s good reason to remain hopeful that Nvidia’s momentum will continue, given its expansive portfolio of AI solutions tailored to meet the needs of all its clients. Leveraging its extensive expertise in the field, Nvidia is well-equipped to conceive and create cutting-edge products and services for the future. Furthermore, Nvidia has pledged to upgrade its GPUs annually, enhancing efficiency each time. This commitment is crucial because a faster training time for AI models results in reduced costs over the long term.

The road to $5 trillion

The information presented suggests that Nvidia’s history, current status, and future look promising. However, what implications might this have on its market value in the upcoming months? Let’s delve into the potential path to $5 trillion. Currently, an Nvidia share is valued at around $171, giving it a market capitalization of approximately $4.2 trillion. A rise from $4.2 trillion to $5 trillion would represent a 20% increase. In my opinion, achieving a 20% growth in the stock price (and consequently the market cap) over a few months could be quite achievable for Nvidia.

Making such a move could elevate Nvidia’s current 12-month price-to-earnings ratio (P/E) from approximately 55 to 66. This calculation assumes a trailing-12-month earnings-per-share of $3.10. While the valuation would be increased, it wouldn’t appear excessively high for a top-tier growth stock.

This implies that, considering the technical aspects, Nvidia has a strong potential to achieve a market capitalization of $5 trillion by 2025, all without inflating its valuation beyond reasonable limits.

In light of the unpredictable nature of the stock market over short periods, such as a few months, it would be premature to definitively state whether Nvidia will achieve its milestone this year. The stock market can be influenced by unexpected events that may impact a company’s performance. For instance, President Donald Trump’s announcement of import tariffs this spring had a temporary effect on stocks. Therefore, when investing, it’s wise to consider the long-term perspective and stay mindful of potential unforeseen circumstances.

Based on the current data, it seems quite plausible that Nvidia, due to its rapid expansion and promising future, might not only maintain its position as the world’s largest company by 2025, but could also hit the $5 trillion market value mark in approximately the next 5.5 months.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 11:24